| Pension stories these days often depict a fiscal landscape in which city and state budgets all across America are in flames — a landscape where public employees are feeling the heat of taxpayer anger over benefits they can no longer afford.

In news reports and official studies, pundits and politicians call out public employees — and the officials who oversee them — for pushing cities to the brink of bankruptcy.

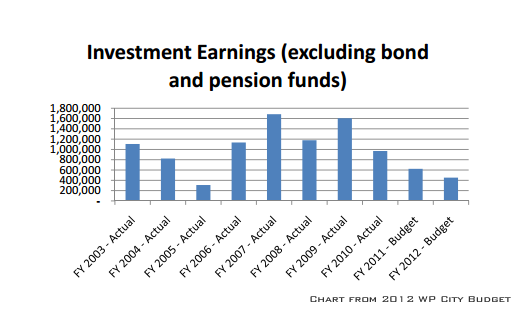

In Winter Park’s just-released 2013 Proposed Budget, City Manager Randy Knight warns “Substantial budget cuts have been necessary in our budget for the past few years both to balance the budget in those years and to create sustainability going forward. This year the overall revenue was fairly flat compared to last year so the cuts were not as drastic. Going forward, if revenues do not return to a growth that keeps up with inflation, it may be necessary to consider either service level reductions or a modest millage rate increase”

No hint of bankruptcy, but a warning nonetheless.

Some commentators paint a far darker picture of pension plan challenges. In a Senate Finance Committee report The Pension Debt Crisis that Threatens America, Senator Orrin Hatch concludes “. . . it is becoming increasingly apparent that defined benefit pension plans will never be financially sound enough over the long term for use by state and local governments.”

Fareed Zacharia writes in Why We Need Pension Reform, “Warren Buffett calls the costs of public-sector retirees a “time bomb.” They are the single biggest threat to the U.S.’s fiscal health. If the U.S. is going to face a Greek-style crisis, it will not be at the federal level but rather with state and local governments. The numbers are staggering.”

Just like pension plans in other cities, our city’s firefighter and police pensions took a hit during the great recession. And yet, a Google search of the phrase “Winter Park Pension” shows that — unlike many other cities — Winter Park’s story has remained decidedly low-profile. By contrast, a search of “San Jose Pension” and “California Pension” yields page after page of dramatic news coverage. Why them and not us?

California Pension Chaos

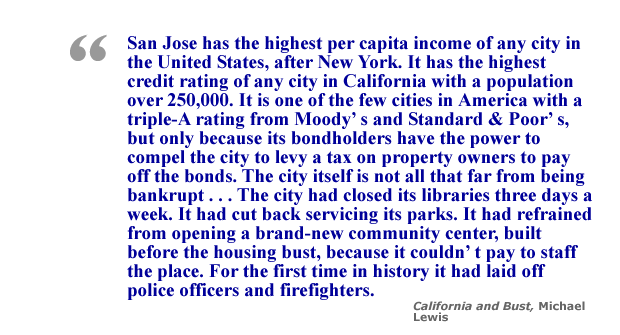

2012 was the year San Jose, CA became a poster child for public pension excess and municipal folly. Both San Jose and nearby Vallejo are the subject of a recent five-alarm expose in Vanity Fair Magazine. In California and Bust, Michael Lewis tells a tale of cities in deep trouble in a state whose future is no longer golden.

The fate of San Jose and cities like it have triggered a chain reaction — feeding the fear that drives the stories that embolden politicians to take on public workers. Stockton’s budget collapse forced it into bankruptcy this summer. San Bernardino voted to file for bankruptcy on July 10. And now, even liberal Democrats are taking a hard look at entitlements. Illinois and its largest city, Chicago, are bleeding more red ink than most — forcing Chicago mayor, Rahm Emanuel to challenge benefits that are important to traditional Democratic party allies.

|

Recent Comments