Slash Reserves and Services? Annex Maitland? Winter Park Mulls Answers to Property Tax Cuts

The (some not so serious) suggestions came in response to Legislative proposals to dramatically reduce city revenue and recommendations from Florida DOGE to eliminate some cities

Feb. 19, 2026

By Beth Kassab

The Florida House voted Thursday to ask voters to eliminate all property taxes — except those that fund schools — for people who live in their homes, but the Senate has yet to take up a plan.

With just three weeks left in the regular legislative session, Gov. Ron DeSantis signaled Thursday morning that he is in no hurry to finalize a proposal that must be approved by 60% of voters to take effect.

“Given that it can’t be voted on by the people before November, it’s better to do it right than do it quick!” the governor posted on X.

State leaders could call a special session after the annual 60-day lawmaking period ends March 13 to address property tax cuts or other unfinished matters.

The uncertainty over the future of their most important and flexible revenue stream has local governments such as Winter Park contemplating a bleak future if the cuts become reality.

“We’re losing people. We’re losing quality of life. We’re losing services,” Commissioner Kris Cruzada said last week as the City Commission heard staff projections. “You call down to City Hall, and you may not get a live person to deal with an issue.”

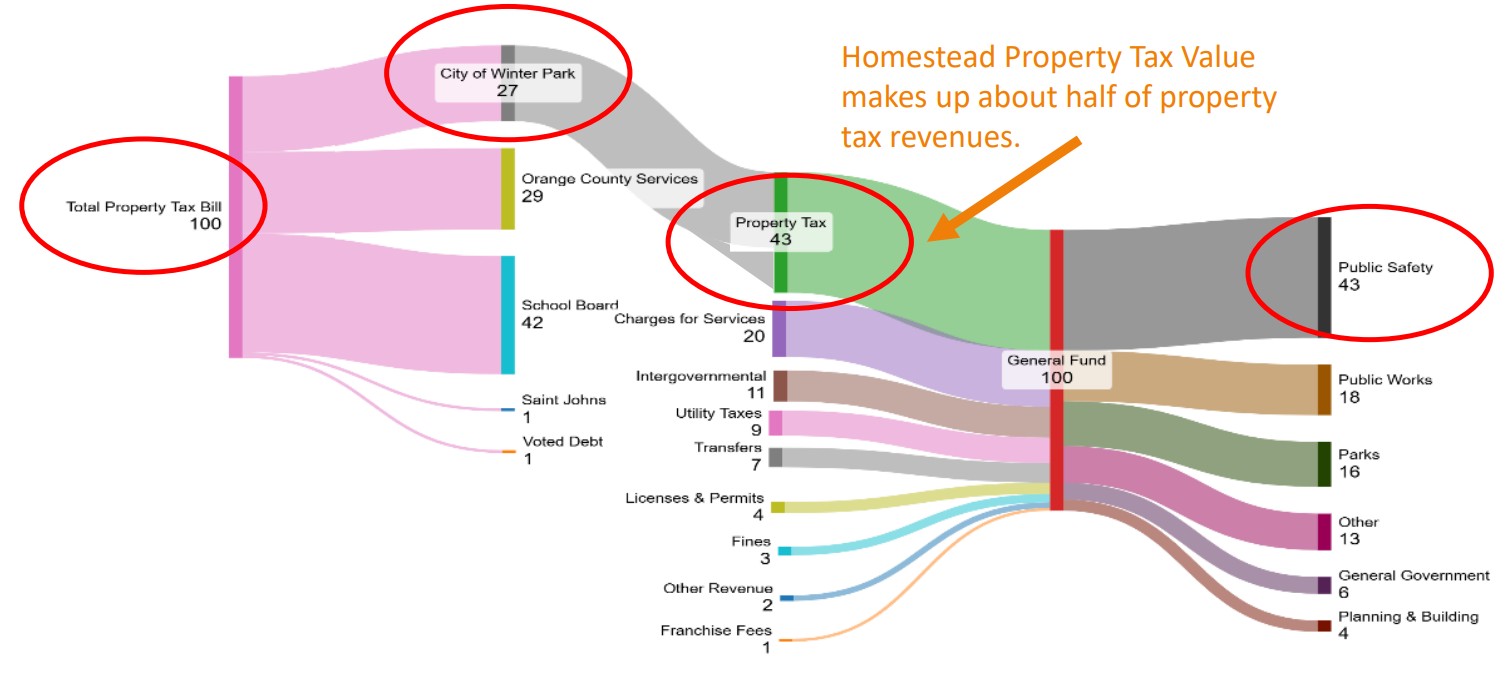

Peter Moore, director of the city’s Office of Management and Budget, presented an analysis projecting a $250 million loss over 11 years if a proposal like the one adopted by the House on Thursday is ultimately approved by voters.

While the House proposal aims to protect police and fire funding by prohibiting local governments from cutting those departments, it would impede the city’s ability to expand public safety and meet other local needs, including parks, roads, building permits and inspections, code enforcement, storm-related tree trimming, after-school programs, and playing fields for youth and adult sports leagues.

“This would call into question our ability to grow, and in the past we’ve had plans to expand our police and fire personnel. Those things are certainly not possible under scenarios like this,” he said. “It also implies that any government service that’s not public safety isn’t important.”

The tax repeal proposals address only those paid by property owners with homestead exemptions — those who live in their homes as a primary residence. That means people who own second homes, businesses, commercial properties or rental houses would likely face a higher, shifting tax burden that could be passed along to tenants in the form of higher rent.

“The part that bothers me the most,” Moore told the commission, “is that those who deserve the greatest voice in government — our local citizens — are not going to be contributing anything to it. And — this is tongue-in-cheek, and we don’t mean it — but we would be financially better off as a city if we really upset our citizens, they all left, sold their homes to BlackRock and let them be rented out as an Airbnb. Then we could at least pay for roads.”

Property taxes assessed on homesteaded property make up about $19 million — roughly half of the city’s annual property tax revenue — and more than 20% of total annual revenue, according to Moore.

Commissioner Warren Lindsey called the proposals “objectively one of the greatest threats, certainly since I’ve lived in Winter Park for 35 years.”

DeSantis and other state leaders have argued the proposals are driven by the need to make life more affordable for Floridians as government spending and waste have spiraled out of control.

But city officials across the state argue that state spending is ballooning at the same rate as local governments because both are affected by inflation and higher costs of goods and services, especially wages for police officers and firefighters.

Moore said the city’s general fund spent about $70 million in 2024, up from about $43 million in 2015 — an annualized growth rate of about 5.6%. The state of Florida increased spending during that same period from $30 billion to $50 billion, or about a 5.7% annual growth rate.

City officials also took exception to some of the characterizations and recommendations in the recently released “Report on Local Government Spending” by DeSantis’ Florida DOGE, or Department of Government Efficiency.

The report calls out 13 cities and counties, including Orange County, for what it describes as “excessive spending.”

“Property taxes are an expense that is entirely within the control of governments to rein in, and by ending the era of irresponsible spending, Florida and its local governments can give Florida’s homeowners freedom from this burden,” the report states.

The 98-page report is part financial audit and part ideological playbook outlining what the governor considers appropriate local government activities.

In the recommendations section, the unnamed authors predicted their proposals “will spark opposition.”

“Bureaucracies entrench themselves and create stakeholders who will argue that stronger oversight threatens ‘home rule,’ disrupts operations, risks federal funding or undermines public servants,” the report states. “They will highlight some recipient who benefits from every expenditure of public funds — ignoring that every dollar spent must also be taken from a taxpayer who is thereby harmed.”

The recommendations include giving Florida’s chief financial officer more power over local governments and standardizing local budgeting processes and wages, including freezing hiring and pay levels for city and county employees.

The report also says the state should forbid the use of government funds, facilities or communications to promote diversity, equity and inclusion concepts such as “social justice” or “systemic bias,” along with any phrases “that rely on the concept that mankind is inherently racist, sexist or oppressive, whether consciously or unconsciously, or bears responsibility for actions committed in the past by others based on race, sex or related characteristics.”

In addition, the report recommends changing state law so that state and local governments cannot enforce “green energy” or other “climate initiatives.”

The recommendation that drew the most pushback from Winter Park officials included a proposal to cap city reserve, or rainy day, funds at 10%.

After Hurricane Charley in 2004, Winter Park adopted a policy calling for reserves to stand at about 30%.

Winter Park’s reserve fund is about 27% today, or roughly $23 million.

Mayor Sheila DeCiccio said the funds are used to respond quickly to flooding and power outages before state and federal emergency reimbursements arrive.

Cruzada said the state is essentially telling local governments to be “irresponsible” and rely on state and federal assistance rather than manage their own affairs.

“What the state is doing is limiting our ability to raise revenue but, at the same time, reducing our reserves and it’s practically — for lack of a better term — telling us to be irresponsible,” he said.

An image created in jest by city staff to bring some levity to the property tax discussion shows City Manager Randy Knight and Assistant City Manager Michelle del Valle on a quest to annex Maitland, which is not actually under consideration at this time, though the Florida DOGE report recommended some cities should consolidate.

The report’s final recommendation calls for some cities to disappear entirely and be absorbed by larger neighboring cities or counties.

“Florida should review the 411 municipalities for potential opportunities to provide local government services more efficiently through abolition or consolidation, with particular attention paid to small municipalities and highly urbanized counties,” the report states.

That prompted another tongue-in-cheek response from Winter Park officials, who joked about annexing neighboring Maitland.

Moore pointed to what he called a “curious note” in the report suggesting that “perhaps there are too many cities.”

He then showed an AI-generated image of City Manager Randy Knight and Assistant City Manager Michelle del Valle dressed in Colonial-era attire “crossing Howell Creek to invade our neighbors to the north.”

“Never to not be a team player, we are willing to do this,” Moore said, drawing laughter from the chamber.

WinterParkVoiceEditor@gmail.com

I say this with all due respect, but Winter Park city council spends money like it’s water. The best thing to happen to Winter Park is for the city to focus on the core requirements and stop wasting tax payer monies. This council bought golf course without voter approval, I can list dozens of projects that were not fiscally responsible. BTW who does an 11 year forecast? 5,10,15 Okay but 11?

They’re going to cut services anyway. So that fear won’t work. Secondly, they have mismanaged and wasted funds. Don’t incent them to cut taxes. And if you lived here for 35 years what are your property taxes? $300. Maybe remove property taxes except for schools and reassess with homestead every ten years?

Of course Winter Park won’t agree to reduce reserves. They are afraid they won’t have money to organize events for out of towners.

Please give some examples of these events. I’ve lived here a long time and I’m not familiar with them.

There isn’t a government in this country that couldn’t make cuts that make sense from a fiscal standpoint, and WP is not an exception.

That being said, this is an incredibly stupid proposal. I am a lifelong Republican voter and I am unlikely to vote Republican if this is where we’re headed. That doesn’t mean I can vote for what the Democrats are trying to do, I’ll write in my dogs name going forward.

I have no problem with reducing expenses that make sense. But this type of cut would devastate our city. It would put undue stress on the police and fire departments as they will be expected to take on roles other city professionals would do, such as code enforcement. Building permitting will take longer, parks will look like dirt dumps, flooding could increase as water mitigation methods are reduced or shut down, and tourists will find other locations. But on the bright side, we will be able to do some good fishing in the road potholes that enlarge and are not repaired!

The whole concept of getting rid of property taxes in a state with no income taxe is idiotic. Winter Park does a pretty good job of protecting quality of life here. Without the property tax revenue the services provided by the City would definitely be degraded. The people who complain about taxes are always the same ones who whine about how sh@tty the government services are.

As a long-time resident, I think it’s important to separate rhetoric from reality.

The City’s purchase of Winter Park Pines wasn’t about running a “golf business”; it was about long-term land stewardship. Ninety-plus acres of centrally located green space in a fully built-out city is not something you get back once it’s gone. Public ownership permanently protects that land for recreation and community use.

Look at what happened with the Winter Park 9. What some once dismissed as unnecessary is now internationally recognized and a point of pride for our city. It generates revenue, supports youth programs, draws visitors who spend money locally, and enhances property values nearby. That didn’t happen overnight; it required vision and competent management.

The Pines has the same long-term potential. The driving range improvements and phased upgrades will increase usage and revenue over time. Municipal golf across the country has seen record participation since 2020, and Winter Park is uniquely positioned to capitalize on that momentum. Evaluating a 95-acre public asset on a short-term snapshot misses the bigger picture.

More broadly, many residents don’t fully realize how fortunate we are in Winter Park. Our public works, lakes, parks, recreation programming, and behind-the-scenes infrastructure services are exceptionally well run. The quality of life we enjoy doesn’t happen by accident; it comes from professional staff and responsible long-term planning.

Sweeping property tax cuts that force zero-base budgeting and deep headcount reductions would not “trim fat”; they would fundamentally change the level of service that makes Winter Park one of the most desirable cities in Florida. Once experienced staff leave and programs are eliminated, rebuilding that capacity is extremely difficult.

We can debate individual line items, but let’s not undermine the very structure that has made this city so strong. I, for one, am voting no on any version of a proposal that risks gutting essential services and long-term community assets.

Thank you for expressing so eloquently how I feel about this issue. The WPPD and WPFD have excellent response times. Can anyone here imagine waiting an hour for a response? I did, several years ago, when I lived in Seminole County and called 911 for a neighbor‘s domestic dispute. I thought the wife would be dead before they arrived.

How about if you need an ambulance? Want to wait for the next available one?

I believe this city is very well run.

I also believe that the state is overstepping and that their DOGE team wasn’t interested in listening to responses from cities and counties.

We have representatives; contact them if you have an issue!

Fiscal accountability has never been at the forefront of of Winter Park politics. As a city of approximately 37,000 citizens we have over 1400 employees spending what amounts to approximately $7800 .00 annually in the taxes of every man women and child! It has to stop and yet city officials tout they need more Parks, Real Estate, Community Redevelopment Funding benefiting locale developers, etc.

All the while Rollins, Advent Health, The Mayflower pay virtually no property taxes.

Not to mention the fact that the Cities planning board virtually rubber stamps remodels around town that are classified as a huge mechanisms for tripling their tax revenue base well as all others around them which Jack up all property taxes. And yet we haven’t had a millage increase in 16 years because they don’t need one to keep revenues flowing constantly up ward.

The Commission needs to step up accountable and demand more oversight in the budget process and then hold department heads responsible for hitting their reduced funding targets without compromising results!

In all bureaucracies around the world, they no longer manifest Public Service! It’s about increasing revenues at the expense of their citizens and our Governor has finally taken a stand and said enough is enough!

I for one urge you to vote yes on the reduced property taxes initiatives on the up coming ballot. They ,

the bureaucracy will find a way to cut back and produce the same level of services without the revenue they previously demanded!