by Anne Mooney | Sep 10, 2020 | Custom Author, News, Taxes

FY 2021 Budget Passes First Reading

Millage Rate Unchanged

Chickens Squeak Through

by Anne Mooney / September 10, 2020

Chickens will come home to roost

Despite emails indicating Winter Park was split down the middle on the backyard chicken question, the ordinance creating a two-year backyard chicken pilot program narrowly squeaked through its second and final reading on a 3-2 vote – with a few amendments.

Among the raft of amendments was reduction of maximum coop height to six feet, requirement for a fence to obscure the coop from neighbors and a requirement to obtain written permission from all neighbors whose property abuts the property with the chickens. A provision for 48-hour warning before inspections was removed, allowing Code Enforcement to make unannounced spot inspections. Coops can be in backyards only, not side yards. Chicken owners who receive repeated complaints will face escalating fines, and a “three-strikes-you’re-out” rule will remove the chicken owner from the program on the third complaint.

None of the current Commissioners will apply to keep backyard chickens.

Commission passes 2021 Budget, millage rate on First Reading

The FY 2021 Budget passed on a 5-0 vote with only one amendment, proposed by Commissioner Sheila DeCiccio, to grant up to 3.5 percent raises to City staff rather than freezing their salaries.

Mayor argues for rollback rate

The millage rate was kept at 4.0923 for the 13th year, despite arguments by Mayor Steve Leary to drop the millage to the rollback rate of 3.9509. The rolled-back rate represents the millage rate that would generate the same level of property tax revenue as the prior year, excepting growth due to inflation factor and new construction.

Dropping the millage rate to the rollback level would mean removing the contingency, but Leary said he felt comfortable the $17 million in reserves would cover any contingency.

Vice-Mayor: “Situation is too fluid.”

Vice-Mayor Carolyn Cooper disagreed. “I am not comfortable,” she said, “because the City is cutting services and curtailing and freezing staff. First, the City brought us a balanced, but curtailed budget. Then we were told that revenue projections were even lower, but that was followed by state projections that changed again.”

Cooper went on to point out just how fluid the situation might be. “Orange and Osceola Counties have a backlog of foreclosures stacked up until the moratorium is lifted. What happens then? What about people being evicted from apartments? And if empty property remains vacant, what will happen to property valuations? I believe it is prudent to hold back on costs and continue to accrue the same millage rate we have had for 12 years.”

The August 18 Orlando Business Journal noted Central Florida is still dealing with high unemployment and pandemic. “Orlando attorneys were prepared for a wave of evictions and foreclosures when the statewide moratorium neared expiration at the end of July.” According to the most recent data available, the unemployment rate for metro Orlando was 16.5 percent in June, while the rate in Florida was 10.7 percent.

To comment or read comments from others, click here →

by Anne Mooney | Sep 8, 2020 | Custom Author, Taxes

First Millage Vote Tomorrow

Second Reading September 23

by Anne Mooney / September 8, 2020

Tomorrow, Wednesday September 9, the first vote on the millage rate — how much we will pay in property taxes in FY2021 — will come before the Commission. If you want to let your Commissioners know how you feel about this, now is the time to write mayorandcommissioners@cityofwinterpark.org or register for Wednesday’s virtual Commission meeting by going to www.cityofwinterpark.org

Perfect storm brewing

Earlier this year in July, the Commission found themselves with the makings of a perfect storm. Higher property value assessments had been set in January 2020 in a strong economy. Within about two months, however, the COVID19 pandemic hit, sending state revenues plummeting. And, being July, we were entering the height of hurricane season. At that time, the State of Florida was unable to come up with a reliable estimate of how much money the City would receive, so the Commission did what they felt was prudent. They agreed to a ceiling – a number beyond which they cannot go – of a half-mil rise in the tax rate, should it turn out the City needed it to maintain essential services. A ‘mil’ is 1/1,000 of a dollar.

The ceiling is not the tax rate

Email blasts from two former Commissioners immediately decried what they characterized as “a vote to raise property taxes.” Yard signs popped up here and there urging, “stop Winter Park tax increases.”

Were the former Commissioners unaware that the July 11 vote did nothing to establish the actual tax rate? In fact, it simply set the ceiling beyond which the current Commission could not go. The current Commission was required to take that action in order for Orange County to send out the “TRIM” notice, which lets us all know the worst we can expect. No doubt you’ve noticed, the TRIM notice has a box advising you in capital letters, “Do Not Pay. The Is Not a Bill.” Happens every year, so previous Commissioners could reasonably be expected to be familiar with the process.

The July 11 vote was a safeguard, not a commitment.

Further email blasts from the former commissioners claimed credit for Commissioners Sheila DeCiccio and Marty Sullivan “publicly reversing themselves” on what they claim was a July vote for a millage rate increase.

State revenue projections adjusted August 24

Commissioner Carolyn Cooper noted it was more than a full month later that state officials told local governments they would be getting more money than originally expected.

The State revised their revenue projections more than a month after the Commission agreed to adjust the cap on the millage rate to give themselves a small half-mil cushion in case it was needed. The August 24 adjustment was a welcome piece of news, and probably means the Commission can leave the current millage rate as is — though we won’t know for sure until September 23.

Commissioners Sheila DeCiccio and Marty Sullivan sent out emails with the good news that, now that we have a better idea what the revenues are going to be, we can probably make the necessary budget cuts and get by without raising the millage rate – and still provide the high level of service for which our City is known. It is disingenuous at best for anyone besides the sitting Commission to claim to have influenced the tax rate.

If you miss the first vote on the millage rate tomorrow, you will have another chance to make your views known at the second and final vote on September 23.

As Commissioner Cooper emphatically stated, “[Weldon’s] spin was definitely not the deciding factor.”

To comment or read comments from others, click here →

by Anne Mooney | Aug 31, 2020 | Custom Author, Taxes

No One Has Decided Our Property Taxes

They will September 23, but they haven’t yet.

by Anne Mooney / August 31, 2020

You know that thing we get every year called a TRIM notice? You probably just got yours. It lets you know what your proposed property tax bill is. On the upper right-hand corner of the document is a box advising you, in all caps:

This lets you know, worst possible case, what your tax bill could be if the proposed millage rates from all those taxing authorities in the left-hand column pass. You’ll notice that the City of Winter Park is not the only taxing authority that wants your money, or that has tentatively raised the cap on their millage rate. Orange County and the school board are right in there.

Millage Rates Have Not Passed

With the exception of Winter Park debt, which has to do with the bond issues for the Public Safety complex and the Library-Events Center and is already fixed, those millage rates have not passed and will not pass until late September. This is just a notice so you’ll be prepared in case one or more of the proposed millage rates does go up. That’s why you are advised not to pay; it is not a bill.

That is why it is puzzling to see yard signs and email blasts from people who are in a position to know better claiming that this Commission has raised your taxes. This Commission has not done anything yet.

Early Campaign Literature from Former Commissioner Sprinkel

An August 25 email from hello@electsarahsprinkel.com proclaimed, “The Winter Park City Commissioners voted to raise your taxes – now, during the pandemic.”

Former Commissioner Sarah Sprinkel must know, after nine years on the Commission, that the Commissioners did not have all the information from the state and the county they needed to set a millage rate that would ensure a balanced budget. The Commission voted to increase the ‘not-to-exceed’ rate – the ‘cap’ — in case projected revenue shortfalls did materialize.

Ms. Sprinkel is in a unique position to know also that the millage rate is never ‘set’ until the second Commission meeting in September, just before the October 1 beginning of the new fiscal year.

City Budget Will Be Balanced

At the August 26 Commission meeting, Management & Budget Division Director Peter Moore announced good news from Tallahassee that the revenue shortfall would not be as great as expected, and that an increase may not be necessary.

One thing is sure: additional property taxes were never intended, as Sprinkel stated in her email, for ”. . .government funding (spending) above a balanced budget.”

Weldon Sets the Stage

In an August 16 email blast, presaging Sprinkel’s missive, former Commissioner Peter Weldon advertised “Stop Your Tax Increases” yard signs for anyone who wanted them – well in advance of any actual tax increase.

Weldon stated in his email: “Arguments in support of [the Commissioners’] vote to increase the millage rate include claims of better information by September, concerns about the city’s solvency and hurricane recovery costs, and comparisons of millage rates between cities. The truth is they just want to spend more of your money.”

Weldon’s email goes on: “So what is the truth about the tax increase?”

“The truth is that these four commissioners are spending your money on their pet projects while they fabricate justifications for raising your taxes.”

So what IS the truth about the tax increase?

The truth is, as of now, there is no tax increase. The Winter Park City millage rate will be established sometime after the five o’clock hour on September 23 by the Winter Park City Commission. Until then, nothing has happened.

To comment or read comments from others, click here →

by Anne Mooney | Aug 30, 2020 | Custom Author, Election, Events

WP Voters to Decide on Single Member Districts

Back Yard Chicken Pilot Program Takes Off

by Anne Mooney / August 30, 2020

Single Member Districts on March 2021 Ballot

At their August 26 regular meeting, Commissioners voted 3-2 to draft an ordinance that would add the single member districts question to the March 2021 ballot. If the ordinance is passed by the Commission, the ballot question would ask voters if they want to continue the current “at large” form of representation, in which each Commissioner represents all Winter Park citizens, regardless of where they live, or if the City should be divided into districts, with each district represented by a Commissioner from that district.

This issue was discussed at length during the 2019 Charter Review in preparation for the 2020 vote on updated Charter revisions. Single member districts was not among the 11 Charter questions on the 2020 ballot, as the Charter Review Committee felt Winter Park was geographically too small to be divided up into separate districts.

The question remained, however, in the minds of some citizens who are advocating for single member districts, which they believe will provide members of the historically Black Hannibal Square neighborhood a better chance for a strong voice in city government. There has not been a Black commissioner in Winter Park since the late 19th century, despite the crucial role of the Black community in the incorporation of first the town and then the city of Winter Park.

Advisory Board Appointments a First Step

One of the 11 Charter revisions that passed in 2020 was the change in Advisory Board appointments. Instead of the Mayor making all board appointments, each Commissioner also has authority to make board appointments, resulting in the appointments of several Black citizens to advisory boards this year. Service on a Citizen Advisory Board is generally regarded as one path to election to the City Commission.

Single Member Districts Requires a City Charter Change

In order to create single member districts, the City Charter would have to be revised, and a Charter revision can only be accomplished at the ballot box. There are two ways to put the question to the voters – by petition or by ordinance. In a citizen initiative, at least 10 percent of registered voters must sign a petition requesting the change. That would require gathering just over 2,000 signatures – in the midst of a pandemic.

The Commissioners also have the authority to pass an ordinance placing the question on the ballot, without the need for a petition drive. And that is what they did on August 26th, with Commissioners Todd Weaver, Sheila DeCiccio and Marty Sullivan voting in support and Commissioner Carolyn Cooper and Mayor Steve Leary dissenting.

January 20, 2021 – Deadline for the 2021 Ballot

Between now and January 2021, the Commissioners expect to hold a series of workshops in which they will have to decide how many districts there would be, where district lines would be drawn and, if the measure were to pass, how any change would affect those Commissioners currently holding office. In most cities that have single member districts, for example Orlando, the Mayor serves the city at large and each Commissioner represents a single district.

Personal Fowl

An ordinance allowing back yard chickens, which has been under discussion since 2014 or earlier, finally passed its first reading at the August 26 Commission meeting. The City plans to issue up to 25 permits for residents in single family homes to keep up to four hens – the recommended number for happy hens.

An ordinance allowing back yard chickens, which has been under discussion since 2014 or earlier, finally passed its first reading at the August 26 Commission meeting. The City plans to issue up to 25 permits for residents in single family homes to keep up to four hens – the recommended number for happy hens.

Did you know, the color of the chicken’s eggs is the same as the color of her ears. Have you ever been close enough to a chicken to look at her ears? You may now have the chance.

The chickens must be cooped in a structure no higher than 7 feet. Chicken coops must be in fenced back or side yards and placed far enough from neighboring homes to cause no disturbance. Only hens are allowed; roosters are prohibited, as they are the ones who are noisy. Residents who keep chickens must complete an educational class on chicken care and will undergo periodic City inspections to ensure coops are clean and well maintained.

The ordinance establishing this two-year pilot program is based on successful programs already in place in Orlando, Maitland and Longwood. Winter Park’s back yard chicken ordinance still has to pass its second reading before it becomes a reality, but Commissioner Todd Weaver believes that will come soon.

To comment or read comments from others, click here →

by Anne Mooney | Aug 1, 2020 | Custom Author, Headline, News

Commission Raises Tax Cap

But Will They Raise the Tax?

by Anne Mooney / August 1, 2020

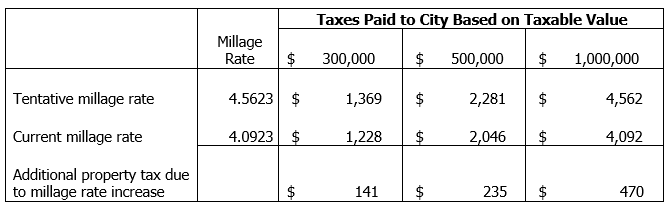

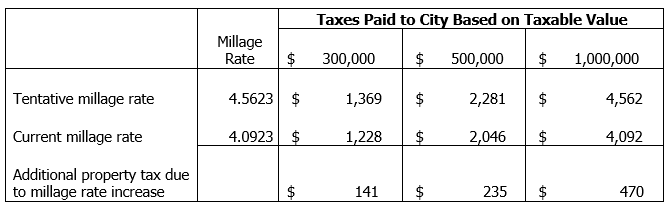

At their July 22 meeting, the Commission set a tentative millage rate of 4.5623. That figure represents a cap, a not-to-exceed number, and it’s the first raise in 13 years. Between now and September 23, the Commission can decide to leave the rate at its current level of 4.0923, they can raise it a little, or they can raise it to the 4.5623 cap set at the July 22 meeting. Much depends on information the City still does not have, such as information regarding available funds from the state in FY 2021. Ultimately, those projections will depend upon the depth of the recession caused by the coronavirus pandemic.

Nothing is final until September 23.

Because each year’s budget is adopted by ordinance, two readings with public input are required. The first reading of the FY 2021 budget is September 9; the second and final reading is September 23. The FY 2021 Budget will be adopted and the final millage rate will be set when the Commission votes on September 23.

It’s not just the City that sets the tax rate.

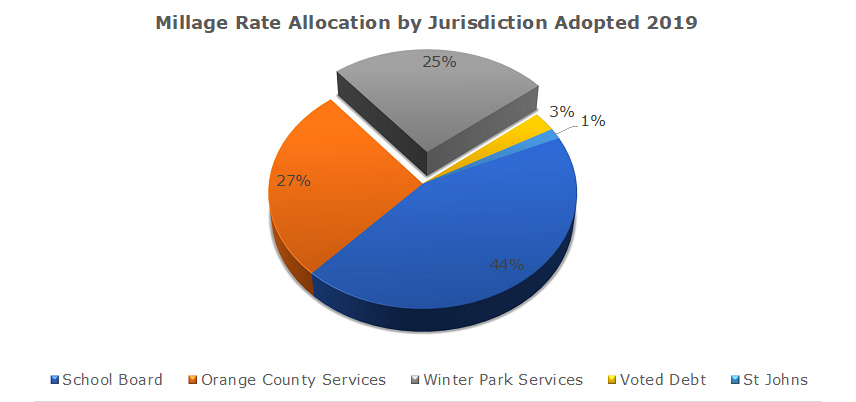

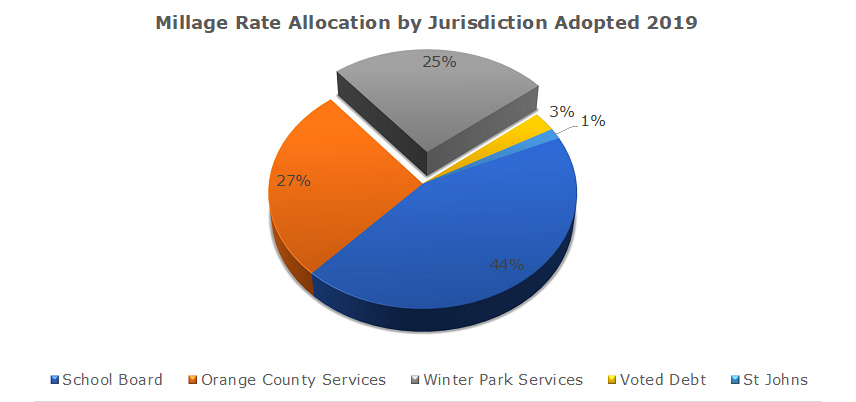

The City establishes the millage rate by creating a draft budget that seeks to balance projected expenses and revenues. Simultaneously, four other entities are doing exactly the same thing – each with eyes on our tax dollars. Our tax bill is based on a combination millage rates set by five entities — Orange County, St. Johns River Water Management District, the School Board, the City of Winter Park and the private debt created by Winter Park voters to build the Public Safety Complex and the Library-Events Center. These five millage rates will combine to form the rate we will pay on the assessed value of our property. The current rate for Winter Park is 16.3156.

Only about 25 percent of that total goes to support City services, while 44 percent goes to the schools and 27 percent goes to Orange County.

The economy has contracted in the pandemic.

According to Finance Director Wes Hamill, the City is currently facing a shortfall in 2020 of about $3 million due to the coronavirus pandemic. Hamill said he believes that by cutting costs, but without cutting services, there is still a good chance the City will break even by the September 30 year end. Some events, such as the Fourth of July parade, were cancelled because of the pandemic, thus saving those funds. Several open City positions have been frozen. If there is still a shortfall at the end of September, Hamill said the City will use reserves to cover the difference.

SunRail contribution postponed.

Hamill says he anticipates a $1.4 million decline in the FY 2021 budget from 2020. He did have one piece of good news, though. The City’s obligation to contribute to Sunrail has been delayed for two years, and will not begin until 2023.

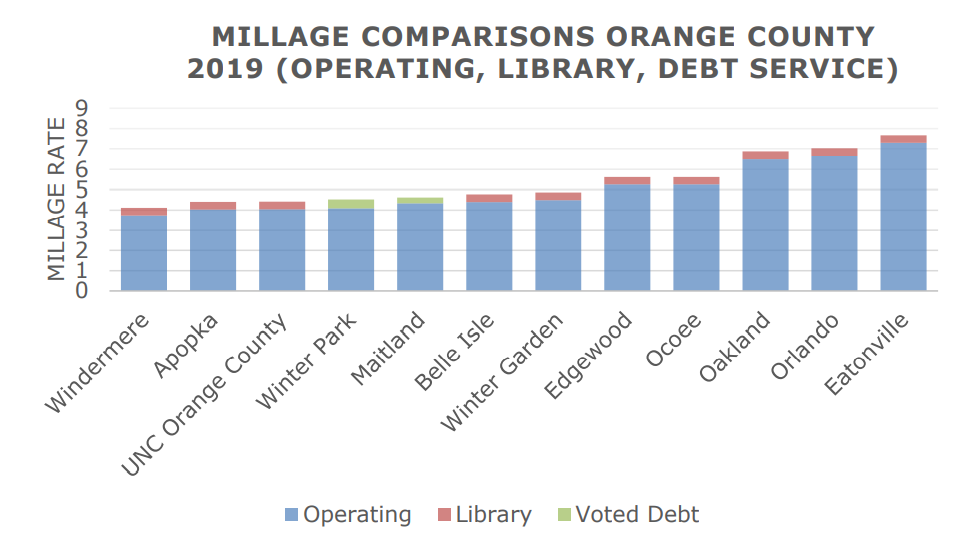

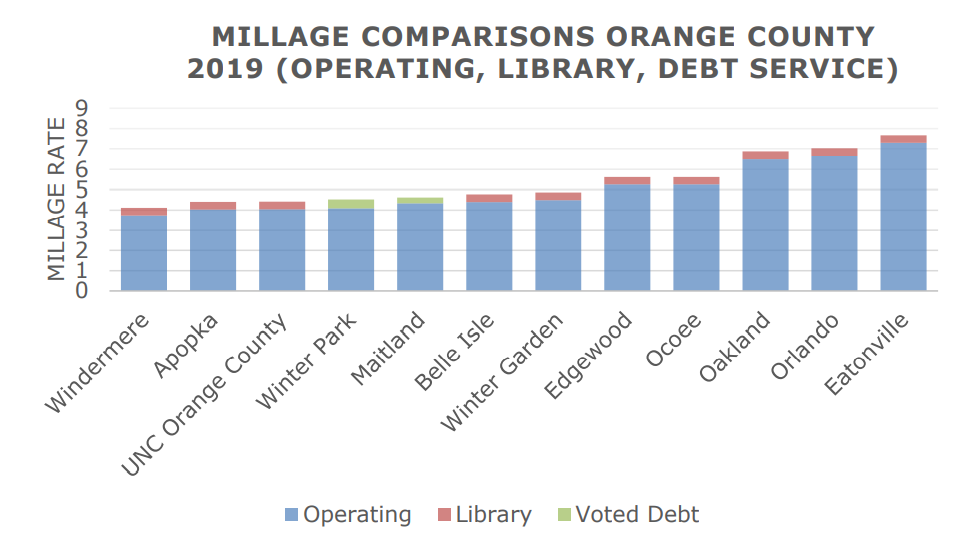

Despite the doom-and-gloom spin circulating the blogosphere, the City remains in good shape. The proposed budget document points out, “Winter park is fortunate to have the lowest operating millage rate among major jurisdictions in Orange County.” A comparison of tax rates is below.

To review the entire 401-page document, click here. https://cityofwinterpark.org/docs/departments/finance/budget/proposed-budget-2021.pdf

What does this mean for us?

The chart below illustrates the impact a rise to the current Winter Park millage cap would have on the average Winter Park homeowner. (This does not include increases from the other four taxing entities.) The chart was prepared by Finance Director Wes Hamill and Assistant City Manager Michelle Neuner.

There is still much we don’t know about FY 2021projections, and these are very uncertain times. “If you asked us to guess on a hurricane, we’d be pretty good,” said Michelle Neuner. “This year, in a pandemic, it’s a little tougher.”

To comment or read comments from others, click here →

Recent Comments