Residents face higher electric and water rates in new proposed budget

The draft $233.5 million city spending plan represents a nearly 9% increase over last year

July 7, 2025

By Beth Kassab

Winter Park residents will start to pay higher electric and water bills later this year if higher rates proposed in the 2026 budget are approved by the City Commission.

The Commission will begin on Wednesday to consider the draft budget for $233.5 million across all funds, an 8.9% or $19 million increase over this year amid widespread uncertainty about the national economic outlook and signs of slowing growth.

About half of the city’s budget increase is driven by the cost of undergrounding electric wires — a popular multi-year project that cuts down on outages — and other improvements to the city’s water and wastewater systems, which prompted staff to push for increases in the rates that utility customers will pay.

This year the city celebrated the 20th anniversary of its acquisition of the electric utility from the former Progress Energy, now Duke Energy, in a landmark deal that promised better reliability and lower rates.

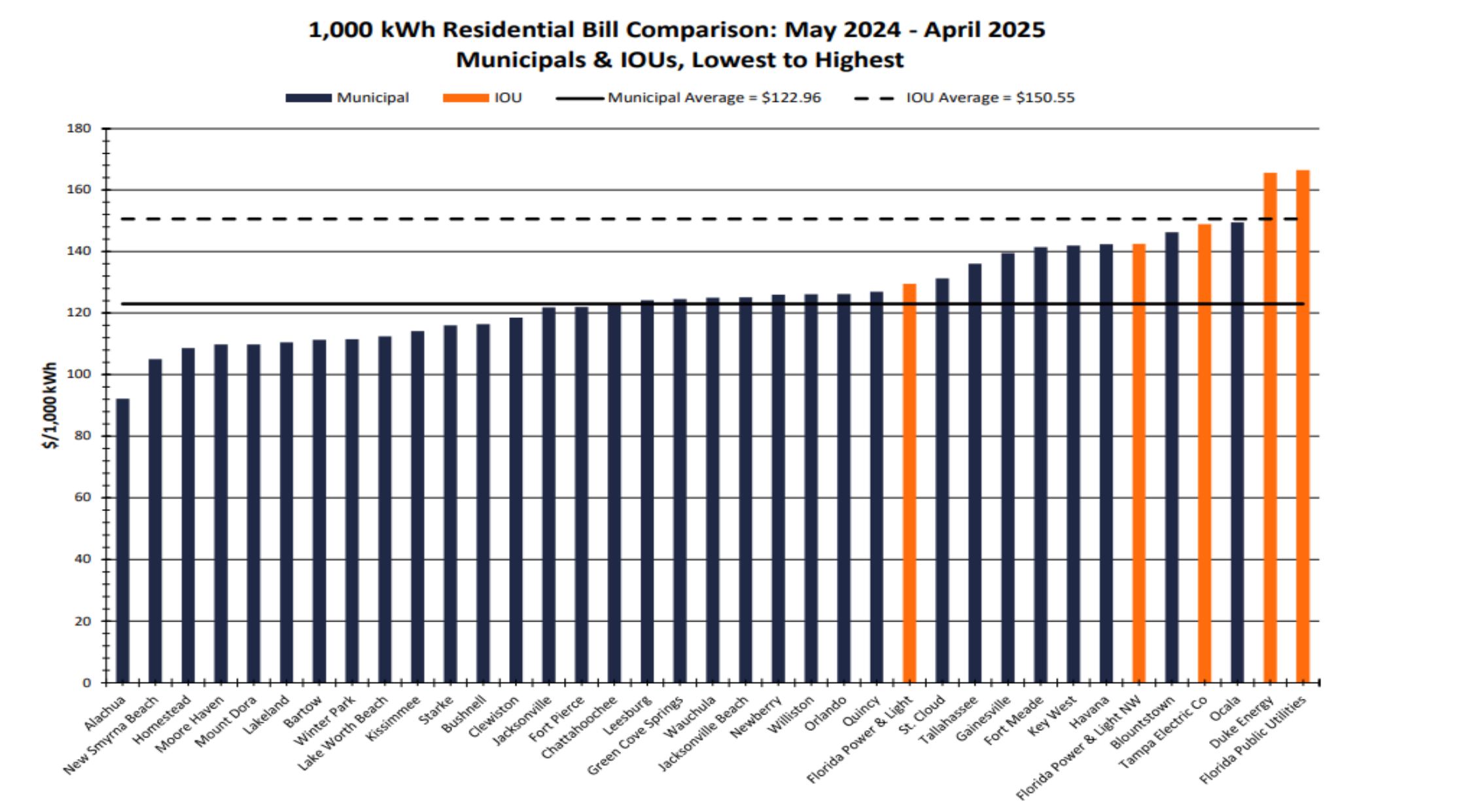

Winter Park, which has about 30,000 residents, often boasts of providing customers with one of the lowest electric bills in the state .Over the most recent 12-month period, the city’s rates were about 10% below the average for municipal-owned utilities in Florida and 33% below Duke Energy.

A chart from the draft 2026 budget proposal shows how Winter Park’s electric rates compare across the state. Above image: A crew from the city’s electric utility works outside of a resident’s home. (Photo courtesy of Winter Park Budget Proposal)

But the cost of the undergrounding project, which is now set to be complete by 2030, on top of persistent inflation means expenses are outpacing the current rate structure and, as the proposal noted, “the ability to continue to hold rates but still provide safe and reliable electricity has ended.”

The proposal calls for a 10% increase or about $15 more per month on a 1,000 kWh customer bill. The higher rates will fund the undergrounding project, substation and facility improvements and meter replacement, according to the budget document.

“While this is higher than would have been preferred, not having an annual index or policy for raising rates gradually leaves the utility with making periodic dramatic increases when outside shocks such as inflation and tariffs, affect the ability to maintain the current level of service,” reads the draft proposal. “It is actually surprising that the utility has not had to raise its non-fuel rates for years and is a testament to the extremely good power agreements and low-cost operation of the utility.”

Staff is proposing an additional 2% increase on water bills on top of the 2.23% increase set by the state Public Service Commission, which regulates utilities. The total adjustment would mean a $3.41 increase per month on the average 8,000 gallon customer.

The additional money would help the water utility keep up with capital expenses and stop using reserves to fund its obligations to help improve regional wastewater treatment plants.

Stormwater rates are also set to increase about $4 a month, according to the draft, based on a rate structure the City Commission put in place last year to increase rates by one penny per each property’s impervious square foot, each year, for three years. Those dollars go toward flood prevention, including setting into motion the results of recent basin studies, which identified the most urgent needs.

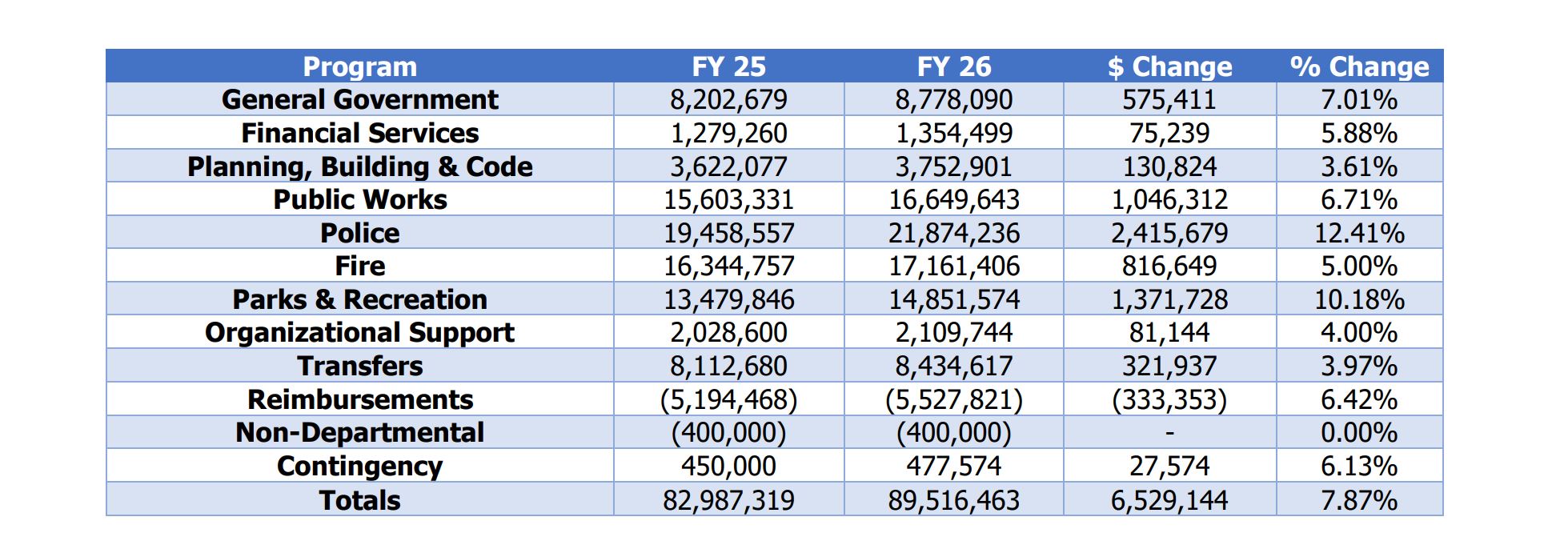

A chart from the draft proposal breaks down Winter Park’s General Fund, which makes up the largest portion of the city’s budget.

On top of those increases that will hit residents directly in the wallet each month, the budget proposal emphasized the need to balance an uncertain economic climate with political and other pressure to increase wages for police office officers.

“We are entering our 5th year of elevated inflation,” the budget draft states. “The long-vaunted U.S. economy is showing some concerning cracks as job growth is slowing, the number of home buyers vs home sellers has been dropping, retail sales are down, businesses have reduced hiring, creating the largest difference in unemployment between recent college graduates and the general workforce in years. All this points to a slowing economy that is likely going to remain at an elevated new normal of inflation around 3%. This means that the city will be experiencing slowing revenue growth while still facing an elevated inflation rate.

The draft noted that city governments often see a lag of about 18 months between signs of weakness in the economy and when the city begins to feel the downturn.

The budget keeps the city’s property tax rate the same — at 4.2991 mills, including debt service — though revenue will increase as property values increase. Each mill generates $1 for every $1,000 in the assessed value of a property.

“Property taxes are continuing to row the boat for the city’s fiscal picture, rising 7% and accounting for 44% of General Fund revenue,” the draft states. “This stabilizing force is what keeps most city services humming. Its rate of growth is sufficient to support the existing level of city services, but it is limited in what it can provide in excess of just staying on course.”

But even that steady revenue source is being threatened as Gov. Ron DeSantis and the Florida Legislature are looking to cut property taxes while putting pressure on local governments to increase police pay.

DeSantis announced proposed pay increases of 25% for state public safety workers, which pushing cities to set higher wages for their own police and fire personnel to stay competitive.

Winter Park plans to spend an additional $700,000 on public safety pay next year so that the starting salary for Winter Park police officers will reach about $65,000. At the same time, public safety pension costs will rise by $671,000.

Overall, the city employs 555 people and is budgeting for 2% cost of living raises plus an additional merit increase of up to 3%. The city is the fourth largest employer in Winter Park after AdventHealth, Orange County Schools and Rollins College. Publix rounds out the Top 5.

Other budget highlights include a warning that the capital improvement budget is tight and some projects may be deferred, particularly in the area of Parks & Recreation.

The current proposal calls for $885,000 for the following:

- $410,000 for ball tracking technology at the Winter Park Pines driving range and bunker improvements at the Winter Park Nine

- $200,000 through a grant application to replace eight hard courts at the Tennis Center

- $75,000 for LED lighting at athletic fields and tennis courts

- $150,000 for the landscaping office

- $50,000 for general parks maintenance

“The ability to fund new capital projects and priorities is diminished and doing anything new outside of identifying new revenue sources or grant opportunities will be difficult without cutting other services,” the proposal stated. “City services are only as reliable as the people, equipment, and infrastructure that deliver them.”

The city also expects its reserve funds to decline when measured as a percent of reoccurring expenses in the General Fund. Winter Park officials have stated their goal is to maintain reserves equal to about 30% of those costs and have reached that in recent years.

The new budget proposes $478,000 in contingency funds, which would bring the total reserves to about $22.3 million by the end of 2026, or about 26% of expenses. It would take another $3.6 million in savings to get to the 30% mark.

“It should be noted that even though the percentage is slipping, the total balance in the reserves is increasing,” the draft said.

Wednesday will kick off budget discussions in front of the City Commission. Time is set aside for public input on the budget during the City Commission meetings on Aug. 13 and Aug. 27. The first of the two required Commission votes on the budget is scheduled for Sept. 10.

WinterParkVoiceEditor@gmail.com

it is a cost increase because undergrounding was supposed to be completed many years ago before these market cost increases ever took place

Why does Winter Park need a 10% increase in utilities pricing when we have a 6+million dollar fuel cost reserve when crude prices are falling?

Bureaucracies will always ask for increases in funding and sooner or later their customers ie. Tax Payers must demand cutting costs and increasing economy of scale!

Furthermore, spending another $885K on the Pines Black hole should be completely taken off the table! Winter Park bailed out a developer to purchase this luxury and now the projected losses are front and center!

One must raise the issue of management s commitment to economizing rather than the continuous spending cycle that starts with our City Manager!!!!

The projected spend on the Pines is less than $400,000 per the story. Of that, $250,000 will go toward the ball tracking tech at the Pines driving range and the rest to some bunker improvements over at WP9. The Pines operations covers its operating expenses minus the debt service. The city is holding off on replacing the irrigation system at the Pines to save dollars. As for the utility rates, there some some specific ways those are structured. The fuel costs are passed through to the customers … and I don’t believe there’s a variable margin. The city is proposing increasing the margin through this additional rate increase.

I continue to believe that the purchase of the WP Pines Golf course was a wonderful idea. I am not a golfer , and $250,000 is a bunch of money. What is “Ball tracking”?

The ball-tracking technology referenced in the story is similar to what you see if you play at Top

Golf. The tech allows the players to aim for different targets and tracks info about the range etc. I’m not a golfer, either, so forgive my simplistic explanation but this is an attempt to attract more players to the driving range and, if successful, would serve as an additional revenue source a the club.

Think about the money spent on Seven Oaks Park, a park absolutely no one uses. And how about the revenue not realized by renting cheaply the old library to Blue Bamboo, instead of selling it!

The City Commission went on a spending spree that in retrospect, was ill conceived.

I’m thrilled that undergrounding is proceeeding. It puts us way ahead of much of the rest of the country. I am grateful that Winter Park values community, culture, and open space, too. Not everything can be measured in dollars. And not everywhere should be giant homes and commercial buildings.

(What should have replaced the library or built at Seven Oaks, Heavy? A McDonald’s? An absurdly oversized mansion?)

I don’t even know what ball tracking is but is probably unnecessary with those funds being applied to more urgent needs like undergrounding power or repairing streets and sidewalks. Are we really in an uncertain political and economic time? Also, I would except more from our police in terms of community policing if they get additional funding.

What about all the nonprofits that continue to eat up property in the Winter Park area? Are they paying the same taxes to the city for water electric and services? Or are they exempt or provided those at a reduced rate? Every time you look around a, Hospital has expanded or bought more property. Can the city offer these nonprofits a percentage at a reduced or exempt status with the rest subject to the going rate? This never seems to get discussed, and I am guessing when added up, these churches schools and hospitals, encompass a fair percentage of the city property… so revenue increases can only come from tax hikes or increasing density to make up for any short falls.

Utility rates (water, electricity, etc.) are not discounted for non-profit organizations.

Thank you to our mayor and all city employees for keeping our city beautiful! I commend the city for the underground project. My friends in other Orange County municipalities lose power constantly during storms, but my area has yet to lose power during a tropical storm or hurricane. This city is a jewel.

Comment on two items; first is the increase in Electricity and Water.

The Utility Advisory Board should be reviewing, and if appropriate, adjusting rates annually. A rate change may or may not be necessary but waiting years to make an adjustment of this magnitude is irresponsible.

If a rate increase due to undergrounding is necessary, that increase should be isolated from a general increase in rates and placed in a “trust fund” only to be used for that purpose. When the undergrounding is completed; the fee goes away. The trust fund approach is common in Florida State Government.

Second is the annual increase in property tax revenue. We can all see the sale, demolish, and build of a home double the size and triple or more in value. At some point this will begin to fade. My concern is when our elected officials continue to count on these funds and more importantly spend to that level; what happens then? And this has nothing to do with reserves it has everything to do with increasing the City Budget Base and run rate.

It’s another reason the trust fund approach can benefit taxpayers. Need to invest in storm water management? Fund it separately and when done funding for that stops. Unfunded Pension Liability; fund it separately with a goal of fully funding; when gone it’s funded out of the regular budget.

I also urge residents to look at their tax bill and see what percentage of their total bill goes to the City of Winter Park and what goes elsewhere. They may be surprised to see it’s about a third! Where does the rest go? Take a look and few folk if any have any interest in the spending that makes up about two thirds of the annual bill. oh and that includes The Voice!

From my perspective, looking at the services we receive from the City, we get good value for our money.

Regarding where the property tax money goes, as an example, how many know the Orange County public school system provides free lunches to ALL students? Yep. True.

What’s your point?

Free lunches for everyone? Come on. Why? Just sets the stage for kids growing up expecting handouts. What happened to, “There is no such thing as a free lunch?” Why should the taxpayers provide lunch for every student?

I feel sorry for your lack of empathy and knowledge of the real world outside of your own experience. “I’ve got mine, why should I help you, eh?”

The lunches are not paid for with local tax dollars. None of your property taxes pay for them.

You’re right. I’m wrong. The meals are funded federally through the Community Eligibility Provision. So, those of us who pay federal taxes fund them … just not through local property taxes.

Interesting notion to “trust fund” the larger budget projects and manage them for what they are meant to be without mixing them with other budget items.

What does elevated inflation rate mean? What are the sources confirming this statement.

Over the past 5 years inflation rates have dropped precipitously from an all time high in 2021 to much lower rates today.

If you torture statistics enough, they’ll confess to anything.

These are not statistics under duress lol. The information about the inflation rate is widely available and there is wide agreement across the board. Here are a few facts from bankrate.com:

The current annual inflation rate is 2.4%, still stubbornly above the Federal Reserve’s 2% target.

Consumers pay more close attention to cumulative inflation, and prices are 23.7% more expensive today than they were before the coronavirus pandemic recession began in February 2020.

The Federal Reserve cut interest rates a full percentage point across three consecutive meetings in 2024, but officials are taking a more cautious approach in 2025 as price pressures stay sticky and President Donald Trump’s tariff policies threaten to reignite inflation.

Wow! Prices are 23% higher than before February 2020? If you say so, I believe it.

I wonder why the city’s general revenue budget for next year is 52% higher than FY 2020?

Politicians have always been very generous with other people’s money.

Have you shopped for groceries recently?

The higher electric rates are expected to help fund $10,000,000 a year for undergrounding until the project is completed in 2030. Further, the primary city wholesale electricity contract for up to 90% of our needs expires in 2027, leaving considerable uncertainty as to what costs will be in 2028.

Our rates should fully fund undergrounding as fast as it can be completed. But after that? Rate payers should stay on top of this issue as it is likely rates should be reduced when undergrounding is completed.