by Beth Kassab | Dec 8, 2025 | City Commission, Election, News

Unopposed Races Seal Seats for Craig Russell and Elizabeth Ingram, Canceling Winter Park’s March Vote

The Winter Park High School coach will get a second term and a political newcomer will join the commission in March

Dec. 8, 2025

By Beth Kassab

Two City Commissioners were elected without opposition on Monday after the qualifying period ended at noon with only one candidate filing for each of the two seats that would have appeared on Winter Park’s March ballot.

City Commissioner Craig Russell was re-elected to his first full term in Seat 2 after winning a tight race in 2024 to finish the term vacated by Sheila DeCiccio when she became mayor. First-time candidate Elizabeth Ingram was elected to fill Seat 1, which was an open seat after Commissioner Marty Sullivan chose not to run again.

Elizabeth Ingram. Above photo: Ingram talks with a supporter at a recent event. Photos courtesy of the Ingram campaign.

Ingram, 38, will become the youngest member of the five-person commission.

A trained opera singer, she serves on the Public Art Advisory Board and previously led the Dommerich Elementary PTA. She said she hopes to focus on protecting the character that sets Winter Park apart from other communities.

She has been campaigning since the summer and filed to run in July.

“I’m so, so thankful for all of the supporters who rallied around me from the beginning,” Ingram said Monday afternoon, shortly after learning she would be elected without an opponent. “The most important thing for me as a commissioner is just being there for the residents. Am I representing them as well and as accurately as I can? Because that’s truly what my job is about. I’m excited to be a new young voice for Winter Park, and I’m excited to represent everybody.”

She raised just under $13,000, according to the most recent campaign finance report.

Michael Carolan, chairman of the real estate department at Winderweedle, Haines, Ward & Woodman, told the Voice in September that he planned to run for Seat 1 with backing from the Winter Park Chamber of Commerce. But Carolan announced on Facebook last month that he had decided not to run.

Russell said Monday that he is thrilled to have the opportunity to serve another term.

The Winter Park High School teacher and coach made history nearly two years ago as the first Black candidate elected in the city in more than a century. At 45, he is the youngest current commissioner.

Craig Russell

“I’m excited to continue the work that I started,” Russell said. “And I’m excited to hopefully gain the trust and respect of those who didn’t vote for me, because I work for and speak for all the residents.”

He listed engaging young people, improving infrastructure and transportation, and boosting community volunteerism and civic involvement as priorities. He helped spearhead the formation of a youth advisory council as well as an educational series on the safety of e-bikes and e-scooters for kids.

He has not yet filed a campaign finance report because he just filed his initial campaign documents last month.

Unopposed contests—particularly in local races—aren’t unusual and may even be increasing. According to data from BallotReady, 61% of city contests across the country were unopposed last year, compared to 44% in 2020.

Craig Russell poses with students who came out to support him at a candidate forum in 2024.

Fewer candidates mean voters have fewer choices about who represents them at the level of government closest to home—the policymakers who decide police and fire budgets, set road and traffic priorities, and shape the community through decisions about development, parks and how much residents pay for electricity and clean water.

Because both Winter Park races drew only one candidate, the March city election is canceled, and Russell and Ingram will be sworn in that same month. Commissioner Warren Lindsey was also elected without opposition earlier this year to Seat 4, meaning three of the five members of the incoming commission did not face voters at the polls.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 13, 2025 | City Commission, News, Police and Public Safety, Taxes, Uncategorized

New Firefighter Contract Boosts Pay as Winter Park Faces Rising Public Safety Costs

Base pay will rise 12% this year after negotiations with the union plus cost-of-living and potential merit increases as part of a new three-year contract

Nov. 13, 2025

By Beth Kassab

The base pay for Winter Park firefighters will increase by 12% this year, along with additional cost-of-living and merit raises, under a new three-year contract with the department’s union.

The City Commission approved the contract with little discussion in a 4-0 vote. Commissioner Marty Sullivan was absent.

Mayor Sheila DeCiccio briefly remarked that the city was “fortunate” to have a “high-quality department” serving residents.

Under the new agreement, base salaries for firefighter EMTs will rise from $50,618 to $56,700. Firefighter paramedics will see their base pay increase from $61,908 to $69,300. Both groups will also receive a 2% cost-of-living adjustment and up to 3% in merit raises.

The contract includes merit and cost-of-living adjustments in the second and third years, consistent with those provided to other city employees.

Union President Joe Celletti, a firefighter paramedic who has been with the department about eight years, said the contract will provide increased financial stability for firefighters.

“We’re appreciative of the commission,” Celletti said. “It’s a historic raise for the fire department … we’re on par with Orlando, which is our biggest competitor.”

In addition to the built-in increases over three years, firefighters also have plenty of opportunities for overtime pay and special holiday pay. The contract changed the way firefighters are paid when they call out sick, but Celletti said it was a small concession.

“I think it will definitely keep us at an elite level,” he said. “People might even move out of state to come to a department like ours … you can be a great fireman, a great paramedic and have the financial stability to raise a family comfortably.”

Fire Chief Dan Hagedorn told The Voice in an email that the contract is designed to “maintain Winter Park’s competitiveness in a rapidly evolving regional market.”

Fire Chief Dan Hagedorn. (Photos courtesy of the city of Winter Park)

He said other area fire departments are “negotiating base pay increases as high as 25–30%,” making it harder for Winter Park to retain firefighters. Turnover, he noted, is costly.

“Losing experienced personnel costs the city thousands of dollars in retraining, onboarding, and lost operational expertise,” he said. “Any turnover impacts the continuity of service and public safety readiness.”

The pay increases come as the Florida Legislature prepares for its session in January, where Gov. Ron DeSantis has urged lawmakers to cut property taxes. Such a measure—if it reaches the November 2026 ballot and passes—could significantly reduce local government revenues.

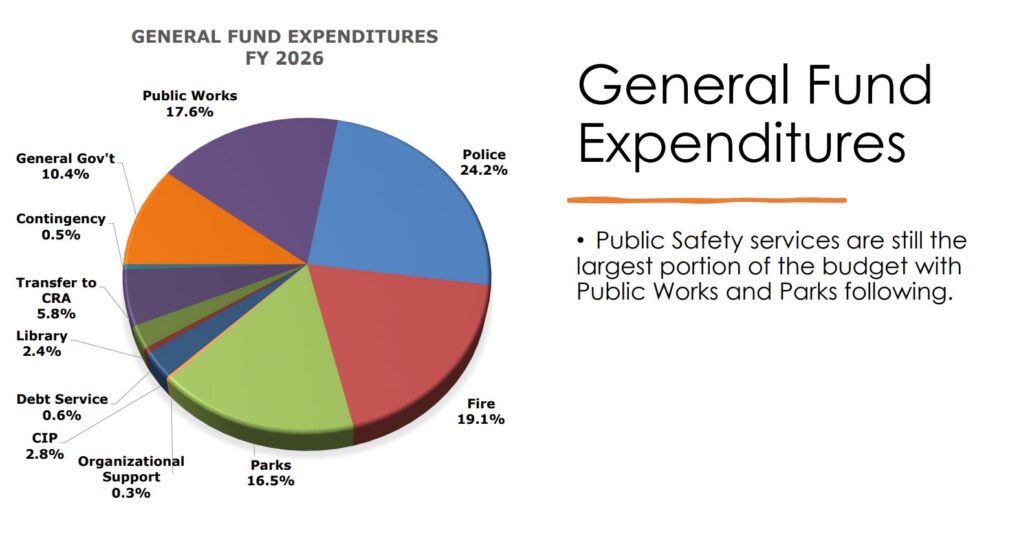

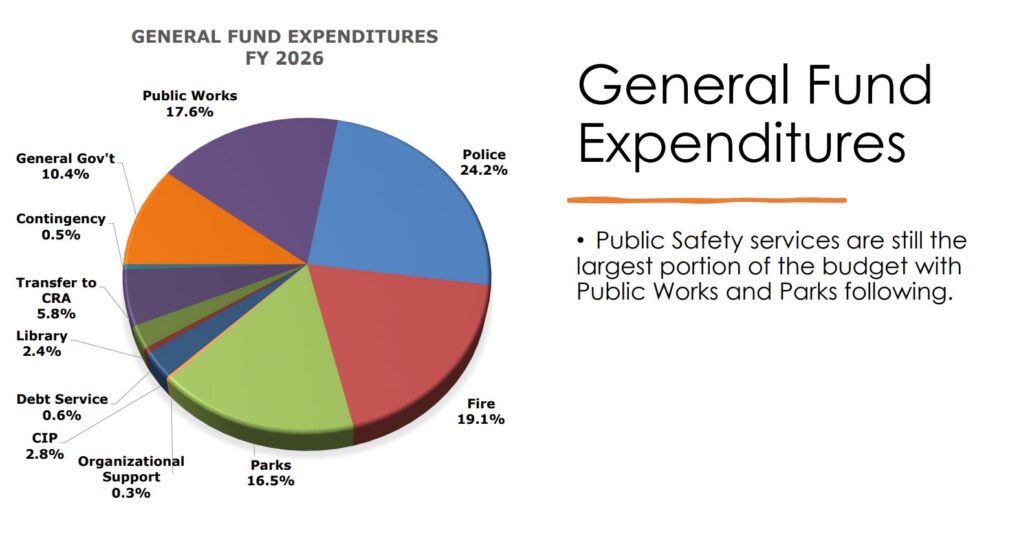

Property taxes provide the largest share of the city’s General Fund, which pays for police, fire, parks, roads, and other services, including cybersecurity for public data. The General Fund totals about $90 million this year, with property taxes contributing roughly $39 million, or 44% of the total—enough to cover both the police and fire budgets, which are the fund’s largest expenses.

Hagedorn noted that the fire department doesn’t have the option of operating short-staffed, even briefly, when someone is out sick or on vacation. That means paying overtime or other costs to ensure stations are fully staffed every day.

The contract also includes policy changes for personal leave and overtime management aimed at “reducing unscheduled leave, improving staffing reliability, and lowering overtime costs.”

Staffing levels directly affect how quickly paramedics and firefighters can respond to 911 calls for medical help, fires, accidents, or other emergencies.

In 2024, the department’s average response time was six minutes and 52 seconds. So far in 2025, that average has improved to six minutes and 41 seconds. The goal for 2026 is to reach six minutes, according to performance metrics listed in the city’s budget.

The raises will be funded by an additional $350,000 allocated for fire department personnel in the city’s 2026 budget, which took effect Oct. 1.

The increases reflect a broader trend of rising public safety costs for local governments.

Winter Park’s budget includes an additional $700,000 this year for public safety wages across the fire and police departments. Meanwhile, city pension costs for public safety employees are expected to rise by $671,000, according to budget documents.

“Additionally, the governor has recommended in HB 929 that fire personnel have reduced weekly shifts with the same pay,” the budget states. “If this becomes the new standard in the state, the Fire Department would need to hire over 15 additional personnel to provide shift coverage. While only a few cities, such as Kissimmee, have enacted this change, staff is watching closely to see how it might affect future budgets.”

Police and fire expenses account for about half of the growth in the city’s General Fund this year—roughly $3.2 million.

Overall, the fire department’s budget increased by more than $800,000 this year to $17.1 million, with 85 full-time positions.

Just four years ago, in 2022, the fire budget was $13.6 million with 81 full-time positions.

The police budget increased by $2.4 million this year to $21.8 million, with 122 full-time positions. In 2022, the police budget was $16.3 million with 114 full-time positions.

No new positions were added this year. The higher costs stem from wage increases and the city’s new responsibility for providing dispatch services to Maitland, which will reimburse Winter Park for those services.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 12, 2025 | City Commission, News, Zoning and Development

Backyard Palm Trees on Lake Spark a Pricey Legal Battle in Winter Park

A homeowner is suing the city over a decision that the height of his landscaping must be limited to help maintain the lake view of his neighbors

Nov. 12, 2025

By Gabrielle Russon

A fight over two palm trees has cost the city of Winter Park nearly $29,000 in legal fees so far.

Jonathan Cole, the owner of a newly constructed 5,300-square-foot home at 721 Virginia Dr., filed a legal challenge to keep a pair of backyard palm trees that his neighbors say impede their view of Lake Virginia.

Cole is asking Orange Circuit Court to overturn a decision by the city — and a construction condition Cole originally agreed to — that limits landscaping behind his house to less than six feet in height.

Winter Park spokeswoman Clarissa Howard said in a statement, “The case has been fully briefed and is in the hands of the three-judge panel for a ruling. We have been given no indication as to when that ruling might be issued.” She said no settlement talks are currently underway.

Cole’s attorneys did not respond to a request for comment for this story.

A photo of Cole’s backyard included in the court file shows the palm trees in question.

Cole argued he should be allowed to keep his trees since his interpretation of the Planning & Zoning Board’s decision is that the height limit doesn’t apply to his entire backyard, only the property line.

“This is a case of local government overreach and cries out for reversal,” he said in his February court petition. “Almost every single home on Lake Virginia has either very large trees on or near its property line running down to the lake or very large privacy hedges — and this includes the eastern neighbor who’s the one that complained about this.”

The tall, skinny palm trees don’t ruin anyone’s view, Cole’s legal team said when the issue went before the Winter Park City Commission in January. But several city officials said they were concerned about setting a precedent to allow the palm trees and unanimously voted to uphold the P&Z Board’s 2021 decision. Cole then filed a circuit court challenge.

Winter Park officials said the six-foot limit is reasonable to protect his neighbors, and Cole had been given more than his fair due process.

With the approval of P&Z, Cole “got everything that he asked for (all the square footage, construction closer to the lake, all the coverage of property, etc.) but was merely required to be considerate of his neighbors by restricting the height of the landscaping behind his home to no more than six feet,” the city said in an August court filing in response to Cole’s complaint, which is part of the hundreds of pages of court records.

The city also pointed out that Cole and his attorney both agreed to the six-foot requirement at the time in 2021. Cole missed the 30-day window to challenge the P&Z decision.

Construction was delayed on Cole’s house, and the lakefront landscaping was finally installed last year. That’s when his neighbor alerted the city about the two palm trees and overgrown holly shrubs.

Cole maintained he was in compliance, while the city called the plantings a violation of the original agreement.

Both Cole and his neighbors made emotional arguments to the City Commission earlier this year.

Neighbor Michelle Randolph said Cole already received special permission to build his home and now he wanted more.

“He was granted a major privilege to be able to build a house of this size and to be able to shift the house against the code … towards the lake,” Randolph told commissioners in January, according to court records. “This is what we were given as residents — just the common courtesy of please don’t plant anything over six feet. Like, you’re getting the house you want. You get to move it towards the lake. Please don’t plant anything over six feet.”

She insisted the palm trees did affect her lake view — even more so because of the house’s ultimate location.

Cole said he was exhausted by the construction process and has worked to satisfy his neighbors.

“Clearly I’m being painted as this guy that’s built a privileged monstrosity,” he told city leaders. “I’ve tried to be neighborly. I’ve tried to have discussions.”

When construction started, his daughter was 12; now she is 16, he said. Cole bought the vacant lot in 2020 for $2.1 million, according to Orange County Property Appraiser records. The property’s value was assessed at about $3.8 million this year.

“I’m sick of dealing with the stress of building a house,” Cole said. “At this stage, I want to be done with it. I don’t have time to fight this forever. I’m shocked that I’m here talking about palm trees.”

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 7, 2025 | Arts and Culture, City Commission, Events, News

Veterans Honored and Shared Stories at Annual Veterans Day Event

Two veterans were gifted Quilts of Valor and a local mother who lost her son in the U.S. Army earlier this year shared his story and legacy

Nov. 7, 2025

By Beth Kassab

A 28-year employee of the Winter Park Library and the city worker who runs both Winter Park-owned cemeteries were awarded Quilts of Valor on Friday as part of an emotional ceremony honoring locals who have served ahead of Veterans Day.

Sarah Williams, who is acquisitions manager at the library, served in the U.S. Marine Corps from 1982 to 1994 during the Cold War, Persian Gulf War, Desert Shield and Desert Storm.

Sarah Williams, a Marine Corps veteran and Winter Park Library employee, is presented with a Quilt of Valor on Friday.

At one point, she was deployed when her daughter was about 8 months old and returned when she was 2.

“It means the world,” Williams said after she was presented with the colorful quilt bordered in a red, white and blue floral pattern that Melissa Mathews and other representatives from the Quilts of Valor Foundation wrapped around her shoulders.

Michael Webb, who served in the U.S. Army from 1994 to 2015 and joined the city’s Parks & Recreation Department in 2017, was also moved by his quilt as it was placed around him. He served in Operation Iraqi Freedom and Operation New Dawn. (Webb, second from right in the photo at the top of this page, receives his quilt from the foundation.)

“I’ll definitely keep this in the family forever for my sons,” said Webb, who runs Palm and Pineywood cemeteries, after the ceremony. “It will become a family heirloom.”

Quilts of Valor was founded in 2003 and has comforted more than 400,000 veterans with handmade quilts, according to its website.

The crowd at the city’s 15th annual Veterans celebration at the Community Center also heard from Laurie Houck, a Gold Star Mother and vice president of institutional advancement at Rollins College.

Laurie Houck, a Gold Star Mother and a vice president at Rollins College, addresses the crowd at the city’s Veterans Day celebration on Friday.

Houck lost her 22-year-old son David, a U.S. Army Supply Specialist and company armorer stationed at Fort Eisenhower near Augusta, Ga. He was killed in a vehicle accident in January just outside of the base.

Houck remembered how her son struggled when he first enlisted and didn’t care much for bootcamp. But in the military, she said, the tiny malnourished 2-year-old she adopted from China 20 years ago “had found his second home.”

She recalled how he worked to overcome his earliest years in an orphanage where he was left in his crib so long the back of his head was flat to his days in Boy Scouts and, later, as a camp counselor. Skills — she said — that eventually helped him in the Army.

“He belonged and he mattered,” Houck said. “David was known for the way he made people feel valued.”

Ben Mack-Jackson, founder of the WWII Veterans History Project and a Winter Park resident, displays a uniform that belonged to Tuskegee Airman Richard Hall Jr.

The ceremony was emceed by Pastor Troy East of New Hope Missionary Baptist Church and also featured a number of city officials, including Mayor Sheila DeCiccio and a performance by Maria Bryant and the VFW Post 2093 Community Band.

DeCiccio noted the lineup of events the city has planned beginning in January to celebrate the nation’s 250th year. For more information click here.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 4, 2025 | Arts and Culture, City Commission, News

No Takers to Develop Portion of Seven Oaks Park

Developers like East End Market’s John Rife says the park first needs stronger programming. Green space advocates are happy the park will remain untouched

Nov. 4, 2025

By Beth Kassab

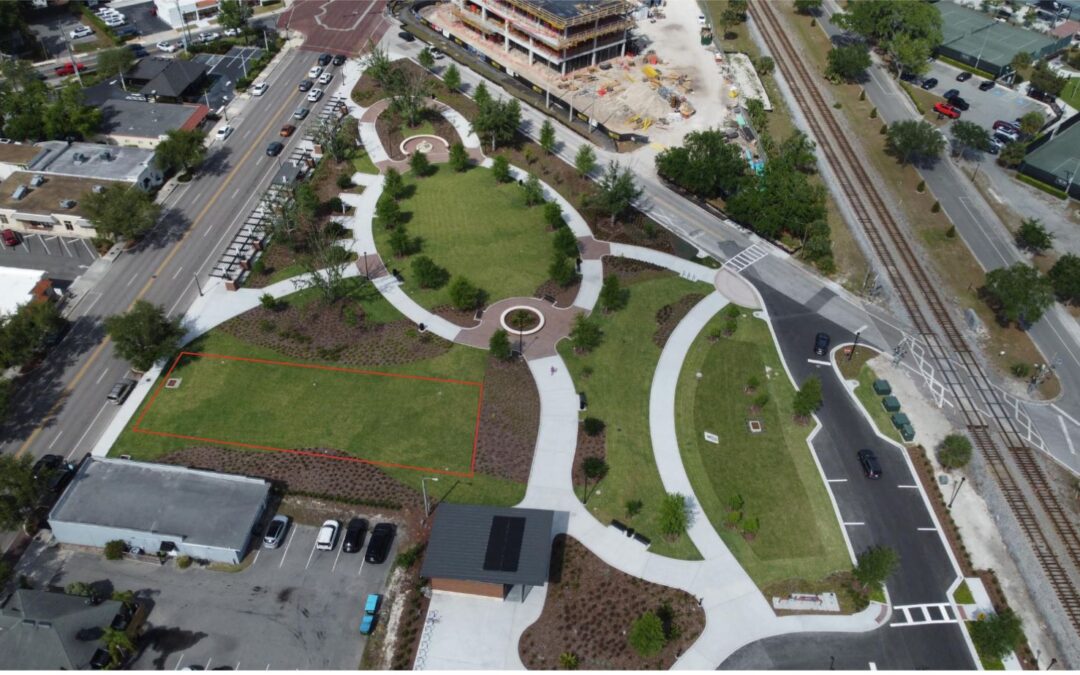

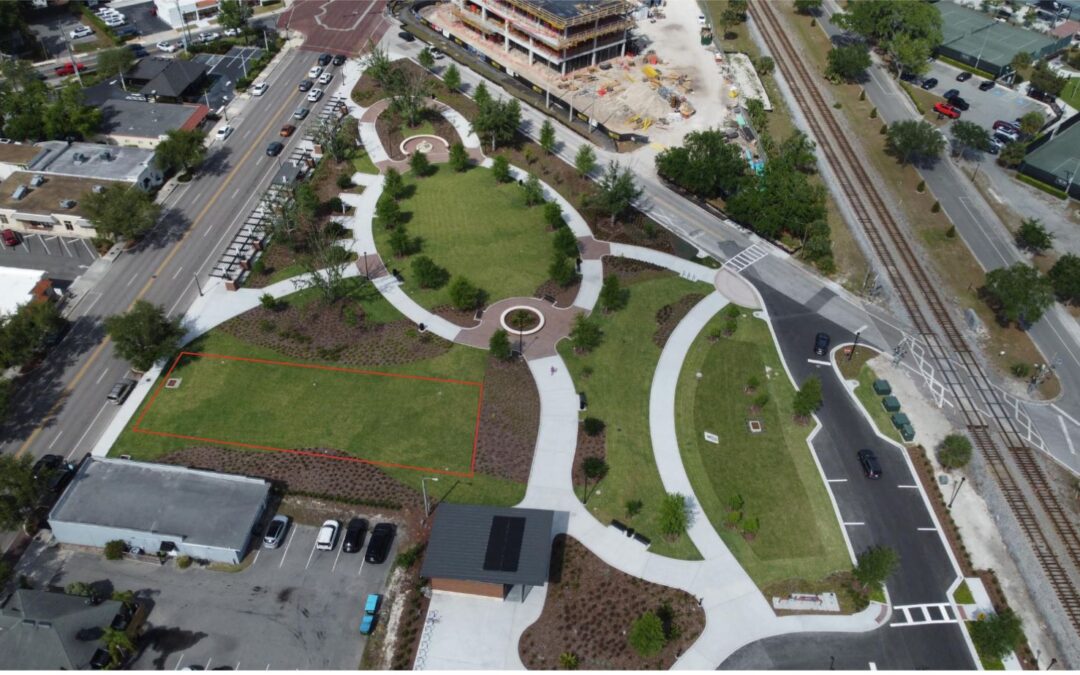

There were no eligible responses on the city’s request for developers to submit ideas to build a cafe, shop or other concept at Seven Oaks Park, the new 2.4-acre open space at North Orange Avenue and South Denning Drive.

With hardly any interest, the city closed the request for negotiations to develop a portion of the park (red outline in above photo at top of page). The city rejected the single response it received and would not answer questions about it, citing a public records exemption that keeps the response inaccessible to the public for up to 12 months.

City spokeswoman Clarissa Howard said the City Commission could decide to try again to solicit interest, but no date has been set for a discussion.

Mayor Sheila DeCiccio advocated to push forward with a plan to “activate” the park, which opened earlier this year, because she said nearby business owners “desperately” wanted to see something happen there.

The sign that welcomes visitors at Seven Oaks Park.

The park opened in February, a culmination of an effort by the city to purchase the land and transform it into a public open space in the middle of a busy urban corridor. But critics have noted that the park is often empty and offers little refuge from the sun because the oaks planted there have yet to mature enough to provide shade.

On many days, the parking lot that accompanies the park is busier than the park itself with patrons finding a spot there to visit Foxtail Coffee, Buttermilk Bakery and a number of other popular businesses in the area.

John Rife, who developed East End Market on Orlando’s Corrine Drive, said he was interested in the property but the economics don’t make sense for now. The city’s request to negotiate on the project required the developer would pay a ground lease to the city.

“I did East End Market not because I hoped people would show up, but because we had already been nurturing a bunch of purveyors,” in the Audubon Park neighborhood, said Rife, who opened the market 12 years ago.

He said the city might generate more interest if it first establishes good temporary programming in the park that “serves the needs of the neighborhood first.”

For example the corridor has at least a half dozen interior design businesses within a few blocks.

So perhaps, he said, a “design pop-up” could occupy the park for a weekend. It could be a way to nurture new talent that can’t afford permanent Winter Park rents.

“If your mission is to incubate cool upcoming stuff then you have to subsidize it,” said Rife, who is a Winter Park resident. “Is this a top dollar thing? Or is a thing for the betterment of the community? I think it’s hard to do both.”

He suggested one key step would be for the city to make it as easy as possible for people to pitch ideas and host temporary programming in the park to generate activity.

The McCraney office building is under construction across Denning Drive from Seven Oaks Park.

Winter Park moved its popular Farmer’s Market to Seven Oaks one day last month rather than close it during the weekend of the Autumn Art Festival. The Farmer’s Market will be held at Seven Oaks again on Nov. 15 to avoid a conflict with the annual Cows ‘N Cabs charity event.

Not everyone in Winter Park was on board with the plan to develop a piece of the park.

Leslie Kemp Poole, a member of the Winter Park Land Trust and a professor of environmental studies at Rollins College, said Seven Oaks needs more time for residents to discover it. She noted the foresight of city leaders to protect the land as green space rather than see it developed into another office building as an investment in Winter Park’s future.

“There are complaints that the Seven Oaks isn’t being ‘activated’ or used enough,” Poole said in an email. “Judging it in 98-degree Florida summers hammered by daily lightning storms is hardly fair. Now, with cooler weather, residents are beginning to discover and enjoy it.”

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Oct 27, 2025 | Arts and Culture, City Commission, News, Police and Public Safety, Taxes

Fearing Property Tax Cuts by State, WP Opts Against Giving Extra to Nonprofits

Florida voters could be asked next year to cut their property taxes. That already has cities like Winter Park reeling over how they will fund essential services like police, fire and flood prevention.

Oct. 27, 2025

By Beth Kassab

City Commissioners met late last week to consider a plan to give out about $100,000 that once went to the Dr. Phillips Performing Arts Center each year to 10 local nonprofits in the form of $10,000 grants.

The conversation quickly reached consensus among city leaders that even $100,000 out of a $230 million budget couldn’t be spared amid proposals by Gov. Ron DeSantis and the Legislature to dramatically cut property taxes — a move they fear would kneecap local governments.

Budget Director Peter Moore said he was waking up at night thinking about what those proposals would mean on the doorsteps of residents who rely on the city government for essential services such as quick police and fire response times, clean drinking water, safe roads and sidewalks that don’t flood during storms and reliable electricity.

“I can’t even comprehend how we would wrap our brain around how that would even work,” he told commissioners during the Thursday work session. “But there’s five different proposals out there, which makes me think something is going to end up on the ballot.”

Property tax collections make up the largest source of dollars in the city’s General Fund, which pays for police, fire, parks, roads and other government services, including cyber security for public data.

The General Fund is about $90 million in the 2026 budget and city property taxes account for about $39 million or about 44% of that total. The money from property taxes is so significant it’s enough this year to cover the two largest expenses in the general fund: the police department ($21.9 million) and the fire department ($17.1 million).

“I’ve lost sleep over what’s going to happen,” said Commissioner Warren Lindsey. “I don’t know what they are doing up in Tallahassee. They have no idea how a local municipality and a county is run in terms of the things they’ve said and done.”

Proposals from the Florida House so far range from raising the homestead exemption to $100,000 to eliminating or phasing out non-school designated property taxes.

When a Winter Park property owner pays taxes, about 27% of that money goes to the city while 44% goes to Orange County Public Schools, 28% goes to Orange County government and 1% goes to the St. Johns River Water Management District, according to city budget documents.

DeSantis said last week he was unsatisfied with the House’s work, which would potentially put more than one tax-cutting measure on the November 2026 ballot. That could make it difficult for any single proposal to gain enough support to pass.

“Placing more than one property tax measure on the ballot represents an attempt to kill anything on property taxes,” DeSantis said on X. “It’s a political game, not a serious attempt to get it done for the people.”

The Legislative session begins on Jan. 13, earlier than usual because it’s an election year.

DeSantis’ administration is touring the state in an attempt to make a public spectacle out of his “DOGE” efforts to audit cities and counties. A Winter Park spokeswoman said the city has not received additional requests from Florida’s DOGE office beyond the requests that went to all local governments earlier this year.

State officials are pointing to the increase in property tax collections as property values have soared as largesse in local government.

For example, property tax collections in Winter Park have jumped from $27.5 million in 2022 to about $39 million in the current budget, a 41 percent increase. The growth is the result of a hot housing market as the city’s tax rate has remained the same for 16 years.

But local governments like Winter Park argue that costs have also soared during that time. The city spent $16.3 million on the police department in 2022 and now spends $21.9 million, largely the result of competition across the state to raise law enforcement pay. The fire department cost $13.4 million in 2022 and now costs $17.1 million, also a result of pay and other cost pressures.

Those two departments alone account for $9.3 million of the additional $11.5 million in property taxes collected by Winter Park due to rising property values since 2022.

Commissioners noted the potential “bad optics” of providing even small grants to nonprofits after Moore suggested it was the kind of expenditure that “could get picked up in a news article.”

Mayor Sheila DeCiccio said the city would continue to give grants to the nonprofits that are regularly funded in each year’s budget. But, she said “we will probably” be able to reallocate the money for Blue Bamboo Center for the Arts, which is undergoing a leadership transition after founder Chris Cortez was recently diagnosed with brain cancer and the county is reviewing its $1 million grant.

Jeff Flowers, who is taking over the management of Blue Bamboo, said the group is growing and remains sustainable.

The money for the nonprofit grants comes from .25% of the gross revenue from each of the city’s three major funds — the general fund, electric and water and wastewater.

The electric and water and wastewater funds, which the city calls enterprise funds, account for even larger increases in the city’s budget than property taxes. Those funds, which charge residents and businesses for service based on a combination of flat fees and prices tied to the amount of water and electricity consumed, have grown to a combined $100 million this year.

City Commissioners have raised those prices in recent years to account for increased costs of maintaining the utility systems and what the city says are soaring prices to finish a citywide project that will underground all overhead power lines.

The funds “must support their operations through the revenues they generate, operating like a conventional private business,” the budget notes.

The quarter of a percent from those three funds — the general fund, electric and water — generates about $442,000. Those that receive yearly funding, including the Winter Park Library, which also receives additional dollars, are:

- Mead Botanical Gardens: $102,000

- Winter Park Historical Association: $97,000

- Winter Park Day Nursery: $42,500

- United Arts: $20,000

- Blue Bamboo: $12,500

- Polasek Museum: $28,000

- Winter Park Library: $2.1 million

During the same work session about whether to hand out an additional $100,000 to nonprofits, commissioner also discussed a plan by the Parks & Recreation Department to formalize a policy to sell sponsorships or advertising opportunities at is facilities to raise additional new revenue.

Staff estimates such transactions could generate $100,000 or more a year.

City commissioners indicated support for the plan so long as ads or sponsorship plaques or banners are “tasteful” and major deals would come before the commission for approval. Commissioners must also still approve the policy for the new revenue stream.

The effort would mostly focus on the city’s two golf courses, the tennis center and other parks with high foot traffic. Central Park, the highest-profile public green space along Park Avenue, would be off limits to advertisers, according to the proposal.

Even before talk of property tax cuts heated up to its current white-hot level, city staff was warning of slower times ahead for the city government.

“While this budget does not assume a recession in FY26, there are concerns on the horizon and visible weakening in the economy,” the budget proposal released in the early summer stated. “This could just mean a return to normal growth after the post-Pandemic spike, or this could portend something worse.”

Adding new services and projects will only be possible in the future by raising property taxes or raising the fees customers pay for services, according to the budget analysis.

With the governor and Legislature poised to try to take property tax increases off the table, that leaves the prices residents pay for everything from the use of athletic fields and after-school programs to the cost of building permits and water and electricity as the primary ways for the city to generate dollars.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

Recent Comments