No One Has Decided Our Property Taxes

They will September 23, but they haven’t yet.

by Anne Mooney / August 31, 2020

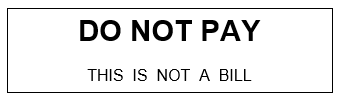

You know that thing we get every year called a TRIM notice? You probably just got yours. It lets you know what your proposed property tax bill is. On the upper right-hand corner of the document is a box advising you, in all caps:

This lets you know, worst possible case, what your tax bill could be if the proposed millage rates from all those taxing authorities in the left-hand column pass. You’ll notice that the City of Winter Park is not the only taxing authority that wants your money, or that has tentatively raised the cap on their millage rate. Orange County and the school board are right in there.

Millage Rates Have Not Passed

With the exception of Winter Park debt, which has to do with the bond issues for the Public Safety complex and the Library-Events Center and is already fixed, those millage rates have not passed and will not pass until late September. This is just a notice so you’ll be prepared in case one or more of the proposed millage rates does go up. That’s why you are advised not to pay; it is not a bill.

That is why it is puzzling to see yard signs and email blasts from people who are in a position to know better claiming that this Commission has raised your taxes. This Commission has not done anything yet.

Early Campaign Literature from Former Commissioner Sprinkel

An August 25 email from hello@electsarahsprinkel.com proclaimed, “The Winter Park City Commissioners voted to raise your taxes – now, during the pandemic.”

Former Commissioner Sarah Sprinkel must know, after nine years on the Commission, that the Commissioners did not have all the information from the state and the county they needed to set a millage rate that would ensure a balanced budget. The Commission voted to increase the ‘not-to-exceed’ rate – the ‘cap’ — in case projected revenue shortfalls did materialize.

Ms. Sprinkel is in a unique position to know also that the millage rate is never ‘set’ until the second Commission meeting in September, just before the October 1 beginning of the new fiscal year.

City Budget Will Be Balanced

At the August 26 Commission meeting, Management & Budget Division Director Peter Moore announced good news from Tallahassee that the revenue shortfall would not be as great as expected, and that an increase may not be necessary.

One thing is sure: additional property taxes were never intended, as Sprinkel stated in her email, for ”. . .government funding (spending) above a balanced budget.”

Weldon Sets the Stage

In an August 16 email blast, presaging Sprinkel’s missive, former Commissioner Peter Weldon advertised “Stop Your Tax Increases” yard signs for anyone who wanted them – well in advance of any actual tax increase.

Weldon stated in his email: “Arguments in support of [the Commissioners’] vote to increase the millage rate include claims of better information by September, concerns about the city’s solvency and hurricane recovery costs, and comparisons of millage rates between cities. The truth is they just want to spend more of your money.”

Weldon’s email goes on: “So what is the truth about the tax increase?”

“The truth is that these four commissioners are spending your money on their pet projects while they fabricate justifications for raising your taxes.”

So what IS the truth about the tax increase?

The truth is, as of now, there is no tax increase. The Winter Park City millage rate will be established sometime after the five o’clock hour on September 23 by the Winter Park City Commission. Until then, nothing has happened.

Anne: Thank you for the truth. Simply stated.

Weldon and Sprinkel have created a veritable Sharknado for the city commission. Guess the pandemic was not sufficient.

Any idea of a tax increase in this pandemic time period is ridiculous. Not will it just affect home owners but all retailers

The fact it was even considered was a mistake by our QUAD! The reason for the up rise was so our commissioners would understand how our community feels Can’t wait until 9/23 to express our disdain

Just wait until you receive your assessment for the new Library/Convention Center/Massage Parlor. Speaking of bad timing….

I am always grateful to our former elected officials (or those planning to seek higher office) when they offer a special fiscal master class. All ears. Of course, always appreciative, when the details and facts are presented in the light of truth. Too bad, this last foray on millage rates presented by two former commissioners was an exercise in “shade”. Fool me once, fool me twice—this voter moves on. Game over.

Anne, you really show your true colors here (and who pays your bills…). Smearing Sarah and attacking Pete for telling the truth is very low – even for this partisan blog. No one is saying the tax increase is a done deal – but you already know that. They are simply saying STOP the tax increase from becoming permanent on the second vote later this month – this by shedding light on a Commission that prefers to conduct its business under the secrecy of mid-day, online “work sessions” to form its legislative agenda.

The four senior members of this (do nothing) Commission have basically been “outed” trying to sneak through a large increase to our millage rate to cover their pet projects (i.e., chicken coops in WP – brilliant…). The problem is that a tax increase is simply not mathematically needed at this time – end of story. Some of the “Gang of Four” Commissioners are now backing away from their prior statements and reversing course on the September vote exactly because of this public pressure (yes – good luck ever getting reelected after cramming through a 10% tax & spend increase on our community during a pandemic).

Based on this article and a few emails I’ve received from the Commissioners, it’s clear this criticism of the tax increase has really gotten under their skin – and now your skin – which simply validates and amplifies Sarah and Pete’s positions on the issue.

Please Anne – refute this if you can – but tell the truth and stick to the facts this time. A large tax increase is indeed slated to become law in September if the Commission stays its current course.

Ross Johnston

Ross Johnston- You must not be on the hello@electsarahsprinkel.com email list. The former commissioner stated: “…my taxes were raised. So were yours.”

Again – this is clearly getting under your skin because you are part of the problem – supporting the tax increase and criticizing as many people as possible – and not being part of any viable solution with any viable plan – as usual.

Anon- I have not taken a position on the millage rate. I have no way of knowing yet what it will be.

The first vote will not even take place until September 9th. This date is missing from all communications from Sprinkel and Weldon. Why? Could they wish for you to think the first vote has already taken place? Hmmm.

Want the facts?

Here is a link to the FY 2020-21 City Budget Schedule:

https://cityofwinterpark.org/docs/departments/finance/budget/budget-schedule-21.pdf

All ordinances require 2 votes and nothing is finalized until that occurs. To say nothing has happened is misleading since TRIM notices show the proposed increase. During the nine years I served, the city commission never voted to increase the millage rate (property tax rate). The city commission sets the millage rate. It is their responsibility. The city commission does not control the property appraiser, schools, county or voter approved bonds. A millage rate is seldom rolled back after implementation. I am very glad our citizens became aware of the increase and let their opinions be heard.

And the Commission will not find it necessary to increase taxes this time. But this will be a numbers based decision. Not an emotional decision based on a promise to “never, ever increase taxes”. Commissioners must make decisions based on financial data not political platitudes.

Sarah, what part of “Do not pay – this is not a bill” don’t you understand. Your lack of understanding about this process and the laws behind it is certainly concerning, especially coming from someone with your “years of experience” in WP city government, and who aspires to lead our City as Mayor. You will need to do much better than this to earn the trust and votes of your fellow citizens…

These are the first two lines from the infamous email: “I received my TRIM notice and my taxes were raised. So were yours. The Winter Park City Commissioners voted to raise your taxes – now, during the pandemic.”

It is obvious this was written to scare the citizens, to try to make the Commission look irresponsible and to cause all the commotion. Weldon is infamous for being incorrect in his emails since he lost his last race for re-election. And now we know the next female who may want to run for Mayor. This and other emails were totally unnecessary and have hidden agendas. Such antics do not get my votes.

Deflecting nonsense. They clearly noticed their intent by voting to increase the millage from 4.0923 to 4.5623 on July 22nd. I clearly noted in all my correspondence that the final vote is September 23rd. Anne Mooney, now is the time to disclose who is paying you.

Thank you Anne, for shining a light on the Weldon-Sprinkel subterfuge intended to smear 4 Commissioners’ reputations on a flimsy and misleading accusation. We now know Sprinkel’s playbook – stooping to any lowly means in order to gain traction in her campaign for mayor.

When the community continues to suffer through an extreme economic and health crises, these two clowns create gotcha controversy to give her an edge. Is it really worth it to upset residents over an issue that doesn’t exist?

In today’s Sentinel we read about the fiscally responsible stop order implemented for the Orange County Convention Center by Mayor Demings and his colleagues because of the tourism tax revenue collapse. They can do it because they inked a responsible contract with vendors.

If you want to be alarmed about something, understand that the City can’t cancel or change any part of the library construction contract without heavy financial penalty. And we can thank Sprinkel and her buddies for blindly approving a contract without paying any attention to the details. The growing construction debt is real. The tax increase is not.

It must be difficult to cover one’s derrière while walking backwards.

That beeping sound you hear is Sprinkel quickly shifting to reverse. She is back tracking from what SHE actually put in writing to many residents.

Beep…beep…beep.

Rumor has it that Sprinkel is hoping that ANOTHER Sprinkel will soon run for City Commission.

That could explain her sudden interest in flaunting the Sprinkel name on local Winter Park media such as The Voice.

Sprinkel raised taxes more than any City Commissioner in Winter Park’s history, when measured in dollars. That’s because as Winter Park property values skyrocketed, Sprinkel voted to leave the millage rate (percent upon which property values are taxed) the same. The effect was a massive and unprecedented increase in property tax dollars over the nine year period Sprinkel sat on the Commission.

Dear Pete Weldon-

When will you run for U.S. Senate? – so we can share you with the rest of the country? (I know they will enjoy your speeches on the Senate floor) #MarcoStepAside

Sounds more like you’re trying to start a rumor. 0% chance I’ll run for office. This, along with the rest of your anonymous post, is complete nonsense.