by Beth Kassab | Feb 19, 2026 | City Commission, News, Taxes

Slash Reserves and Services? Annex Maitland? Winter Park Mulls Answers to Property Tax Cuts

The (some not so serious) suggestions came in response to Legislative proposals to dramatically reduce city revenue and recommendations from Florida DOGE to eliminate some cities

Feb. 19, 2026

By Beth Kassab

The Florida House voted Thursday to ask voters to eliminate all property taxes — except those that fund schools — for people who live in their homes, but the Senate has yet to take up a plan.

With just three weeks left in the regular legislative session, Gov. Ron DeSantis signaled Thursday morning that he is in no hurry to finalize a proposal that must be approved by 60% of voters to take effect.

“Given that it can’t be voted on by the people before November, it’s better to do it right than do it quick!” the governor posted on X.

State leaders could call a special session after the annual 60-day lawmaking period ends March 13 to address property tax cuts or other unfinished matters.

The uncertainty over the future of their most important and flexible revenue stream has local governments such as Winter Park contemplating a bleak future if the cuts become reality.

“We’re losing people. We’re losing quality of life. We’re losing services,” Commissioner Kris Cruzada said last week as the City Commission heard staff projections. “You call down to City Hall, and you may not get a live person to deal with an issue.”

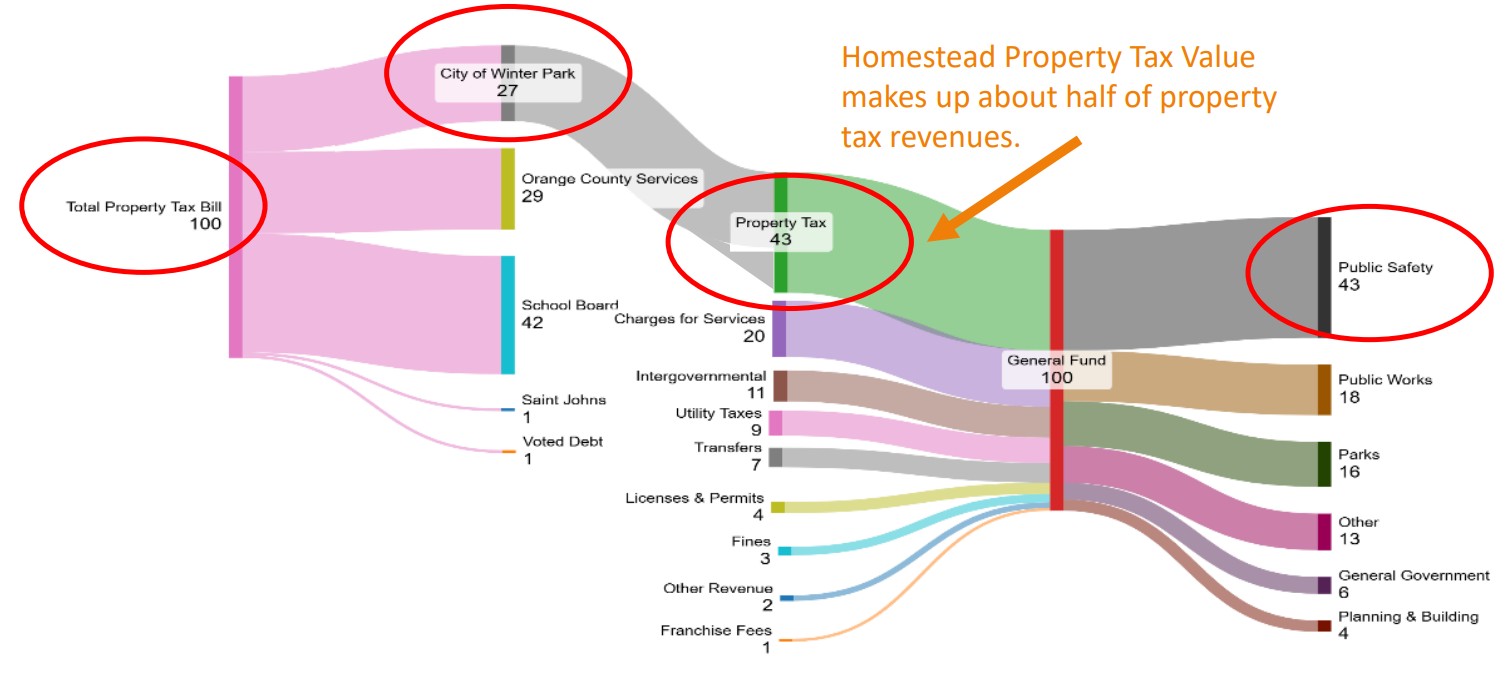

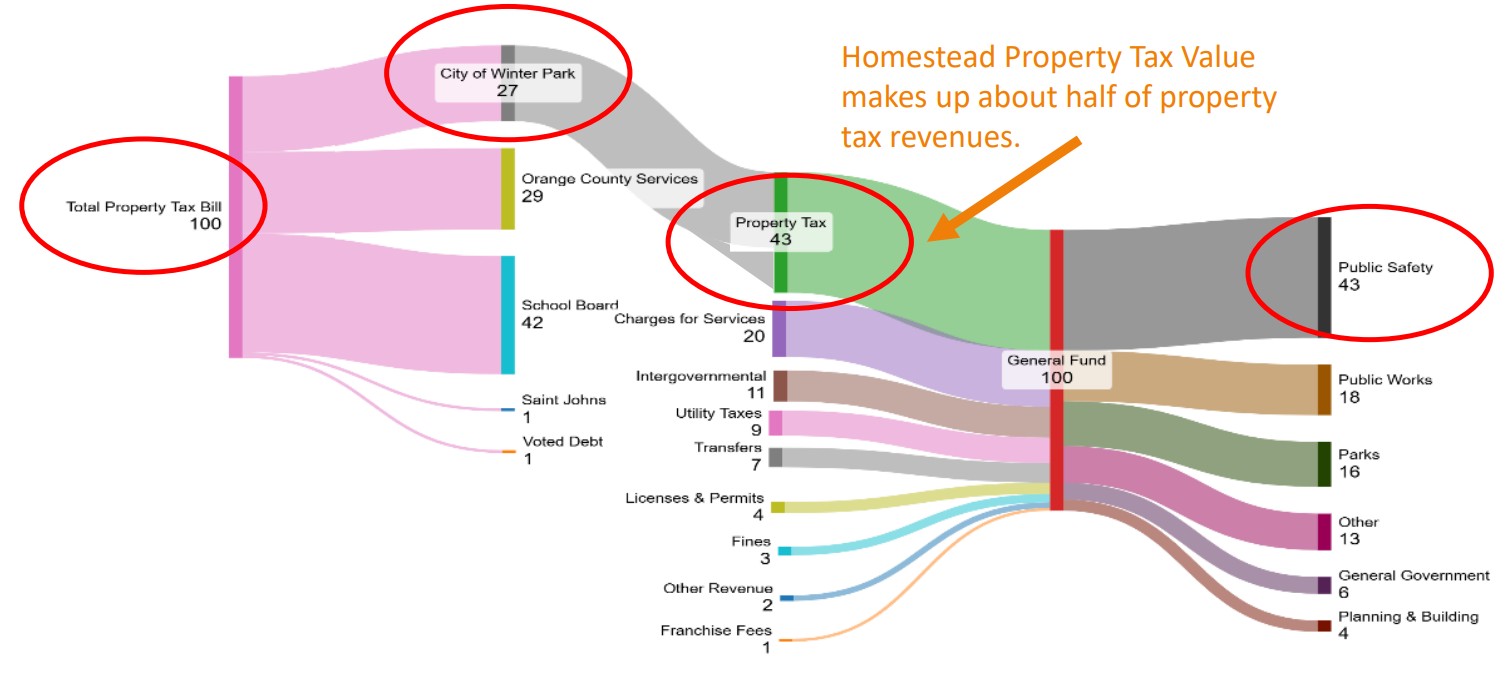

A city of Winter Park chart shows how property taxes flow into city services.

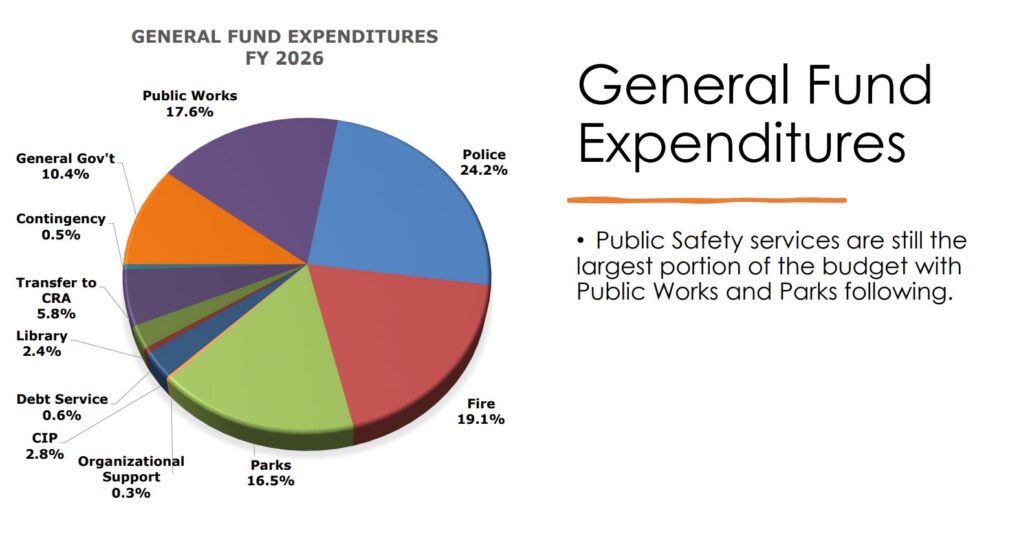

Peter Moore, director of the city’s Office of Management and Budget, presented an analysis projecting a $250 million loss over 11 years if a proposal like the one adopted by the House on Thursday is ultimately approved by voters.

While the House proposal aims to protect police and fire funding by prohibiting local governments from cutting those departments, it would impede the city’s ability to expand public safety and meet other local needs, including parks, roads, building permits and inspections, code enforcement, storm-related tree trimming, after-school programs, and playing fields for youth and adult sports leagues.

“This would call into question our ability to grow, and in the past we’ve had plans to expand our police and fire personnel. Those things are certainly not possible under scenarios like this,” he said. “It also implies that any government service that’s not public safety isn’t important.”

The tax repeal proposals address only those paid by property owners with homestead exemptions — those who live in their homes as a primary residence. That means people who own second homes, businesses, commercial properties or rental houses would likely face a higher, shifting tax burden that could be passed along to tenants in the form of higher rent.

“The part that bothers me the most,” Moore told the commission, “is that those who deserve the greatest voice in government — our local citizens — are not going to be contributing anything to it. And — this is tongue-in-cheek, and we don’t mean it — but we would be financially better off as a city if we really upset our citizens, they all left, sold their homes to BlackRock and let them be rented out as an Airbnb. Then we could at least pay for roads.”

Property taxes assessed on homesteaded property make up about $19 million — roughly half of the city’s annual property tax revenue — and more than 20% of total annual revenue, according to Moore.

Commissioner Warren Lindsey called the proposals “objectively one of the greatest threats, certainly since I’ve lived in Winter Park for 35 years.”

DeSantis and other state leaders have argued the proposals are driven by the need to make life more affordable for Floridians as government spending and waste have spiraled out of control.

But city officials across the state argue that state spending is ballooning at the same rate as local governments because both are affected by inflation and higher costs of goods and services, especially wages for police officers and firefighters.

Moore said the city’s general fund spent about $70 million in 2024, up from about $43 million in 2015 — an annualized growth rate of about 5.6%. The state of Florida increased spending during that same period from $30 billion to $50 billion, or about a 5.7% annual growth rate.

City officials also took exception to some of the characterizations and recommendations in the recently released “Report on Local Government Spending” by DeSantis’ Florida DOGE, or Department of Government Efficiency.

The report calls out 13 cities and counties, including Orange County, for what it describes as “excessive spending.”

“Property taxes are an expense that is entirely within the control of governments to rein in, and by ending the era of irresponsible spending, Florida and its local governments can give Florida’s homeowners freedom from this burden,” the report states.

The 98-page report is part financial audit and part ideological playbook outlining what the governor considers appropriate local government activities.

In the recommendations section, the unnamed authors predicted their proposals “will spark opposition.”

“Bureaucracies entrench themselves and create stakeholders who will argue that stronger oversight threatens ‘home rule,’ disrupts operations, risks federal funding or undermines public servants,” the report states. “They will highlight some recipient who benefits from every expenditure of public funds — ignoring that every dollar spent must also be taken from a taxpayer who is thereby harmed.”

The recommendations include giving Florida’s chief financial officer more power over local governments and standardizing local budgeting processes and wages, including freezing hiring and pay levels for city and county employees.

The report also says the state should forbid the use of government funds, facilities or communications to promote diversity, equity and inclusion concepts such as “social justice” or “systemic bias,” along with any phrases “that rely on the concept that mankind is inherently racist, sexist or oppressive, whether consciously or unconsciously, or bears responsibility for actions committed in the past by others based on race, sex or related characteristics.”

In addition, the report recommends changing state law so that state and local governments cannot enforce “green energy” or other “climate initiatives.”

The recommendation that drew the most pushback from Winter Park officials included a proposal to cap city reserve, or rainy day, funds at 10%.

After Hurricane Charley in 2004, Winter Park adopted a policy calling for reserves to stand at about 30%.

Winter Park’s reserve fund is about 27% today, or roughly $23 million.

Mayor Sheila DeCiccio said the funds are used to respond quickly to flooding and power outages before state and federal emergency reimbursements arrive.

Cruzada said the state is essentially telling local governments to be “irresponsible” and rely on state and federal assistance rather than manage their own affairs.

“What the state is doing is limiting our ability to raise revenue but, at the same time, reducing our reserves and it’s practically — for lack of a better term — telling us to be irresponsible,” he said.

An image created in jest by city staff to bring some levity to the property tax discussion shows City Manager Randy Knight and Assistant City Manager Michelle del Valle on a quest to annex Maitland, which is not actually under consideration at this time, though the Florida DOGE report recommended some cities should consolidate.

The report’s final recommendation calls for some cities to disappear entirely and be absorbed by larger neighboring cities or counties.

“Florida should review the 411 municipalities for potential opportunities to provide local government services more efficiently through abolition or consolidation, with particular attention paid to small municipalities and highly urbanized counties,” the report states.

That prompted another tongue-in-cheek response from Winter Park officials, who joked about annexing neighboring Maitland.

Moore pointed to what he called a “curious note” in the report suggesting that “perhaps there are too many cities.”

He then showed an AI-generated image of City Manager Randy Knight and Assistant City Manager Michelle del Valle dressed in Colonial-era attire “crossing Howell Creek to invade our neighbors to the north.”

“Never to not be a team player, we are willing to do this,” Moore said, drawing laughter from the chamber.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Dec 18, 2025 | Arts and Culture, City Commission, Taxes, Uncategorized

Arts Board Backs Off Seven Oaks Sculptures Because of Spending Optics

The decision came this week just days before state CFO Blaise Ingoglia held a press conference in Winter Park on Thursday to call city governments “wasteful”

Dec. 18, 2025

By Beth Kassab

Winter Park’s Public Art Advisory Board this week hit the pause button on spending as much as $175,000 on permanent sculptures for Seven Oaks Park after City Manager Randy Knight appeared at the meeting to warn of bad optics and even a potential budget shortfall if Gov. Ron DeSantis is successful in his drive to reduce property taxes.

“Is that something we’d be criticized for?” Knight asked of the potential expenditure. “Should we wait and see what’s coming before we decide to spend that kind of money on public art?”

The decision by the board, which includes new Commissioner-elect Elizabeth Ingram, is evidence of a chilling effect on local governments brought by the DeSantis administration’s attacks on local spending and threat to significantly decrease local tax revenue.

Without mentioning Winter Park a single time, state Chief Financial Officer Blaise Ingoglia, who is running for re-election, held a press conference in the city on Thursday morning.

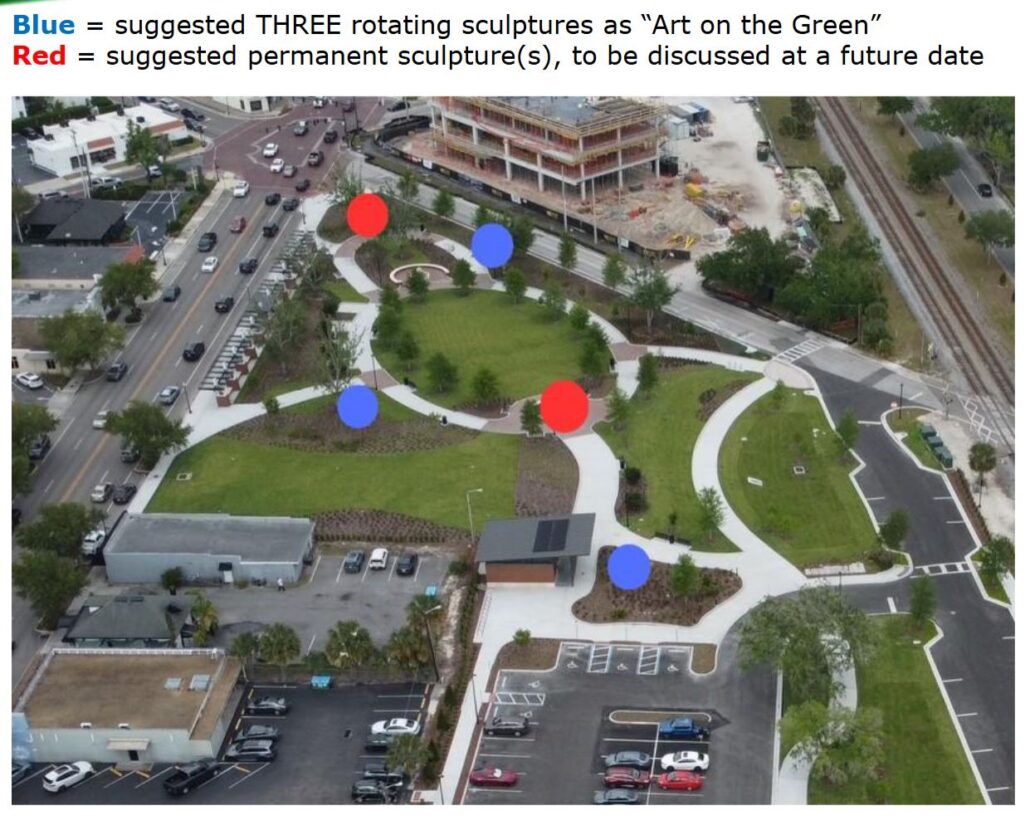

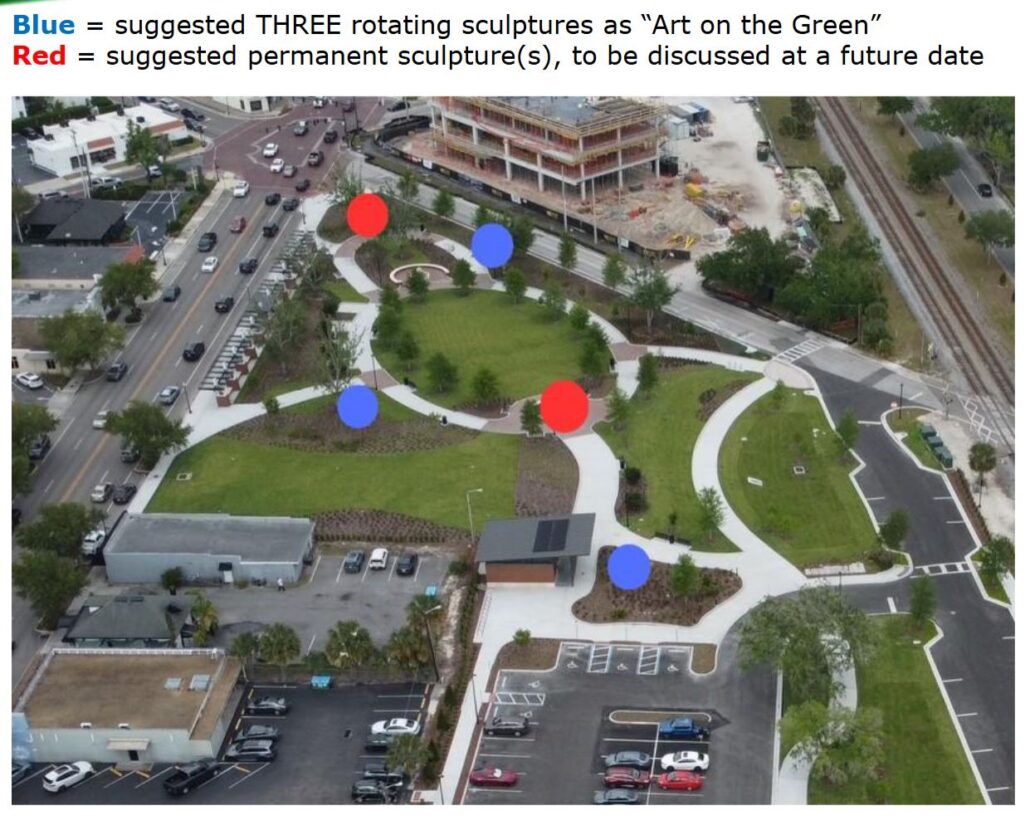

A city graphic shows the proposed location of artwork in Seven Oaks Park.

He repeatedly called cities and counties “wasteful” of public dollars, particularly money collected through property taxes.

But he didn’t cite any examples of cities with bloated budgets that he attributed, in large part, to hiring more staff that far exceeded a city’s need based on its population.

Ingoglia announced a proposal for a new law that would require cities and counties to post their budgets online (which is already required by state law) and to post proposed budget amendments seven days in advance of the hearing. His proposal also would require local governments to identify at least 10% worth of cuts as part of the budget process, though fire and police could not be part of those reductions.

He said the law change would prohibit cities from considering if a business is minority or women-owned when handing out contracts.

Ingoglia called for the end of “the practice of DEI in contracts,” which he said stands for “division, exclusion and indoctrination.”

“Stop with this crap,” he said.

Ingoglia’s office did not immediately respond to a question from the Voice about why the event was held in Winter Park.

The plan for the Seven Oaks Park sculptures came about as part of the city’s public art initiative to promote culture and visitation in Winter Park’s newest public space, which opened earlier this year.

Winter Park is known as one of the top tourism draws in the region and logged 1.4 million visitors to the downtown in 2024.

A plan to bring rotating loaned artwork from Orange County to the park in January is still underway. But the board hit the brakes on purchasing new art to remain in the park permanently.

Arts Board Chairwoman Carolyn Fennell thanked Knight for the information and guidance and noted that the city should “maintain its arts and cultural branding.”

“We all know the importance of arts in our city but others looking in may not have the same value of art as you do or certainly as we do as a community,” Knight said during the meeting.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 19, 2025 | Arts and Culture, News, Taxes

With Partner Gone, Blue Bamboo Works to Push Ahead on Arts Project in Old Library

The music venue received approval to keep $900,000 of its original grant from the Orange County Arts & Cultural Affairs Advisory Council

Nov. 19, 2025

By Beth Kassab

There are still plenty of questions about who or what will replace a key partner that walked away from the Blue Bamboo project to transform Winter Park’s old library into an arts hub.

In a memorandum to Orange County’s Arts & Cultural Affairs Advisory Council last week, Blue Bamboo’s new leader listed 10 arts nonprofits as “examples of prospective tenants.”

But none of the groups contacted by the Voice — from the Orlando Gay Chorus to Orlando Fringe, Central Florida Community Arts, and Rollins College — said they were in discussions to take on permanent space in the three-story building.

Founder Chris Cortez performs at the Blue Bamboo last month in his final concert there.

Jeff Flowers, a chemist and arts philanthropist who served two stints on the Maitland City Council, recently took over day-to-day operations of the music venue after founder Chris Cortez was diagnosed with brain cancer and stepped away.

“I’m holding my nose above water,” he said of the many aspects of the project he has had to pick up on short notice.

Flowers said he is in talks with a couple of potential tenants but declined to name them. He has not yet reached out to the organizations listed as examples in the memorandum he provided to the advisory council when he won approval last week to retain most of the $1 million grant awarded to the original project last year.

Under revised terms, the new grant amount is $900,000 and will likely be disbursed in two payments, he said, after the project reaches certain milestones and provides documentation for construction and other expenses.

Central Florida Vocal Arts, which stages a variety of musicals and operas, was originally slated to occupy the second floor and help Blue Bamboo pay the rent on the building as well as raise the $500,000 in matching funds required by the grant, which comes from the Tourist Development Tax collected on hotel rooms in Orange County.

CFVA withdrew from the project after Executive Director Theresa Smith-Levin said she was unable to reach a lease agreement with Blue Bamboo.

Blue Bamboo will now be responsible for raising $450,000 in matching funds under the new grant terms.

The organization currently pays the city $132,000 a year in rent for the building, an amount scheduled to rise to $276,000 next year.

Flowers said he hopes to secure tenants for the building along with shared spaces for costume design, lighting fabrication, recording suites, back-office support, and more. He added that he still has time to solidify those plans.

“Our revised leasing plan will allow a more diverse group of subleases to support the ongoing costs in our master lease, and the Shared Space plan will provide a new income stream that is responsive to the expressed needs of the community it serves. Finally, our capital campaign efforts will integrate Blue Bamboo into the local business community to ensure continued financial support,” Flowers wrote in the memo to the county.

Flowers is not only a longtime supporter of the venue and now its leader, but also the person who loaned Blue Bamboo money for the initial round of construction and other expenses needed to open this summer in the old library building.

He said he has loaned the project about $1 million so far.

“I’m going to make sure this project succeeds,” he said.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 14, 2025 | County News, News, Taxes

Rosen Hotels Leader Calls for Tourist Transportation Tax to Boost SunRail, Lynx

Frank Santos, who lives in Winter Park, says out-of-state visitors would pay for the upgrades as an added tax on hotel bills

Nov. 14, 2025

By Beth Kassab

Frank Santos wanted to make SunRail work as his daily commute.

The chief executive officer of Rosen Hotels & Resorts had a lot in his favor. He lives just three blocks from the Winter Park station. On his morning walk to the train he often stopped at Croissant Gourmet on Morse Boulevard for coffee and, occasionally, a pastry.

He spent the ride to his office near International Drive reading the day’s news or getting work done — something impossible to do behind the wheel on Interstate 4.

Santos even devised a system for when he arrived at SunRail’s Sand Lake Road Station, the closest stop to his office overlooking the golf course at Rosen Shingle Creek. He left a car there Monday through Friday to cover the last 15 minutes or so of his trip.

But after about a year, he stopped taking SunRail.

“It was just complicated,” he said. He called his experiment with Central Florida’s underfunded and incomplete mass transit system largely worthwhile — even enjoyable at times — but one that underscored how the region is built around the door-to-door convenience of cars.

“I would do it again if I could get closer to my office,” he said.

Winter Park’s SunRail station is one of the commuter train system’s busiest.

It’s been about five years since he stopped his regular SunRail commute. Since then, he has helped guide his company, which operates seven hotels, through the COVID pandemic and, last year, the death of founder Harris Rosen.

But this week he found himself reflecting on those train rides and what he sees as untapped potential for Central Florida to finally build a mass transit system that works for more people.

Santos acknowledged that any inconvenience he experienced on SunRail, or the gridlock he faces routinely on I-4, is small compared to what some of his employees endure. Many Rosen Hotels workers and others who earn their livelihoods as restaurant servers, ride attendants, desk clerks, housekeepers, and groundskeepers rely on the Lynx bus system and spend hours on buses each day.

“We need our employees to get to work faster,” he said. “My employees take up to two hours to get to work.”

That’s why an idea he has tossed around since 1999 now has a name: the Tourist Transportation Tax.

It would be paid only by out-of-state tourists on their hotel bills, and the revenue would be used exclusively for transportation needs such as extending SunRail to Orlando International Airport and the Convention Center and, for the first time, providing a dedicated funding source for Lynx so it can add buses and increase route frequency.

The proposal is gaining interest across the state, including in Winter Park.

Winter Park Mayor Sheila DeCiccio said she shares many of the same goals: extending SunRail service to weekends, which could reduce traffic during major events such as the Winter Park Sidewalk Art Festival, and improving bus service.

Winter Park was SunRail’s second-busiest station last year with 124,000 riders, according to system statistics. Only the Lynx Central Station stop in downtown Orlando had more, with 138,000 passengers.

“We offered to pay for the train to run on the weekend and they wouldn’t do it,” DeCiccio said. “We want the train to run in and out of the airport. We want the buses to run better. Those are exactly the kinds of things I’ll be looking for in a plan.”

DeCiccio’s comments came after joining about 200 people who listened to Santos’ proposal — as well as a plan by Sen. Carlos Guillermo Smith, who wants to change how existing hotel-room tax dollars are spent — at an Orange County League of Women Voters luncheon this week.

The discussion turned tense at times, with Santos arguing that Guillermo Smith’s statements about the Lynx budget were misleading and stepping in to defend the tourism industry, which he noted already contributes heavily to roads, schools, parks, and other essential services as the top property taxpayers in Orange County.

Walt Disney Company, Universal Studios, Marriott Resorts, Hilton Hotels & Resorts, and SeaWorld regularly appear on the county’s Top 10 list of property taxpayers, according to the property appraiser’s records.

Guillermo Smith, an Orlando Democrat, was especially critical of the public dollars allocated to Visit Orlando for marketing hotels and attractions. The quasi-public tourism bureau was the subject of a recent county audit that questioned its expenditures.

Sen. Carlos Guillermo Smith. Frank Santos pictured at top of page.

“I think $105 million in public money to Visit Orlando is an insane amount to give when we have so many community challenges,” he said. “We know that tourism is a huge economic driver in our region. … But we also have to acknowledge that tourists place a large strain on our community’s resources.”

Santos defended the spending.

“The senator doesn’t understand the cost of doing business,” he said. “We spend $40 million a year on sales and marketing at Rosen Hotels. Coming out of COVID, everyone understands the cost of doing business has increased.”

How much of the current 6% tax on hotel stays should be devoted to tourism marketing, the convention center, and other industry needs — versus helping local residents — has long been debated in Central Florida.

The difference this time is that someone from the tourism industry is proposing a new solution instead of simply guarding the existing 6%, which generated $385 million last year.

Santos still wants to protect that 6 cents on the dollar collected by hotels. But he wants to add another 1 to 4 cents dedicated to transportation.

Right now, he explained, guests pay 12.5% in taxes on hotel bills: 6% in Tourist Development Tax and 6.5% in sales tax.

Other popular destinations charge more. Chicago charges 17.3%. Austin charges 17%. New Orleans charges 16.2%. New York charges 14.75%.

“We could go as high as another four cents,” he said.

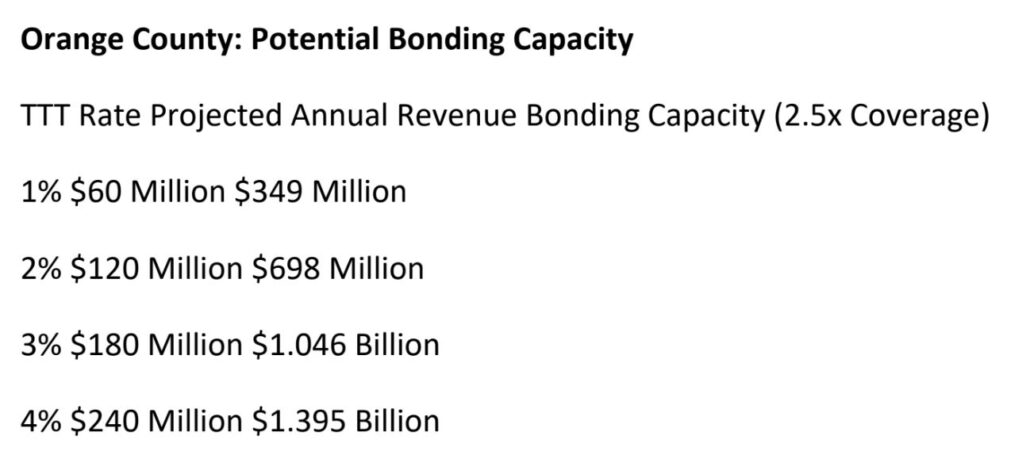

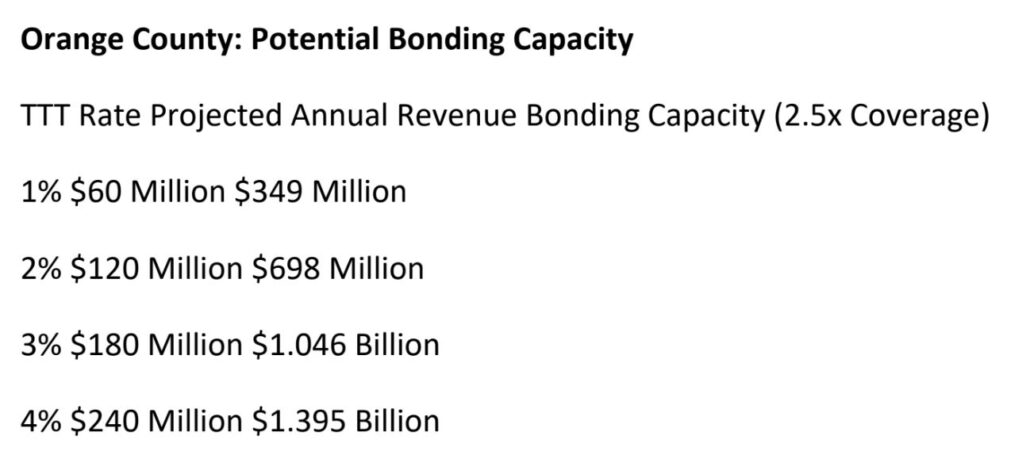

The steady revenue stream provided by the tax could be leveraged to finance major projects through bonds. One extra cent could generate nearly $350 million in bonding capacity, according to projections.

This table projects what different tax rates would generate each year and the capacity to bond against that revenue to fund projects. Source: Policy memorandum on Santos’ proposal

Importantly, hotels would exempt visitors with Florida driver’s licenses from paying the tax, meaning out-of-state visitors would fund the upgrades.

Santos needs the proposal to pass the Legislature and then win voter approval in a referendum. He says he has begun speaking with more tourism leaders to build support.

Without naming names, he said some organizations have encouraged him to continue pushing. At least one major group has suggested increasing the sales tax to fund transit — an idea backed by Orange County Mayor Jerry Demings that failed at the ballot in 2022.

Harris Rosen himself supported Santos’ plan before his death about a year ago, Santos said.

So he plans to keep talking, keep meeting, and keep spreading the word about the region’s needs.

One way he wants to do that is through another experiment. He plans to ride Lynx from a neighborhood where many workers live to his hotels on and near International Drive so he can better understand their challenges.

“I want to do it during the morning,” he said. “I plan to ride the bus from Pine Hills to my office.”

At the end of the day, he’ll face a familiar problem for any transit user in a car-centric region.

“And then I’ll find a way to get back home,” he said.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Nov 13, 2025 | City Commission, News, Police and Public Safety, Taxes, Uncategorized

New Firefighter Contract Boosts Pay as Winter Park Faces Rising Public Safety Costs

Base pay will rise 12% this year after negotiations with the union plus cost-of-living and potential merit increases as part of a new three-year contract

Nov. 13, 2025

By Beth Kassab

The base pay for Winter Park firefighters will increase by 12% this year, along with additional cost-of-living and merit raises, under a new three-year contract with the department’s union.

The City Commission approved the contract with little discussion in a 4-0 vote. Commissioner Marty Sullivan was absent.

Mayor Sheila DeCiccio briefly remarked that the city was “fortunate” to have a “high-quality department” serving residents.

Under the new agreement, base salaries for firefighter EMTs will rise from $50,618 to $56,700. Firefighter paramedics will see their base pay increase from $61,908 to $69,300. Both groups will also receive a 2% cost-of-living adjustment and up to 3% in merit raises.

The contract includes merit and cost-of-living adjustments in the second and third years, consistent with those provided to other city employees.

Union President Joe Celletti, a firefighter paramedic who has been with the department about eight years, said the contract will provide increased financial stability for firefighters.

“We’re appreciative of the commission,” Celletti said. “It’s a historic raise for the fire department … we’re on par with Orlando, which is our biggest competitor.”

In addition to the built-in increases over three years, firefighters also have plenty of opportunities for overtime pay and special holiday pay. The contract changed the way firefighters are paid when they call out sick, but Celletti said it was a small concession.

“I think it will definitely keep us at an elite level,” he said. “People might even move out of state to come to a department like ours … you can be a great fireman, a great paramedic and have the financial stability to raise a family comfortably.”

Fire Chief Dan Hagedorn told The Voice in an email that the contract is designed to “maintain Winter Park’s competitiveness in a rapidly evolving regional market.”

Fire Chief Dan Hagedorn. (Photos courtesy of the city of Winter Park)

He said other area fire departments are “negotiating base pay increases as high as 25–30%,” making it harder for Winter Park to retain firefighters. Turnover, he noted, is costly.

“Losing experienced personnel costs the city thousands of dollars in retraining, onboarding, and lost operational expertise,” he said. “Any turnover impacts the continuity of service and public safety readiness.”

The pay increases come as the Florida Legislature prepares for its session in January, where Gov. Ron DeSantis has urged lawmakers to cut property taxes. Such a measure—if it reaches the November 2026 ballot and passes—could significantly reduce local government revenues.

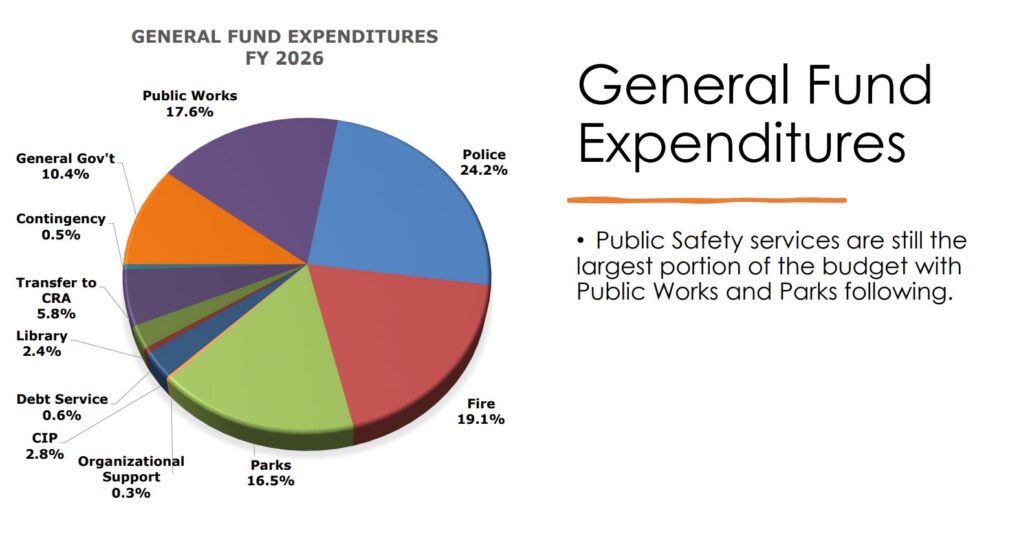

Property taxes provide the largest share of the city’s General Fund, which pays for police, fire, parks, roads, and other services, including cybersecurity for public data. The General Fund totals about $90 million this year, with property taxes contributing roughly $39 million, or 44% of the total—enough to cover both the police and fire budgets, which are the fund’s largest expenses.

Hagedorn noted that the fire department doesn’t have the option of operating short-staffed, even briefly, when someone is out sick or on vacation. That means paying overtime or other costs to ensure stations are fully staffed every day.

The contract also includes policy changes for personal leave and overtime management aimed at “reducing unscheduled leave, improving staffing reliability, and lowering overtime costs.”

Staffing levels directly affect how quickly paramedics and firefighters can respond to 911 calls for medical help, fires, accidents, or other emergencies.

In 2024, the department’s average response time was six minutes and 52 seconds. So far in 2025, that average has improved to six minutes and 41 seconds. The goal for 2026 is to reach six minutes, according to performance metrics listed in the city’s budget.

The raises will be funded by an additional $350,000 allocated for fire department personnel in the city’s 2026 budget, which took effect Oct. 1.

The increases reflect a broader trend of rising public safety costs for local governments.

Winter Park’s budget includes an additional $700,000 this year for public safety wages across the fire and police departments. Meanwhile, city pension costs for public safety employees are expected to rise by $671,000, according to budget documents.

“Additionally, the governor has recommended in HB 929 that fire personnel have reduced weekly shifts with the same pay,” the budget states. “If this becomes the new standard in the state, the Fire Department would need to hire over 15 additional personnel to provide shift coverage. While only a few cities, such as Kissimmee, have enacted this change, staff is watching closely to see how it might affect future budgets.”

Police and fire expenses account for about half of the growth in the city’s General Fund this year—roughly $3.2 million.

Overall, the fire department’s budget increased by more than $800,000 this year to $17.1 million, with 85 full-time positions.

Just four years ago, in 2022, the fire budget was $13.6 million with 81 full-time positions.

The police budget increased by $2.4 million this year to $21.8 million, with 122 full-time positions. In 2022, the police budget was $16.3 million with 114 full-time positions.

No new positions were added this year. The higher costs stem from wage increases and the city’s new responsibility for providing dispatch services to Maitland, which will reimburse Winter Park for those services.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Oct 27, 2025 | Arts and Culture, City Commission, News, Police and Public Safety, Taxes

Fearing Property Tax Cuts by State, WP Opts Against Giving Extra to Nonprofits

Florida voters could be asked next year to cut their property taxes. That already has cities like Winter Park reeling over how they will fund essential services like police, fire and flood prevention.

Oct. 27, 2025

By Beth Kassab

City Commissioners met late last week to consider a plan to give out about $100,000 that once went to the Dr. Phillips Performing Arts Center each year to 10 local nonprofits in the form of $10,000 grants.

The conversation quickly reached consensus among city leaders that even $100,000 out of a $230 million budget couldn’t be spared amid proposals by Gov. Ron DeSantis and the Legislature to dramatically cut property taxes — a move they fear would kneecap local governments.

Budget Director Peter Moore said he was waking up at night thinking about what those proposals would mean on the doorsteps of residents who rely on the city government for essential services such as quick police and fire response times, clean drinking water, safe roads and sidewalks that don’t flood during storms and reliable electricity.

“I can’t even comprehend how we would wrap our brain around how that would even work,” he told commissioners during the Thursday work session. “But there’s five different proposals out there, which makes me think something is going to end up on the ballot.”

Property tax collections make up the largest source of dollars in the city’s General Fund, which pays for police, fire, parks, roads and other government services, including cyber security for public data.

The General Fund is about $90 million in the 2026 budget and city property taxes account for about $39 million or about 44% of that total. The money from property taxes is so significant it’s enough this year to cover the two largest expenses in the general fund: the police department ($21.9 million) and the fire department ($17.1 million).

“I’ve lost sleep over what’s going to happen,” said Commissioner Warren Lindsey. “I don’t know what they are doing up in Tallahassee. They have no idea how a local municipality and a county is run in terms of the things they’ve said and done.”

Proposals from the Florida House so far range from raising the homestead exemption to $100,000 to eliminating or phasing out non-school designated property taxes.

When a Winter Park property owner pays taxes, about 27% of that money goes to the city while 44% goes to Orange County Public Schools, 28% goes to Orange County government and 1% goes to the St. Johns River Water Management District, according to city budget documents.

DeSantis said last week he was unsatisfied with the House’s work, which would potentially put more than one tax-cutting measure on the November 2026 ballot. That could make it difficult for any single proposal to gain enough support to pass.

“Placing more than one property tax measure on the ballot represents an attempt to kill anything on property taxes,” DeSantis said on X. “It’s a political game, not a serious attempt to get it done for the people.”

The Legislative session begins on Jan. 13, earlier than usual because it’s an election year.

DeSantis’ administration is touring the state in an attempt to make a public spectacle out of his “DOGE” efforts to audit cities and counties. A Winter Park spokeswoman said the city has not received additional requests from Florida’s DOGE office beyond the requests that went to all local governments earlier this year.

State officials are pointing to the increase in property tax collections as property values have soared as largesse in local government.

For example, property tax collections in Winter Park have jumped from $27.5 million in 2022 to about $39 million in the current budget, a 41 percent increase. The growth is the result of a hot housing market as the city’s tax rate has remained the same for 16 years.

But local governments like Winter Park argue that costs have also soared during that time. The city spent $16.3 million on the police department in 2022 and now spends $21.9 million, largely the result of competition across the state to raise law enforcement pay. The fire department cost $13.4 million in 2022 and now costs $17.1 million, also a result of pay and other cost pressures.

Those two departments alone account for $9.3 million of the additional $11.5 million in property taxes collected by Winter Park due to rising property values since 2022.

Commissioners noted the potential “bad optics” of providing even small grants to nonprofits after Moore suggested it was the kind of expenditure that “could get picked up in a news article.”

Mayor Sheila DeCiccio said the city would continue to give grants to the nonprofits that are regularly funded in each year’s budget. But, she said “we will probably” be able to reallocate the money for Blue Bamboo Center for the Arts, which is undergoing a leadership transition after founder Chris Cortez was recently diagnosed with brain cancer and the county is reviewing its $1 million grant.

Jeff Flowers, who is taking over the management of Blue Bamboo, said the group is growing and remains sustainable.

The money for the nonprofit grants comes from .25% of the gross revenue from each of the city’s three major funds — the general fund, electric and water and wastewater.

The electric and water and wastewater funds, which the city calls enterprise funds, account for even larger increases in the city’s budget than property taxes. Those funds, which charge residents and businesses for service based on a combination of flat fees and prices tied to the amount of water and electricity consumed, have grown to a combined $100 million this year.

City Commissioners have raised those prices in recent years to account for increased costs of maintaining the utility systems and what the city says are soaring prices to finish a citywide project that will underground all overhead power lines.

The funds “must support their operations through the revenues they generate, operating like a conventional private business,” the budget notes.

The quarter of a percent from those three funds — the general fund, electric and water — generates about $442,000. Those that receive yearly funding, including the Winter Park Library, which also receives additional dollars, are:

- Mead Botanical Gardens: $102,000

- Winter Park Historical Association: $97,000

- Winter Park Day Nursery: $42,500

- United Arts: $20,000

- Blue Bamboo: $12,500

- Polasek Museum: $28,000

- Winter Park Library: $2.1 million

During the same work session about whether to hand out an additional $100,000 to nonprofits, commissioner also discussed a plan by the Parks & Recreation Department to formalize a policy to sell sponsorships or advertising opportunities at is facilities to raise additional new revenue.

Staff estimates such transactions could generate $100,000 or more a year.

City commissioners indicated support for the plan so long as ads or sponsorship plaques or banners are “tasteful” and major deals would come before the commission for approval. Commissioners must also still approve the policy for the new revenue stream.

The effort would mostly focus on the city’s two golf courses, the tennis center and other parks with high foot traffic. Central Park, the highest-profile public green space along Park Avenue, would be off limits to advertisers, according to the proposal.

Even before talk of property tax cuts heated up to its current white-hot level, city staff was warning of slower times ahead for the city government.

“While this budget does not assume a recession in FY26, there are concerns on the horizon and visible weakening in the economy,” the budget proposal released in the early summer stated. “This could just mean a return to normal growth after the post-Pandemic spike, or this could portend something worse.”

Adding new services and projects will only be possible in the future by raising property taxes or raising the fees customers pay for services, according to the budget analysis.

With the governor and Legislature poised to try to take property tax increases off the table, that leaves the prices residents pay for everything from the use of athletic fields and after-school programs to the cost of building permits and water and electricity as the primary ways for the city to generate dollars.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

Recent Comments