Commission Raises Tax Cap

But Will They Raise the Tax?

by Anne Mooney / August 1, 2020

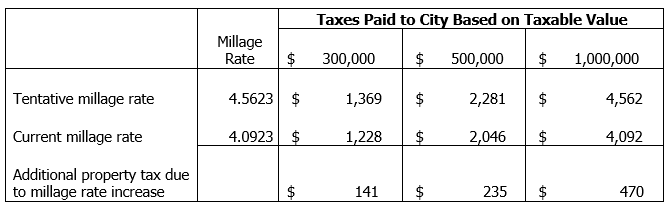

At their July 22 meeting, the Commission set a tentative millage rate of 4.5623. That figure represents a cap, a not-to-exceed number, and it’s the first raise in 13 years. Between now and September 23, the Commission can decide to leave the rate at its current level of 4.0923, they can raise it a little, or they can raise it to the 4.5623 cap set at the July 22 meeting. Much depends on information the City still does not have, such as information regarding available funds from the state in FY 2021. Ultimately, those projections will depend upon the depth of the recession caused by the coronavirus pandemic.

Nothing is final until September 23.

Because each year’s budget is adopted by ordinance, two readings with public input are required. The first reading of the FY 2021 budget is September 9; the second and final reading is September 23. The FY 2021 Budget will be adopted and the final millage rate will be set when the Commission votes on September 23.

It’s not just the City that sets the tax rate.

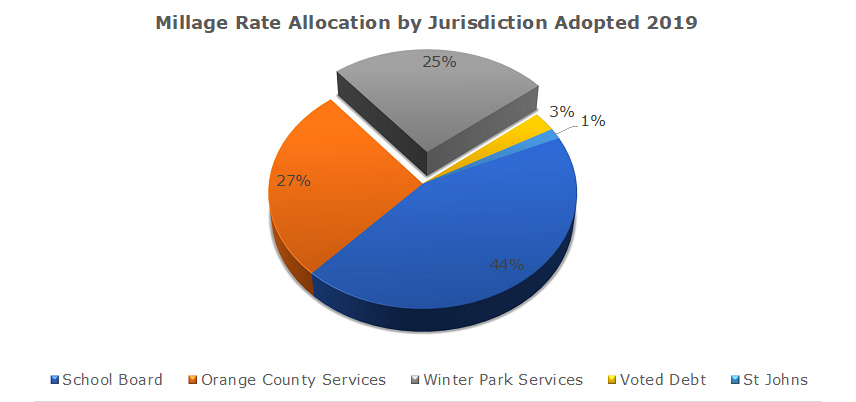

The City establishes the millage rate by creating a draft budget that seeks to balance projected expenses and revenues. Simultaneously, four other entities are doing exactly the same thing – each with eyes on our tax dollars. Our tax bill is based on a combination millage rates set by five entities — Orange County, St. Johns River Water Management District, the School Board, the City of Winter Park and the private debt created by Winter Park voters to build the Public Safety Complex and the Library-Events Center. These five millage rates will combine to form the rate we will pay on the assessed value of our property. The current rate for Winter Park is 16.3156.

Only about 25 percent of that total goes to support City services, while 44 percent goes to the schools and 27 percent goes to Orange County.

The economy has contracted in the pandemic.

According to Finance Director Wes Hamill, the City is currently facing a shortfall in 2020 of about $3 million due to the coronavirus pandemic. Hamill said he believes that by cutting costs, but without cutting services, there is still a good chance the City will break even by the September 30 year end. Some events, such as the Fourth of July parade, were cancelled because of the pandemic, thus saving those funds. Several open City positions have been frozen. If there is still a shortfall at the end of September, Hamill said the City will use reserves to cover the difference.

SunRail contribution postponed.

Hamill says he anticipates a $1.4 million decline in the FY 2021 budget from 2020. He did have one piece of good news, though. The City’s obligation to contribute to Sunrail has been delayed for two years, and will not begin until 2023.

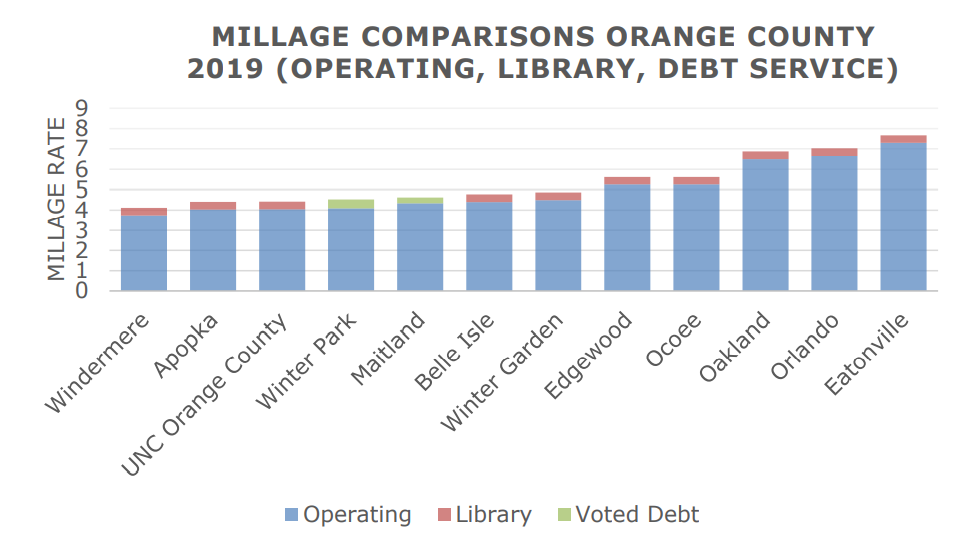

Despite the doom-and-gloom spin circulating the blogosphere, the City remains in good shape. The proposed budget document points out, “Winter park is fortunate to have the lowest operating millage rate among major jurisdictions in Orange County.” A comparison of tax rates is below.

To review the entire 401-page document, click here. https://cityofwinterpark.org/docs/departments/finance/budget/proposed-budget-2021.pdf

What does this mean for us?

The chart below illustrates the impact a rise to the current Winter Park millage cap would have on the average Winter Park homeowner. (This does not include increases from the other four taxing entities.) The chart was prepared by Finance Director Wes Hamill and Assistant City Manager Michelle Neuner.

There is still much we don’t know about FY 2021projections, and these are very uncertain times. “If you asked us to guess on a hurricane, we’d be pretty good,” said Michelle Neuner. “This year, in a pandemic, it’s a little tougher.”

In my opinion we get good service and the taxes we pay to the City of Winter Park are appropriate. I support the mileage rate as proposed. Tom Ackert

Together Pete Weldon and Mayor Leary have today disseminated an e-mail to residents concerning Leary’s distress over his fellow commissioners’ decision to “increase taxes”. Never mind that it hasn’t happened.

He expresses this distress (with Pete’s assistance) in disregard of the fact that the final millage rate has not been set. The other 4 commissioners are adopting a wait and see approach. This would preserve the ability to raise the rate UP TO half a mill, IF and only IF, it appears that important city service levels cannot be preserved otherwise. The word tentative means exactly that. The millage rate has NOT been FINALIZED and won’t be for weeks.

Leary expresses further angst that the majority did not examine ways to cut expenses before possibly raising the rate. Hello?

My question is did Leary miss ALL of the recent city commission meetings where the millage rate, the budget, and the measures the city manager has been exploring in order to trim the budget and tighten the belts of various city departments have been under discussion? I know he has been absent, left early, or been on cruise control lately since he is a lame duck. But he needs to pay closer attention. The budget impacts have been under discussion by the commission since the arrival of the pandemic.

The city manager and the commission majority have been very pro-active in identifying budget areas to cut and trim. There was even a budget work session. All in the public eye.

We all recognize that the financial impact of the pandemic is an unknown which is impossible to predict.

Any one, including Leary or Weldon, who says they know how or where pandemic losses will shake out needs to hang a shingle in Cassadaga and offer psychic readings.

Folks should think about it and make an effort to weigh in as the commission reaches their final decision. The rate has yet to be set.

Commissioners all want to hear from residents. Cooper and DeCiccio have already reached out in e-mail blasts saying they are extremely hesitant to vote to raise the millage absent a clear demonstration of need. For the mayor to castigate the majority for what was a vote to exercise caution seems intended to incite rather than to inform.

We are always told new development will “increase the tax base.” So, our City Commissions approve new development, which increases congestion and traffic and lowers our quality of life. Still, no commission ever LOWERED our taxes because of new development, and now they’re talking about RAISING our taxes. How about cutting City staff and expenses instead? Hello? Randy Knight? Look what Rollins did with their staff cuts due to COVID-19. The City of Winter Park? Nada.

As an experiment, why not try to run the City with NO taxes?

We’re told we NEED a police department, but nobody seems scared when everyone is running around with masks on their faces all day waltzing into places of business.

Everyone is staying home anyway.

Can’t be much crime going on.

Remember folks, City Hall was CLOSED earlier this year for months and nobody seemed to notice – or care.

Yes the occasional pot hole still needs to get patched, but the people who live on the street are perfectly capable of calling a private contractor and paying them to patch it.

So what do you say we try it this year?

ZERO MILLS!

Winter Park has the second-highest per capita taxes (excluding debt) for municipalities in Orange County and for cities with a population between 25,000 – 35,000. The focus on the millage rate is misplaced. I am hopeful that this Commission will begin to focus on our per capita spending which is the more appropriate measurement guide to determine if our spending is delivering the level of services desired.

There is no need to raise the millage rate and I believe the majority of the Commission will vote accordingly. Unfortunately, by keeping the millage rate the same the Commission will be raising our taxes by nearly 7%. This is not the time to raise taxes on residents, especially since many have either lost their jobs or have taken pay reductions.

Now is the time to use our reserves to fund any gaps, as we have plenty of funds to weather this pandemic hurricane.

Good to hear from Michael Poole on this Comment board again.

Hope he will comment here more often.

He’d make a good mayor.

We need him in Winter Park.

Concur. .

Correct. Valuations go up and millage should be lowered. Any commission that does not lower millage to keep revenues neutral or increased only for inflation is in essence passing a net tax increase. So the claim taxes were not raised for 13 years is wrong. I assume all the commissioners over the years can do simple algebra. This failure to maintain the gross revenue from property taxes is one of the primary reasons for Save Our Homes; the other being to restrict governments spending growth by capping the growth of property values to 3%. The math is simple.