by Beth Kassab | Jul 13, 2024 | City Commission, News, Taxes, Uncategorized

City budget talks kick off with modest increase in spending proposed

Commissioners will be called on to set priorities in coming weeks

July 12, 2024

By Beth Kassab

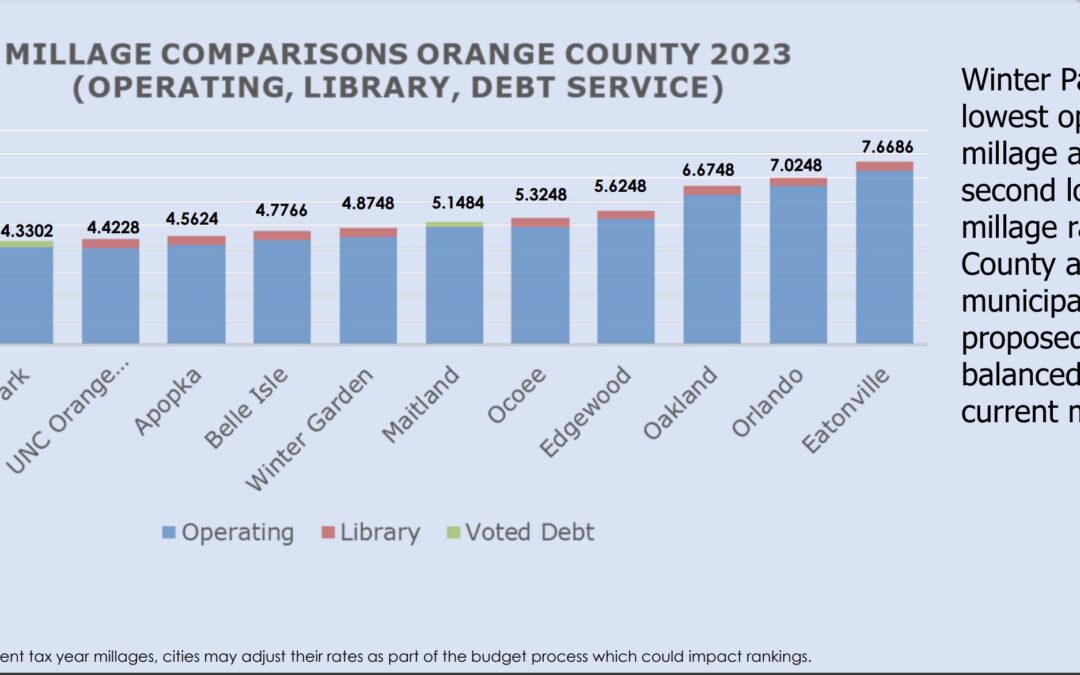

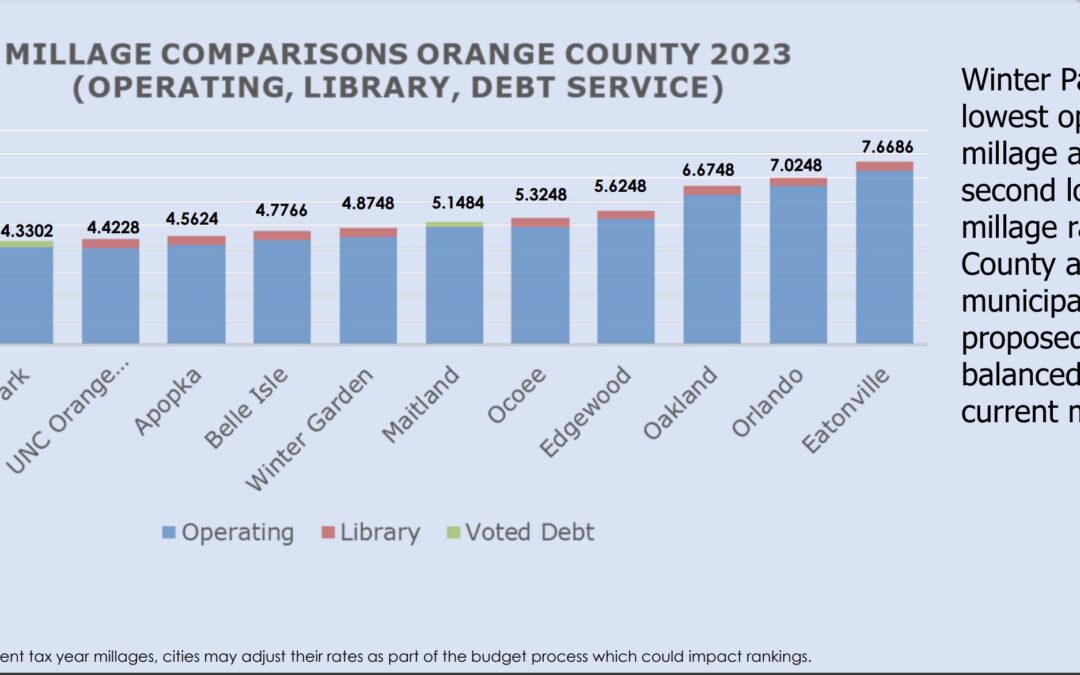

Residents got a first glimpse at next year’s city budget — a $214.6 million proposal with a 3% or $6 million increase over the current year as property taxes remain a key driver of growth in the general fund.

The plan calls for the city to maintain the same property tax rate its held for 16 years, though residents will see additional fee increases for trash pick-up as a result of a contract negotiated last year and there are signals pointing to more fee increases for other services ahead.

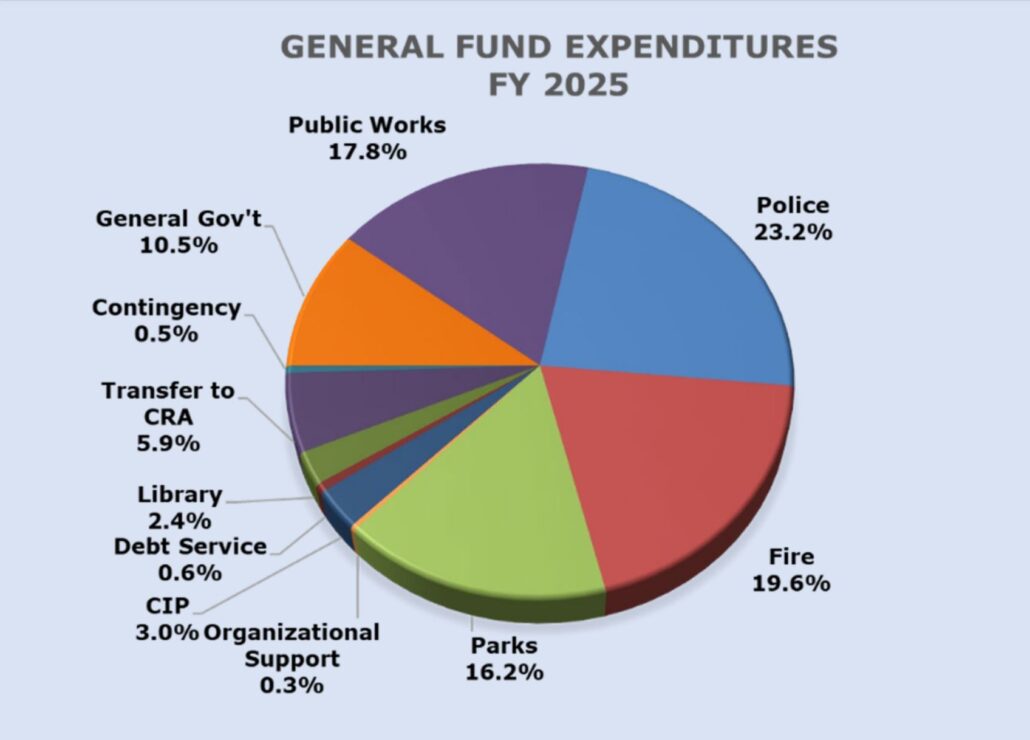

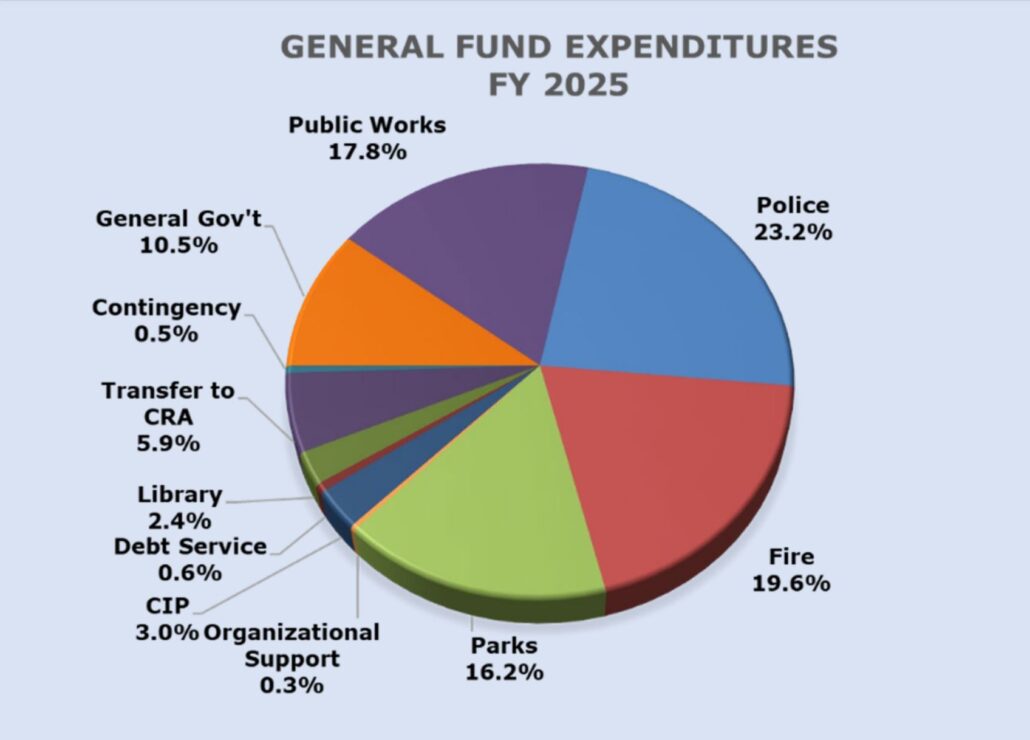

Public safety remains the biggest expenditure in the general fund, rising from about 35% in 2024 to more than 42% in the new budget. The increase comes with four new proposed positions, including two new firefighters/emergency medical technicians, a fire logistics manager and a police grant and accreditation manager that will be upgraded from a part-time to a full-time position.

While inflation continues to put pressure on wages and building costs, the city’s general fund will see almost 7% growth to nearly $83 million as a result of increases in home values, fees for services and Winter Park’s share of the state sales tax. Other funds are flat or seeing declines.

The city’s proposed budget shows where dollars are coming from in the general fund. Source: City of Winter Park budget documents

The water utility, for example, is expected to see declining cash flow as inflation pushes up the costs to maintain the system, according to the budget presentation. The water rates customers pay are driven by the state’s regulatory agency called the Public Service Commission, but the index for regular increases are “are likely insufficient to handle future demand for investment,” the presentation said.

In addition, the city-owned electric utility will “likely need to consider a rate increase” next year due to higher costs within the power portfolio.

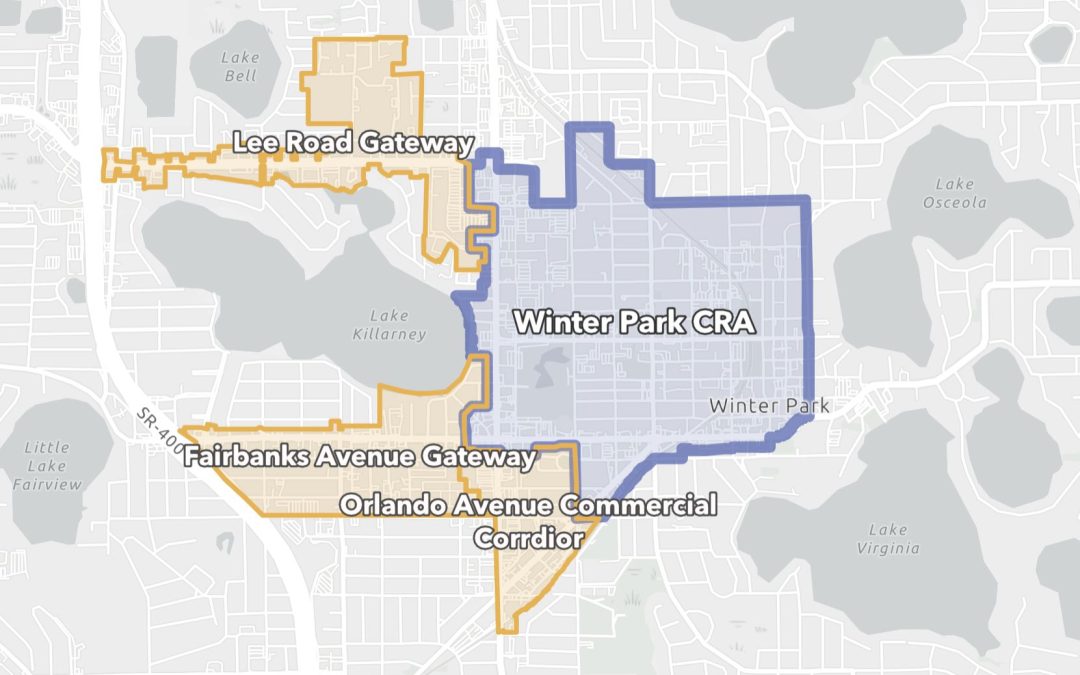

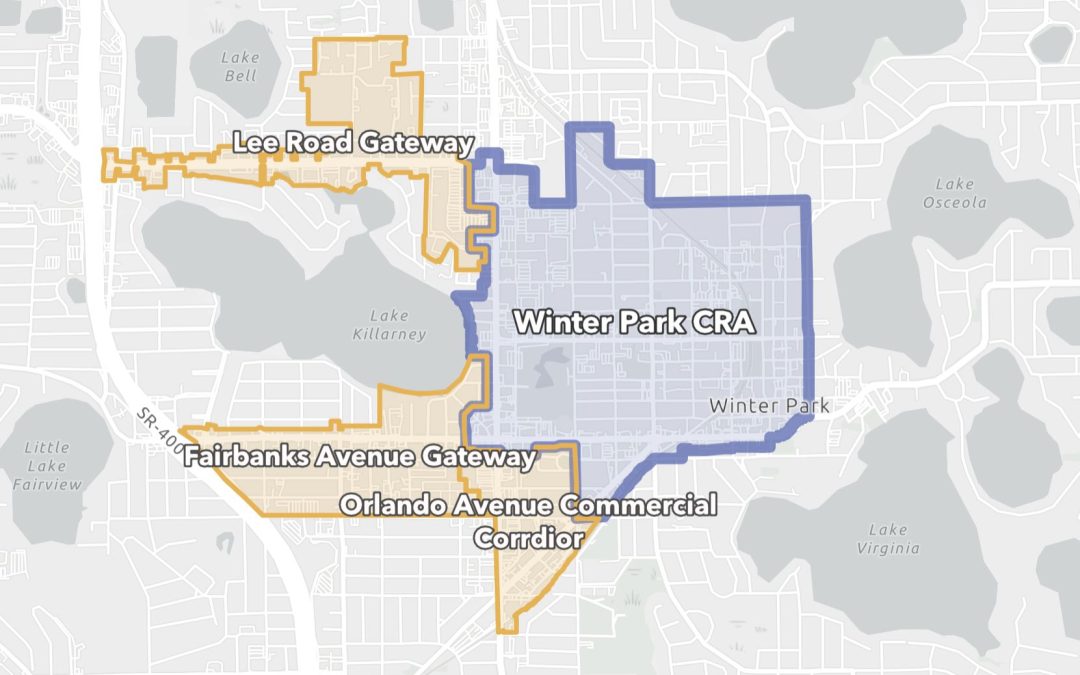

Also at play is the future of the city’s Community Redevelopment Agency, which uses a portion of county tax dollars to fund projects in a special district that covers downtown. The city is looking to the county to extend the CRA (which otherwise would sunset in four years) and expand its borders, but the Orange County Commission has yet to take up the matter.

Overall, there are about $126 million worth of projects in the city’s 25-year plan that don’t currently have a funding source attached to them. That means commissioners will need to continue to set priorities and make choices about how to manage the competing interests that come from wanting to maintain relatively low property taxes and fees for residents with improving services, infrastructure and amenities.

The proposed budget set aside a contingency of about $450,000, roughly the same as last year. The city’s reserves are expected to grow to about $21.2 million or about 27% of the recurring annual operating costs in the general fund, the proposal says. It would take about $2.7 million more to reach the goal of 30%.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Sep 29, 2023 | City Commission, News, Taxes

Winter Park passes $208 million budget

Mayor also provides update on the city’s plan to extend and expand the CRA

Sept. 29, 2023

By Beth Kassab

Winter Park City Commissioners gave final approval Wednesday to a $208 million budget, a $9.5 million increase over last year.

City Manager Randy Knight proposed a last minute change, which won consensus from the board, to drop the city’s federal lobbyist and hire a grant writer, a move that he said will bring “more bang for our buck.” The city’s $6,500 per month contract with Thorn Run Partners will end.

The second and final budget hearing brought little public debate. Two residents complained that the commission is too “progressive” with “out-of-control spending.”

Gigi Papa, who frequently attends the public meetings, urged more people to run for office, noting that the two commissioners up for re-election earlier this year — Sheila DeCiccio and Marty Sullivan — did not face any opposition.

Mayor Phil Anderson, who is up for re-election in March, but is not expected to run again, addressed some of the concerns. He explained that inflation and increased labor costs are the biggest drivers of the budget increase as the city sought to add positions such as in the police department in order to maintain the same level of service to residents.

One person complained that the city’s efforts to underground powerlines are still not complete even as spending has increased on the library and other projects.

Anderson noted that the undergrounding is still underway and delays are not related to a shortage of funds, but long supply lags for transformers and other in-demand equipment.

“We’re not undercapitalized, we can do it,” Anderson said. “We just don’t have the materials to allow us to complete it.”

Anderson and Knight also provided a short update about a recent meeting with Orange County Commissioner Emily Bonilla, who represents Winter Park.

They said she was receptive to the city’s proposal to extend and expand its Community Redevelopment Agency or the special tax district centered on downtown that is scheduled to end in 2027.

Winter Park leaders want to continue the district beyond that and expand its boundaries (see above map for proposal), but that plan must be approved by the county. The decision will be critical to the city’s future considering the CRA is a key source of budget revenue such as providing $350,000 additional dollars next year to expand the hours and services at the library.

Anderson noted that Bonilla and county officials will want to see solid proposals to address affordable housing and transportation needs with those dollars. A consultant is preparing a report for the city and the application for the extension is expected to be considered by the county in the Spring.

Questions or comments? Email the editor at WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Jul 22, 2023 | City Commission, News, Taxes

News & Notes: Hard budget choices ahead; the future of Park Avenue and city promotions

A look ahead at the next Winter Park City Commission meeting

By Beth Kassab

Winter Park City Commissioners will face some hard choices this week as they continue to comb through the city’s budget and set priorities.

Is there enough money to buy the Bank of the Ozarks property to expand Seven Oaks Park? What about an awning for the Cady Way Pickle Ball courts? Can the city afford to build a sorely-needed downtown parking garage or fix more brick streets?

Those are some of the topics expected to come up when commissioners consider what to prioritize at their meeting on Wednesday.

A list of capital projects will need a serious edit, according to city staff, who determined, “the scope and quantity of projects that have been listed are beyond the current ability of expected revenues to be able to accomplish.”

An analysis of $40.9 million worth of projects desired by city staff or elected officials shows at least $30 million of the total is not funded. Staff estimated about $6 million in additional funds will become available over the next five years through the CRA, the general fund, the parks acquisition fund and the mobility impact fee, still leaving a deficit of about $23 million.

Critical to the outcome will be whether the city’s CRA is extended beyond 2027 when it is scheduled to sunset. Extension will require approval by Orange County.

The future of retail on Park Avenue and more

Winter Park wants to keep up with the Joneses. Or rather with Winter Garden, Mt. Dora and other cities that have stepped up their shopping and dining scenes in recent years to compete for Winter Park’s longstanding bragging rights as the favorite among the brunch and stroll crowd.

A new strategies report recommends ways the city can improve not only its central Park Avenue district, but the other retail corridors: Hannibal Square; Fairbanks Avenue; Orange Avenue; U.S. 17-92, which the city also calls “The Golden Mile,” and Aloma Corners on the corner of Lakemont Avenue and S.R. 426.

“Preemptive action is needed to ensure that Park Ave remains metro Orlando’s premier ‘Main Street’ experience in the minds of Central Florida residents, given the ascendancy of newer competitors such as Winter Garden, Mt. Dora, etc.” the report states.

The report also calls on Rollins College to help improve the Fairbanks Avenue area as a gateway to the small liberal arts campus.

“Fairbanks Avenue has long ranked as Winter Park’s most underwhelming commercial corridor, yet it is the prime gateway to Park Avenue as well as the front door to Rollins College, which would seem to have the mandate, the incentive and the financial wherewithal to reinvigorate the two-block stretch it primarily owns and controls so as to better compete with prospective students, professors and researchers (as well as engender good will as a tax-exempt institution)—similar to

how many other elite colleges and universities across the country, in partnership with local government, have acted aggressively to elevate their surroundings for such purpose (even at the expense of their portfolio’s operating margins),” states the report.

The recommendations are scheduled as an item for discussion on Wednesday’s City Commission agenda.

See who’s moving up

Longtime Planning & Zoning Director Jeff Briggs is retiring and Allison McGillis will step into the role after serving as assistant director and preparing for the succession for 14 months. McGillis graduated from Rollins College with a degree in Environmental Studies and Civic Urbanism and a master’s degree in Civic Urbanism. She holds certifications from the Congress for New Urbanism and is a member of American Institute of Certified Planners. Briggs served the city for 45 years and will take on a role as a consultant.

Peter Moore, division director of the Office of Management and Budget, and Pam Russell, division director of Human Resources, will take on the elevated titles of director for their respective departments after a recent pay and benefit study recommended the changes.

Moore joined the city in 2006 and has served in a number of roles. He holds an economics and history degree from Furman University and an MBA from Rollins. Russell joined the city in 2021 and graduated from Trevecca Nazarene University and served in the Army.

Questions or comments? Email the editor at WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Anne Mooney | Jun 20, 2021 | News, Taxes, Zoning and Development

Open Letter to Current Mayor & Commissioners

Do not blow this opportunity again. Now is the time for the Post Office!

Guest Columnist Sally Flynn / June 20, 2021

On June 9, the Orlando Sentinel published a letter from six former Winter Park mayors cautioning the current Winter Park Commission against acquiring the Winter Park Post Office property for the purpose of expanding Central Park.

On June 9, the Orlando Sentinel published a letter from six former Winter Park mayors cautioning the current Winter Park Commission against acquiring the Winter Park Post Office property for the purpose of expanding Central Park.

I do not care what these past mayors think about how we should spend our money, and I don’t believe most Winter Park citizens do, either.

In 1886, When Charles Hosmer Morse deeded the land that is now Central Park to the City, that deed came with a restriction protecting the park from commercial use or development. For 135 years, Winter Parkers have honored that restriction and have taken pride in enhancing and expanding the park.

Protecting the Park

Over the years, City leaders have created a web of local ordinances to protect the park. In 1999, a citizens’ initiative put in place a prohibition to keep the City from building on land in or adjacent to Central Park. In 2009, the height of properties affecting the open vista of Central Park was limited to two stories. In 2011, the downtown area that includes Park Avenue, Central Park and the Post Office was placed on the National Register of Historic Places. In the 2016 Visioning process, Winter Park residents stated unequivocally that one of their top priorities is the expansion of green space within our community.

City has long history of effort to acquire the Post Office

In 2014, then-Congressman John Mica arranged a meeting with the U.S. Postal Service (USPS) and the City, and a series of productive negotiations commenced. The USPS agreed to allow their facilities to be separated between a downtown retail facility and a separate distribution facility. This made the project more affordable and was agreeable to both the City and USPS.

USPS was willing to move

By January 2015, negotiations had progressed. USPS Vice-president of Facilities wrote in response to City Manager Randy Knight’s suggestion of a particular site, “Randy, after completing a few layouts, we believe that the site has high potential of working for us (subject to a 30% design). I think you should proceed with your discussion with the City Council.”

City stalls negotiations

Instead of following the USPS V.P.’s recommendations to continue discussions at the Commission level, however, staff prepared an agenda item recommending the Commission delay negotiations and, instead, prepare a notice of disposition to sell Progress Point and use the proceeds to purchase the Post Office. Mayor Steve Leary moved to cease negotiations with the Post Office; his motion passed on a 3-2 vote.

CRA funding becomes available

Fast-forward to October 28, 2019, when the City Commission voted 5-0 to execute a Resolution in support of acquiring the USPS property to expand Central Park, dedicating this land to park use in perpetuity. In January 2020, the Community Redevelopment Agency (CRA) voted to allocate funding for the Post Office acquisition in the CRA Capital Improvement Plan.

On January 27, 2020, the Commission voted to direct the City Manager to move forward to negotiate and execute a Letter of Intent to buy the Post Office Property. The City now has funds budgeted for FY 2021 and FY 2022 to bring this project to fruition.

Now is the time

Our CRA is scheduled to go out of existence in 2026. After that happens, putting together the necessary funds to acquire the Post Office property will be very difficult, if not impossible. Now is the time for our City to show it has the courage of its convictions: now is the time to act.

To comment or read comments from others, click here →

by Anne Mooney | Jan 31, 2021 | Opinion, Taxes

City Funding Decisions – Let’s Set the Record Straight

Editor's Note: Articles written by citizens reflect their own opinions and not the views of the Winter Park Voice.

Guest Columnist Dr. Katherine Lee Johnson / January 31, 2021

In his latest missive to Winter Parkers, former Commissioner Peter Weldon chides members of the current Commission for redirecting funds to repair City parks.

If we are going to start casting aspersions on Commissioners who direct City funding to specific purposes, then we need to start looking at how and when this policy started. It began in 2015, when Mayor Steve Leary and Sarah Sprinkel, the Vice mayor at the time, committed $1 million from the Municipal Utility budget to support a non-Winter Park charity.

For those who may not recall, Mayor Leary committed the City of Winter Park to a $100,000 annual donation for the Dr. Phillips Performing Arts Center (DPAC) for ten years. This action occurred in 2015 when I served as the Chair of the Utility Advisory Board (UAB).

The UAB members were gravely concerned about the long-term ramifications of his decision. When the City purchased the utility from Florida Power & Light (now Duke Energy), the infrastructure was in disrepair and badly needed service and upgrades. During my tenure on the UAB, we focused our energies on the need for new equipment and began implementing utility undergrounding to improve overall system reliability.

In 2015, thanks to staff’s careful management, the Utility had a surplus in its annual budget. As stewards of this utility, the UAB wanted to use those funds to pay for additional operations and badly-needed maintenance. More fundamentally, we wanted these ratepayer dollars used for the utility, to benefit the ratepayers, rather than having it siphoned off to an out-of-town charity.

When I voiced my concerns at a Commission meeting that this approach could set a dangerous precedent, Vice-mayor Sprinkel publicly reprimanded me in an open meeting for wanting to share this information with the utility ratepayers.

For the past 30 years, I have worked as a consultant with utility companies to establish and evaluate energy efficiency programs—and so I am well-versed in the long-term consequences when utility funds are redirected for political purposes. It happened in several jurisdictions as early as 2010 (see link: Governors Raiding Utility Funds), and I certainly didn’t want this to happen in Winter Park. I worried the DPAC donation could set a dangerous precedent.

Isn’t it ironic that Weldon now supports donating $1 million from Winter Park ratepayers to support a charity in Orlando, but bristles when Commissioners allot funding for City parks and playing fields that will directly benefit the residents of Winter Park?

Let’s set the record straight. Ms. Sprinkel has always supported redirecting funds for whatever political purposes the Commission deems appropriate. If we are going to revisit previous Commission funding decisions, let’s be sure we air all of the facts.

Dr. Katherine Lee Johnson is President, Johnson Consulting Group. She served as UAB Member and Chair (2010-2016; Chair 2013-2016).

Rollins College, The Crummer School, MBA 1990

University of Southern Queensland, Australia, Ph.D., Organizational Change & Strategy 2010

www.johnsonconsults.com

https://www.linkedin.com/in/kjohnsonconsults/

To comment or read comments from others, click here →

by Anne Mooney | Sep 25, 2020 | Custom Author, Headline, Taxes

FY2021 Budget Passes

Millage Rate Unchanged for Year #13

by Anne Mooney / September 25, 2020

On September 23, Commissioners passed the FY2021 Budget, holding the millage rate steady at 4.0923 for the 13th consecutive year. Ordinances establishing the millage rate and adopting the Budget passed on a 4-1 vote, with Mayor Steve Leary dissenting.

Orange County sets property valuations

Property taxes will rise slightly, since property values were assessed by Orange County in January 2020 prior to the beginning of the pandemic. This reporter’s annual property taxes rose by less than $50, so with the steady millage rate, the increase for most property owners will be minimal.

According to Peter Moore, Winter Park’s Division Director of the Office of Management and Budget, residential real estate taxes comprise about 79 percent of the City’s tax base, leaving the City on solid fiscal footing for now. The City boasts unencumbered General Fund reserves of approximately $17 million.

Postponed SunRail payments used to create contingency fund

The City also has created an approximately $500,000 contingency fund. This money was originally budgeted to pay for SunRail, but the state of Florida has postponed SunRail payments for another two years, allowing the money to be reallocated. “These funds are available now for emergency relief,” wrote Peter Moore, “as we manage the economic repercussions of the pandemic.”

Cautiously optimistic outlook for the future

Moore cautioned that while property tax revenues will be unaffected in the present, as values were established before the pandemic, possible future deterioration in the real estate market could affect Winter Park, and business closings and vacant storefronts will have a definite negative impact. “With almost $2 million in assistance either pledged or spent already by the city to assist its businesses and residents,” wrote Moore, “the city continues to work with all our stakeholders to navigate this difficult time.”

To comment or read comments from others, click here →

Recent Comments