Fearing Property Tax Cuts by State, WP Opts Against Giving Extra to Nonprofits

Florida voters could be asked next year to cut their property taxes. That already has cities like Winter Park reeling over how they will fund essential services like police, fire and flood prevention.

Oct. 27, 2025

By Beth Kassab

City Commissioners met late last week to consider a plan to give out about $100,000 that once went to the Dr. Phillips Performing Arts Center each year to 10 local nonprofits in the form of $10,000 grants.

The conversation quickly reached consensus among city leaders that even $100,000 out of a $230 million budget couldn’t be spared amid proposals by Gov. Ron DeSantis and the Legislature to dramatically cut property taxes — a move they fear would kneecap local governments.

Budget Director Peter Moore said he was waking up at night thinking about what those proposals would mean on the doorsteps of residents who rely on the city government for essential services such as quick police and fire response times, clean drinking water, safe roads and sidewalks that don’t flood during storms and reliable electricity.

“I can’t even comprehend how we would wrap our brain around how that would even work,” he told commissioners during the Thursday work session. “But there’s five different proposals out there, which makes me think something is going to end up on the ballot.”

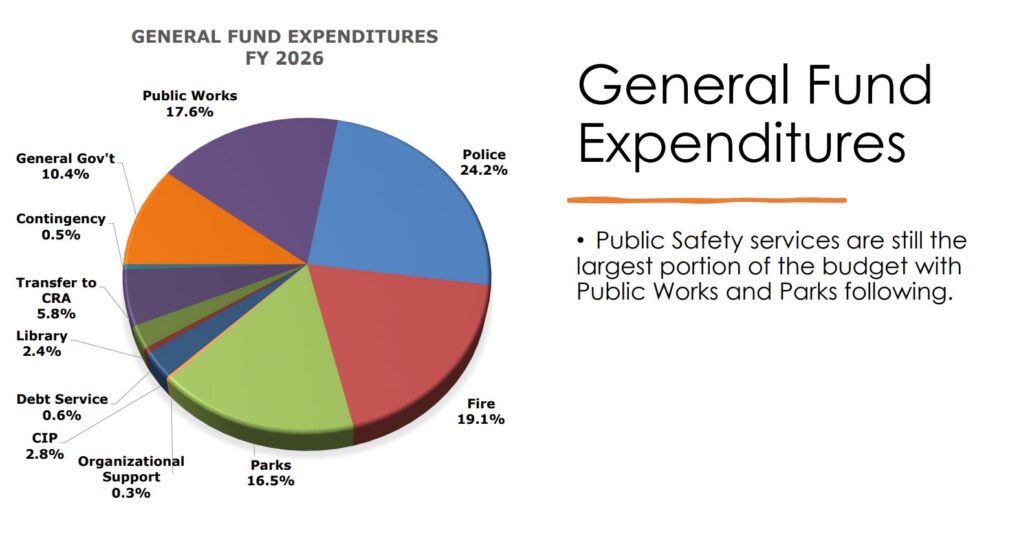

Property tax collections make up the largest source of dollars in the city’s General Fund, which pays for police, fire, parks, roads and other government services, including cyber security for public data.

The General Fund is about $90 million in the 2026 budget and city property taxes account for about $39 million or about 44% of that total. The money from property taxes is so significant it’s enough this year to cover the two largest expenses in the general fund: the police department ($21.9 million) and the fire department ($17.1 million).

“I’ve lost sleep over what’s going to happen,” said Commissioner Warren Lindsey. “I don’t know what they are doing up in Tallahassee. They have no idea how a local municipality and a county is run in terms of the things they’ve said and done.”

Proposals from the Florida House so far range from raising the homestead exemption to $100,000 to eliminating or phasing out non-school designated property taxes.

When a Winter Park property owner pays taxes, about 27% of that money goes to the city while 44% goes to Orange County Public Schools, 28% goes to Orange County government and 1% goes to the St. Johns River Water Management District, according to city budget documents.

DeSantis said last week he was unsatisfied with the House’s work, which would potentially put more than one tax-cutting measure on the November 2026 ballot. That could make it difficult for any single proposal to gain enough support to pass.

“Placing more than one property tax measure on the ballot represents an attempt to kill anything on property taxes,” DeSantis said on X. “It’s a political game, not a serious attempt to get it done for the people.”

The Legislative session begins on Jan. 13, earlier than usual because it’s an election year.

DeSantis’ administration is touring the state in an attempt to make a public spectacle out of his “DOGE” efforts to audit cities and counties. A Winter Park spokeswoman said the city has not received additional requests from Florida’s DOGE office beyond the requests that went to all local governments earlier this year.

State officials are pointing to the increase in property tax collections as property values have soared as largesse in local government.

For example, property tax collections in Winter Park have jumped from $27.5 million in 2022 to about $39 million in the current budget, a 41 percent increase. The growth is the result of a hot housing market as the city’s tax rate has remained the same for 16 years.

But local governments like Winter Park argue that costs have also soared during that time. The city spent $16.3 million on the police department in 2022 and now spends $21.9 million, largely the result of competition across the state to raise law enforcement pay. The fire department cost $13.4 million in 2022 and now costs $17.1 million, also a result of pay and other cost pressures.

Those two departments alone account for $9.3 million of the additional $11.5 million in property taxes collected by Winter Park due to rising property values since 2022.

Commissioners noted the potential “bad optics” of providing even small grants to nonprofits after Moore suggested it was the kind of expenditure that “could get picked up in a news article.”

Mayor Sheila DeCiccio said the city would continue to give grants to the nonprofits that are regularly funded in each year’s budget. But, she said “we will probably” be able to reallocate the money for Blue Bamboo Center for the Arts, which is undergoing a leadership transition after founder Chris Cortez was recently diagnosed with brain cancer and the county is reviewing its $1 million grant.

Jeff Flowers, who is taking over the management of Blue Bamboo, said the group is growing and remains sustainable.

The money for the nonprofit grants comes from .25% of the gross revenue from each of the city’s three major funds — the general fund, electric and water and wastewater.

The electric and water and wastewater funds, which the city calls enterprise funds, account for even larger increases in the city’s budget than property taxes. Those funds, which charge residents and businesses for service based on a combination of flat fees and prices tied to the amount of water and electricity consumed, have grown to a combined $100 million this year.

City Commissioners have raised those prices in recent years to account for increased costs of maintaining the utility systems and what the city says are soaring prices to finish a citywide project that will underground all overhead power lines.

The funds “must support their operations through the revenues they generate, operating like a conventional private business,” the budget notes.

The quarter of a percent from those three funds — the general fund, electric and water — generates about $442,000. Those that receive yearly funding, including the Winter Park Library, which also receives additional dollars, are:

- Mead Botanical Gardens: $102,000

- Winter Park Historical Association: $97,000

- Winter Park Day Nursery: $42,500

- United Arts: $20,000

- Blue Bamboo: $12,500

- Polasek Museum: $28,000

- Winter Park Library: $2.1 million

During the same work session about whether to hand out an additional $100,000 to nonprofits, commissioner also discussed a plan by the Parks & Recreation Department to formalize a policy to sell sponsorships or advertising opportunities at is facilities to raise additional new revenue.

Staff estimates such transactions could generate $100,000 or more a year.

City commissioners indicated support for the plan so long as ads or sponsorship plaques or banners are “tasteful” and major deals would come before the commission for approval. Commissioners must also still approve the policy for the new revenue stream.

The effort would mostly focus on the city’s two golf courses, the tennis center and other parks with high foot traffic. Central Park, the highest-profile public green space along Park Avenue, would be off limits to advertisers, according to the proposal.

Even before talk of property tax cuts heated up to its current white-hot level, city staff was warning of slower times ahead for the city government.

“While this budget does not assume a recession in FY26, there are concerns on the horizon and visible weakening in the economy,” the budget proposal released in the early summer stated. “This could just mean a return to normal growth after the post-Pandemic spike, or this could portend something worse.”

Adding new services and projects will only be possible in the future by raising property taxes or raising the fees customers pay for services, according to the budget analysis.

With the governor and Legislature poised to try to take property tax increases off the table, that leaves the prices residents pay for everything from the use of athletic fields and after-school programs to the cost of building permits and water and electricity as the primary ways for the city to generate dollars.

WinterParkVoiceEditor@gmail.com

Why is the library being granted $2.1 million year? Especially when they operate a venue space which generates significant revenue?

Complete waste of taxpayer funds.

Have you seen WP housing trend? You can’t purchase any decent home in 32789 under $1 million. Homes in WP are selling for excessively more than what they did 5 years ago. The property tax revenues will undoubtedly increase from 2021 numbers. I’d be willing to bet the 2025 calendar year property taxes are double the amount collected in 2021.

And you wonder why people trust a Gov. Ron DeSantis/Blaise Ingoglia report over what City Hall is telling you.

The Event Center is a City of Winter Park operation/venue. The City of Winter Park receives all the event center revenue; not the Winter Park Library.

❤️

The City owns and operates the Events Center. It is not run by Library management. They have nothing to do with it.

Thanks Jack for setting the record straight. It’s amazing in our small town with readily available and easily accessible information that someone could get it so wrong. But I bet he isn’t the only one who has a similar opinion.

For the sake of comparison, Orange County provides 73 million dollars to its libraries.

I agree with Penny and Patricia. Andrew’s reply exposes relevant points but doesn’t tie in outcomes: “excessively” high home sale value is fueling property tax revenue growth; but who is paying that tax?…the people who bought the home pay taxes set by the new appraised value: new homebuyers pay a huge portion of the City’s new income. If you have “homestead” your “taxable value” can only increase at a minimal value (3%per year or the cpi whichever is less) so your tax burden is limited to a 3% annual increase assuming the same tax rate. What’s a solution for that? Government laws limiting how much you can sell your home for? I’ve lived in WP for 61 of my mid 70’s years. It is a very well managed and operated city.

I think the effort to eliminate property taxes is a looming disaster based upon a desire to move local control from local voters to the State. I think it was Jefferson who used the phrase “the best government is the one closest to the people”. We have leaders we elect who you can call or visit and easily attend their meetings and access their records. Can do that for the State Government?

Our city services are second to none, in my opinion. Eliminating property taxes is nuts when you consider what our city provides.

Getting rid of property taxes is the craziest, most illogical idea this administration has come up with yet. And, with apparently no plan on how to cover the shortfall of funds for that which property taxes pays. I’ve been paying property taxes for 53 years, and gladly so, knowing I will get my money’s worth in public services. We can only hope that the administration will come to their senses and nix this absurd idea.

That’s what voting is all about. Let the people decide. I’m looking forward to it 😉