by Beth Kassab | Feb 20, 2026 | City Commission, County News, Police and Public Safety, Schools

New Rules for Electric Bikes and Scooters In the Works for School Campuses

Winter Park residents turned out to a community meeting this week to hear an update on safety as complaints about the fast motorized devices have soared. Orange County schools are considering new rules

Feb. 20, 2026

By Tilly Raij

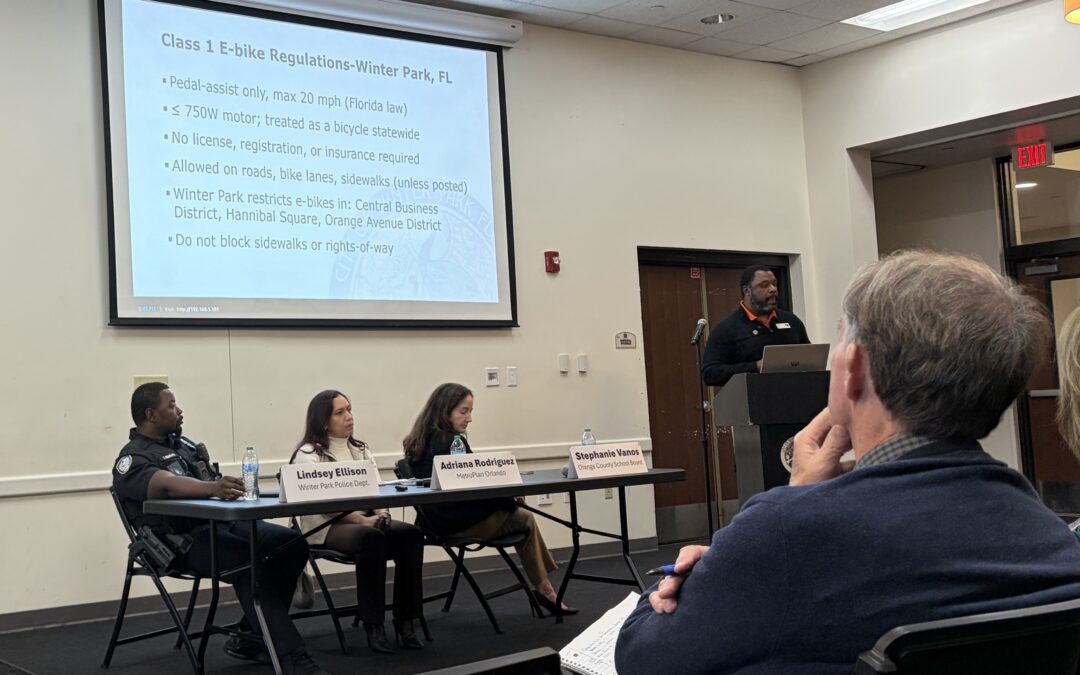

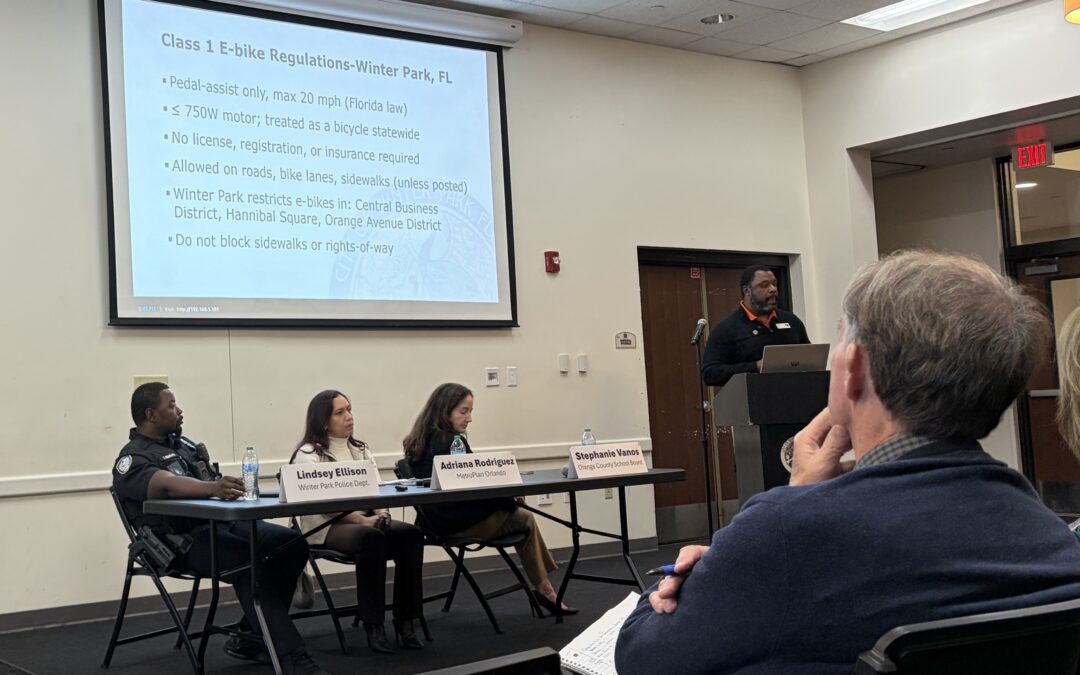

With new rules at the state and school district levels still uncertain, about two dozen people gathered this week to discuss how to make electric bikes and scooters safer in Winter Park.

City Commissioner Craig Russell led the community meeting Tuesday and walked residents through a primer on current regulations and etiquette that could reduce accidents and close calls on sidewalks and roads.

“If you don’t know how to operate the device, my suggestion is don’t get it for your 8-year-old,” said Russell, who is also a teacher and coach at Winter Park High School. He said he has seen students injured on the electric devices.

He emphasized that parents often don’t know the rules when their children begin riding.

The meeting followed increasing complaints from residents about people riding bikes and scooters too fast and recklessly on roads and sidewalks, especially near school campuses.

Orange County School Board member Stephanie Vanos, who also spoke at the meeting, said new rules could be on the horizon across the district.

She said options under discussion include requiring parents and students to take a class and sign an agreement related to riding and parking on campus, similar to the agreements high school students sign to drive and park cars on campus.

Vanos, who represents Winter Park in District 6, said students would receive a sticker to place on their device to show they participated in the training. Faculty members also have communicated with students about electric scooters and bikes.

“Right now, no, there is no requirement that students have to take any kind of education, or parents, but I will say that at many of our schools, particularly some of our middle schools and high schools, the principals are sharing information on e-bike safety and scooters with the students,” Vanos said.

Earlier this month, the school board heard a presentation noting survey results that show nearly 12,000 students ride bikes or scooters to school in Orange County. While most schools require students to walk their devices on campus, only about half issue violations to those who fail to do so.

In addition to permit stickers, district staff members recommend adding rules to the Code of Conduct and installing new signs on campuses requiring students to dismount bikes and scooters.

Last year, the school board held a discussion and presentation on the soaring popularity of bikes and scooters. Since 2017, electric scooter injuries in the U.S. have surged by 400%, with Florida ranking among the top states in emergency room visits for such injuries, staff members told the board at a November work session, citing data from the Consumer Product Safety Commission. Accidents involving children younger than 15 have more than doubled since 2023.

Russell’s presentation this week also covered rules governing e-scooters and e-bikes in certain areas of Winter Park. The devices cannot be ridden on sidewalks in the Park Avenue area known as the Central Business District, Hannibal Square and the Orange Avenue Overlay District.

Carelessly transitioning from sidewalks to roads, crossing crosswalks without looking for oncoming vehicles and ignoring pedestrian signals are among the most frequent safety concerns involving local riders, he said.

Russell shared best practices and described the “Be KIND” acronym for remembering how to properly operate an electric scooter or bike. The letters stand for “keep your eyes up, initiate courtesy, navigate safely and do the right thing.”

Adriana Rodriguez, senior transportation engineer for MetroPlan Orlando, told residents the organization is working with the American Bicycling Education Association to create a series of educational modules aimed at 500 students ages 12-15. Topics will range from safety to road rules and will incorporate graphics and illustrations, ending with a quiz. Students will receive a certificate of completion, and the results will be analyzed by grade level to determine whether the initiative should be expanded.

With about three weeks left in the regular session of the Florida Legislature, officials also are waiting to see whether new state laws emerge.

Proposals — Senate Bill 382 and House Bill 243 — that initially would have required licenses for certain classes of electric bikes have been scaled back to create a safety task force and include provisions such as: “A person operating an electric bicycle on a sidewalk or other area designated for pedestrians may not operate the electric bicycle at a speed greater than 10 miles per hour if a pedestrian is within 50 feet of the electric bicycle.”

Provisions related to motorized scooters were removed from the proposals.

Russell said education will remain essential to improving safety.

“Our goal is simple — to keep our kids safe, our sidewalks safe and our community involved,” he said.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Jan 27, 2026 | News, Police and Public Safety, Uncategorized

Police Release Image of Possible Suspect in Winter Park Church Fire

Police asked the public for information in the case of a person who cut down a banner with a rainbow flag on the lawn of First Congregational Church of Winter Park and set it on fire near the church doors

Jan. 27, 2026

By Beth Kassab

The Winter Park Police Department on Tuesday released an image captured from surveillance video that shows a possible suspect in the fire set at First Congregational Church of Winter Park that targeted a banner that said “Everyone is welcome here” over a sky blue background with a rainbow flag.

The photo appeared to show a man on a sidewalk in dark clothing wearing a hat and possibly a face mask. The man is also wearing dark shoes with white soles. It wasn’t clear from the information released by the police department where the image was captured or when.

An image released by police shows a potential suspect in the church fire that burned a welcome banner.

The department did not address why it waited a week since the fire that left a pile of ash and minor damage on the eastern double doors of the church to solicit help from the public in identifying a suspect.

“All avenues of investigation are being followed to identify the suspect and determine if the crime committed had a biased-based motive,” a release from the department stated.

Florida statutes call for tougher penalties on misdemeanors and felonies if there is evidence the defendant acted out of hate or prejudice based on the “race, color, ancestry, ethnicity, religion, sexual orientation, national origin, homeless status or advanced age of the victim.”

A pile of ash and smoke and heat damage can be seen at the church doors after the banner was set on fire. (Photos courtesy of First Congregational Church of Winter Park)

On Sunday, Senior Minister Shawn Garvey delivered an emotional sermon with a number of notable community members in the pews to show solidarity with the church such as Anna Eskamani, who represents Winter Park in the Florida House, former Mayor Steve Leary, who recently ran for Orange County commissioner, and a number of officials from Rollins College and the Mayflower, a senior community.

Garvey read a statement from Orange County Mayor Jerry Demings that said, in part, “though they destroyed the sign, they can never destroy what’s in your heart.”

Garvey told the congregation that, a times, the church’s long history of social justice work and Christian teachings are principles that “sometimes bring the heat, literally.”

“Bring it …,” he said. “…. If the building disappears, we’ll meet somewhere else. Who cares? They won’t break us.”

Garvey said the church’s newly installed surveillance cameras captured the suspect “making a beeline” toward the welcome banner just before midnight on Jan. 20. The church is widely known for its acceptance and support of the LGBTQ community often represented by the rainbow flag on the banner.

The video shows the person cutting down the banner and bringing it to the church doors before setting it on fire.

The banner stood on the lawn of First Congregational Church of Winter Park since about Easter until it was cut down and set on fire last week.

A police report released Tuesday says an unidentified witness called police about 11:50 p.m. after smelling smoke and seeing the fire while walking to the Alfond Inn, which is just across Interlachen Avenue from the church.

The fire was quickly extinguished and city Fire Marshal Jim Santoro and Det. Daniel Fritz from the state Bureau of Fire, Arson and Explosives arrived to investigate.

Santoro told the Voice that the state bureau along with Winter Park Police would take the lead in the investigation. He said the fire appeared intentionally set, though it wasn’t immediately clear what was used to start the fire.

He said such cases are unusual in Winter Park.

“This is not very common,” Santoro said. “We probably only get something like this every couple or three years and I’ve never seen one exactly like this and I’ve been with the department 36 years.”

The police report listed potential charges of attempted arson, petty theft and damage to church property.

Police are asking anyone who has any information about the incident to contact Winter Park Det. R. Budde at 407-599-3658 or Crimeline at 800-423-TIPS(8477).

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Jan 24, 2026 | News, Police and Public Safety, Uncategorized

Winter Park Church's 'Everyone is Welcome' Banner Cut Down and Set on Fire in Apparent Hate Crime

The incident at First Congregational Church of Winter Park happened earlier this week and appeared to target the church’s welcoming stance toward LGBTQ rights

Jan. 24, 2026

By Beth Kassab

A potential hate crime is under investigation after a banner in front of First Congregational Church of Winter Park with the words “Everyone is welcome here” on a sky blue background and a rainbow flag was cut down by an unidentified man with a knife, placed at the sanctuary door and lit on fire.

The incident happened just before midnight on Tuesday and was caught on security camera footage, said Senior Minister Shawn Garvey, who said he was grateful that a passerby noticed the flames just a few minutes later and called Winter Park Fire Rescue.

A pile of ash remained in front of the doors to the church after the banner fire was extinguished by Winter Park Fire Rescue. (Photos courtesy of First Congregational Church of Winter Park)

“The Fire Department was right there and put it out quickly,” he said. “It could have been worse … at that time of day nobody was on property.”

A pile of ash was left in front of the smoke-stained and heat-damaged white double-doors of the sanctuary. The empty frame that held the banner still stood on the church’s lawn along Interlachen Avenue.

Winter Park Police are investigating, he said, what appeared to be a hate crime against the church’s open and supportive message toward LGBTQ members and the larger community. Winter Park Police could not immediately be reached for comment on Saturday.

The church first added the banner to its lawn around Easter of last year.

“Regrettably in the history of our church, dealing with expressions of hate like that are nothing new,” Garvey said.

The Ku Klux Klan burned a cross on the lawn of the church’s former parsonage (across the street from where the Alfond Inn stands today) in the early 1950’s in response to a sermon that made a case for desegregation in Florida. The church was founded 1884 by New England abolitionists as part of the United Church of Christ, and its members founded Rollins College. It served as a gathering spot for Rollins President Hamilton Holt and Civil Rights leaders like Harry T. Moore and Mary McLeod Bethune to rally against segregation.

More recently, Garvey said, the church saw 50 people line its sidewalk during worship about eight years ago to protest the church because members supported the right to abortion and other reproductive rights. And in the wake of the killing of George Floyd by a Minneapolis police officer in 2020, he said he received angry phone calls about a sign at the church that expressed solidarity with those impacted by Floyd’s death.

An empty frames stands in front of the church from where the “Everyone is welcome here” banner was cut down.

Garvey said the church’s social justice history is an important part of its fabric.

“Even though it’s sometimes scary and upsetting we still feel called to follow that history,” he said of the congregation that has about 350 members. “The gospel of Jesus speaks strongly to being a voice for the voiceless.”

The church’s web site states that “all of the baptized ‘belong body and soul to our Lord and Savior Jesus Christ.’ No matter who – no matter what – no matter where we are on life’s journey – notwithstanding race, gender, sexual orientation, class or creed – we all belong to God and to one worldwide community of faith.”

More than 140 years into the church’s history, he said, some core challenges remain the same.

“As far as we’ve come and all the work we do, hate is just hate and insecurity is insecurity,” he said.

The video footage captured Tuesday by new security cameras the church installed just weeks before does not show a clear image of the face of the man who cut the banner, which had stood on the church lawn since Easter, and lit the fire. He was wearing a black baseball cap.

He appeared to approach the church on foot from the north and walked directly toward the banner. When a car passed by, he appeared to briefly pretend to be on his phone, before continuing toward the banner where he cut it with a knife and then approached the sanctuary doors to light the fire, Garvey said.

At Sunday’s service, Garvey plans to address the incident and share a number of supportive messages, including one from Orange County Mayor Jerry Demings, he’s received in recent days.

He said people are expressing heartbreak and anger over what happened. But also pride at the church’s presence in the community.

During times like this, Garvey said, the church can “often feel like an island, but we’re not.”

The membership will take up a discussion to determine how or if the “Everyone is welcome here” banner is replaced.

“In our years together since I came to be with you, we’ve gone through a lot,” he told the congregation in an email on Friday. “Through all of it, we have remained strong and grown stronger in our faith and in our commitment to one another. This week is yet another thread of the ongoing tapestry of what we truly are as this church and always have been throughout our history here in Winter Park. We will continue to be the inclusive, loving presence of God as we know it through Jesus and not allow events like this week to deter or frighten us.”

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Jan 15, 2026 | Arts and Culture, City Commission, News, Police and Public Safety, Schools

Have Complaints about Electric Scooters and Bikes? Meeting Scheduled for Next Month

Plus Blue Bamboo’s leader offered a short update on the group’s financial status in the wake of multiple changes at the organization operating at the city’s old library

Jan. 15, 2026

By Beth Kassab

Residents who have questions or concerns about safety related to electric bikes and scooters, which have soared in popularity in recent years, are invited to attend a community meeting at Winter Park Community Center on Feb. 17 at 5:30 p.m.

The meeting comes in the wake of a rising number of accidents and concerns surrounding the motorized devices that are increasingly common in and around school campuses.

Commissioner Craig Russell, who is also a teacher and coach at Winter Park High School, has taken the lead on the topic with a series of safety videos aimed at students and parents and, now, plans for a larger community discussion.

Russell said at Wednesday’s City Commission session that the meeting in February will be about sharing the facts and providing any available updates on the Legislative session, where a proposal (HB 243 and SB 382) is being debated that would put more regulations on e-bikes and scooters and their often young drivers.

“I just want to continue with our public safety effort,” Russell said. “It’s not going to be me telling parents what to do. It’s an informational session.”

The Voice reported last month that Orange County School Board members tossed around potential new regulations such as requiring licenses, training and speed limits at a meeting in November.

Since 2017, electric scooter injuries in the U.S. have surged by 400%, with Florida being a top state in emergency room visits for such injuries, staff told board members, citing data from the Consumer Product Safety Commission. These accidents have more than doubled since 2023 for children under 15.

Update on Blue Bamboo

Commissioners heard an update on Wednesday from Jeff Flowers, who is leading the Blue Bamboo Center for the Arts project that is leasing the city’s old library building.

The group’s founder Chris Cortez died last month after a short illness with glioblastoma, the most aggressive form of brain cancer.

Flowers, a chemist and arts philanthropist who served two stints on the Maitland City Council, noted the challenges the group has faced with the loss of Cortez and difficulty finding tenants for the second and third floors of the building. He said there have been three “very serious” sublease prospects, but no deals yet.

“We are in serious discussions now with another,” he said. “It’s not there yet, but it looks good.”

He said the Blue Bamboo tallied 8,300 people attending shows over the past six months and $180,000 in ticket sales. He said revenue totaled about $340,000 including concession sales and donations.

The Blue Bamboo is required to pay the city $132,000 a year in rent for the building, an amount scheduled to rise to $276,000 next year, according to the lease agreement.

The group has access to a $900,000 grant from Orange County for additional work on the building, but is required to raise matching funds and was counting on help in the form of fundraising and rent from Central Florida Vocal Arts before that group walked away from the deal in August when it was not satisfied by the terms of the sublease offered by Blue Bamboo.

Flowers has loaned Blue Bamboo more than $1 million so far to retrofit the first floor of the building into a performance space and other work.

“The message is look, the Blue Bamboo is here to stay,” Flowers told the commission. “We’ve surmounted every barrier thrown at us.”

Mayor Sheila DeCiccio thanked Flowers for appearing at the meeting and quickly moved on to the next topic after no other commissioners offered any comments or asked any questions.

WinterParkVoiceEditor@gmail.com

CORRECTION: The original version of this story included the wrong location and time for the meeting on e-bikes and scooters. The meeting will be held at Winter Park Community Center at 5:30 p.m.

To comment or read comments from others, click here →

by Beth Kassab | Dec 31, 2025 | City Commission, News, Police and Public Safety, Schools

Are Electric Scooters and Bikes Too Dangerous for Schools?

Orange School Board members and Winter Park officials say more safety measures are needed

Dec. 31, 2025

By Tilly Raij

Stricter rules over electric scooters and bikes on school campuses – or even a temporary ban — are slated for discussion next month as officials from Orange County Public Schools and Winter Park grapple with soaring injuries and accidents attributed to the high-speed vehicles.

School board members tossed around potential new regulations such as requiring licenses, training and speed limits at a meeting in November. Stephanie Vanos, the member who represents District 6, which includes Winter Park, said she recognized that regulations involving the devices can be challenging to carry out.

“It’s hard to enforce speed when some of these don’t even have speedometers. It’s hard to enforce licensure because they come from anywhere,” said Vanos, who raised the idea of a temporary ban of electric scooters and similar devices until a more complete evaluation of the situation is done.

OCPS Superintendent Maria Vasquez suggested a ban could be the easiest way to enhance safety without shouldering school staff with the extra work of enforcing new rules while a larger safety plan is explored.

“…I don’t think we want to prohibit them on our campuses, but if we’re looking at the conditions that currently exist, that’s probably the one action we can take that doesn’t add more burden to our staff while we are looking at other options,” Vasquez said.

The comments came in response to a presentation last month from Joe Silvestris, who leads the school district’s Office of Safety and Emergency Management.

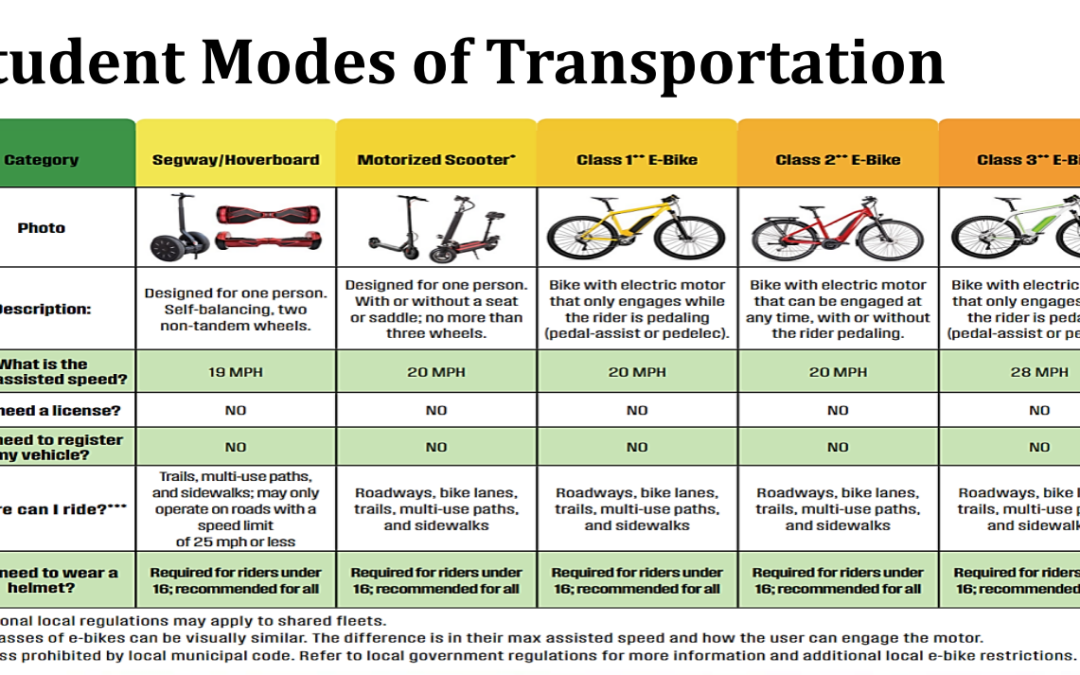

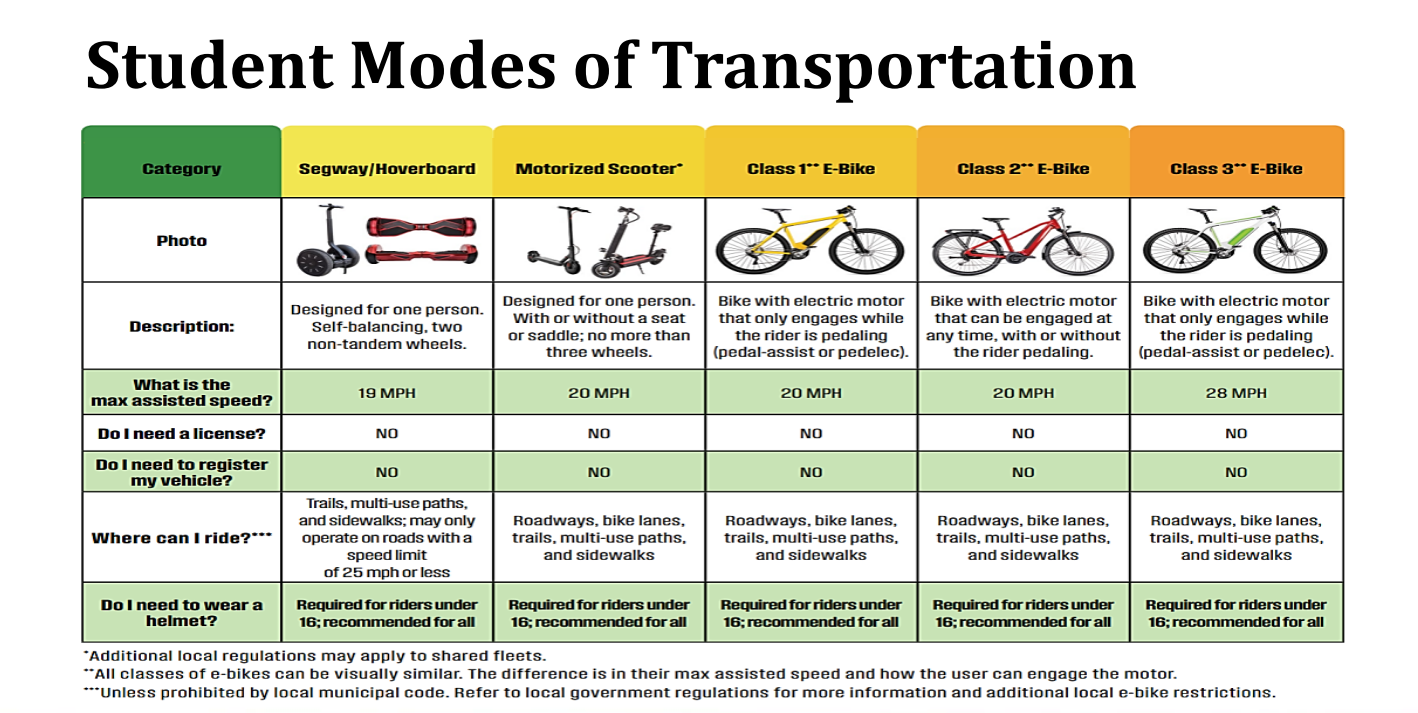

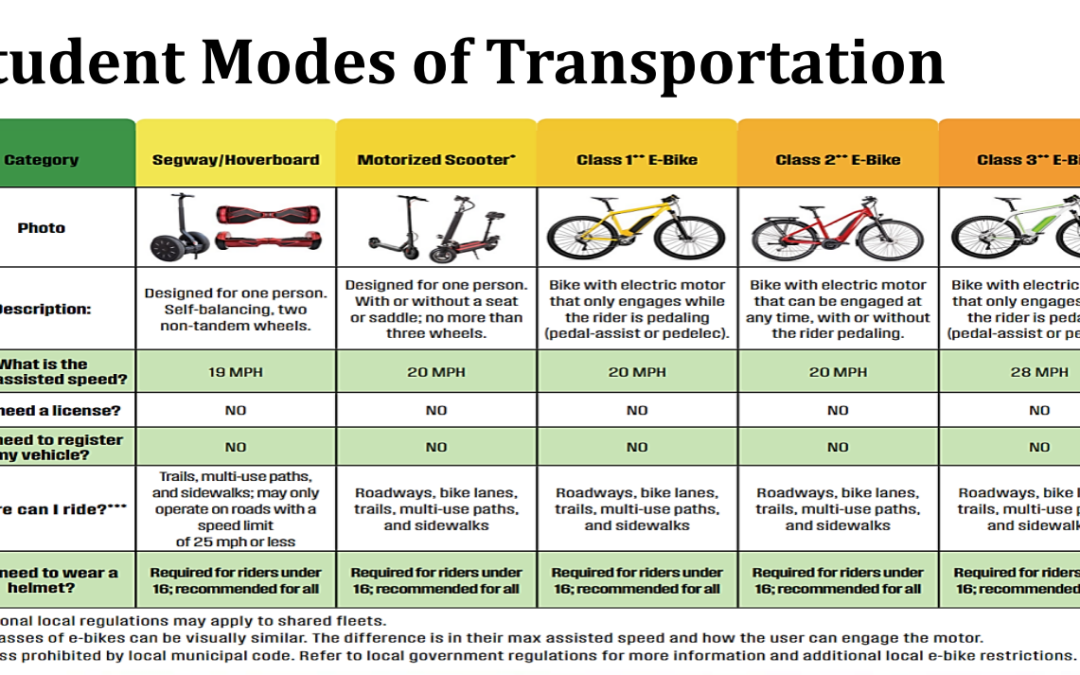

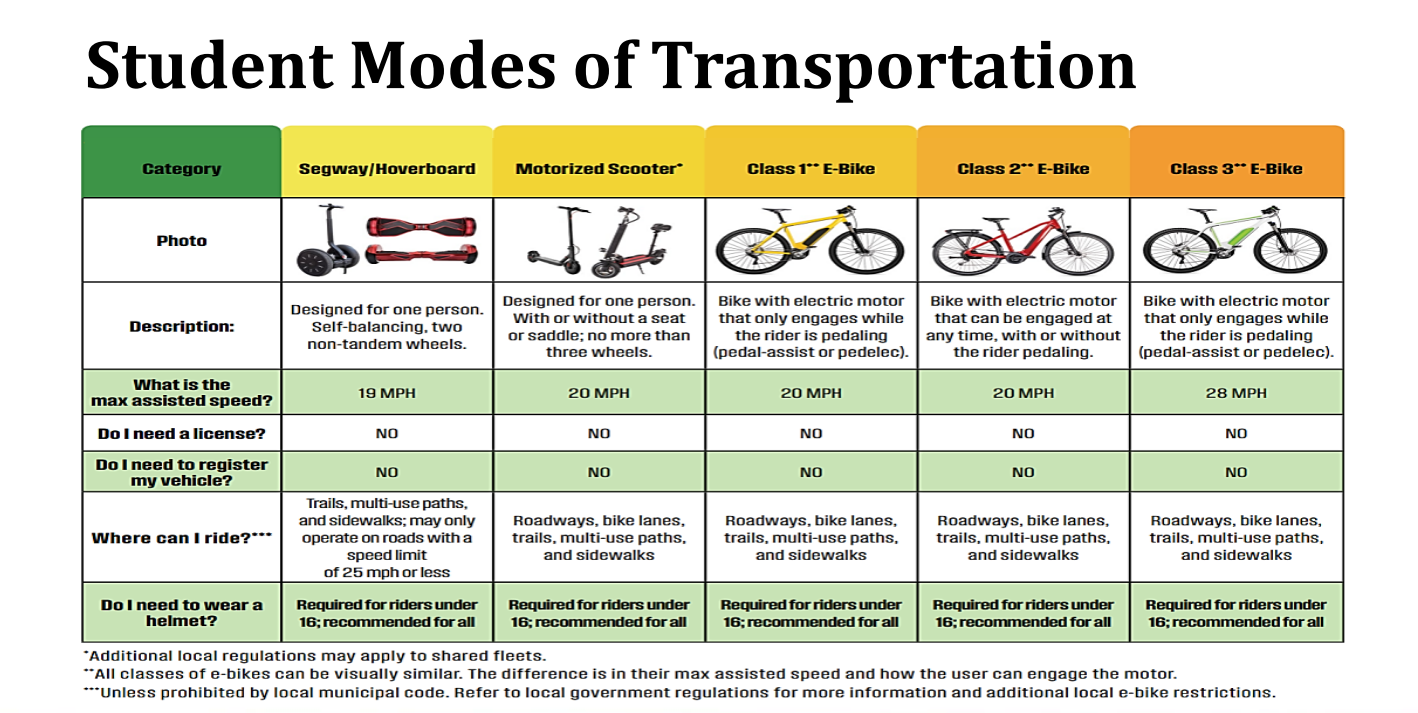

An OCPS presentation detailed the different devices students are commonly using on campuses.

Since 2017, electric scooter injuries in the U.S. have surged by 400%, with Florida being a top state in emergency room visits for such injuries, Silvestris told the school board at a November work session, citing data from the Consumer Product Safety Commission. These accidents have more than doubled since 2023 for children under 15, he said.

Lack of helmets, poor infrastructure, and rider inexperience and poor behavior were some common causes of scooter-related trauma that Silvestris listed. It was also noted that collisions involving distracted drivers, particularly newly licensed high schoolers, are prevalent on OCPS campuses. The district has previously provided guidance on these vehicles in the Deputy Superintendent Newsletter and on ParentSquare, an app used to send messages to families. The district has also partnered with Bike/Walk Central Florida to deliver safety presentations in schools.

But electric bikes and scooters are so common now that some school and city officials say more is needed.

Winter Park City Commissioner Craig Russell, who is a teacher and coach at Winter Park High School, said he has seen first-hand the dangers of electric scooter accidents and has worked with Winter Park Police on a safety campaign aimed at students and parents.

“A student in my class now has to withdraw and do Hospital Homebound because he was hit by a car [while] riding his e-scooter,” Russell said. “I think as a community we need to learn more about the scooters as a tool. We have to empower ourselves with knowledge of not only how to operate them, but how to teach our kids how to operate them properly and know the rules of the road.”

While some policy makers are worried about the dangers of electric scooters and bikes, many students see them as an essential part of daily life to get to school, work, sports practice and other activities.

“They’re not dangerous because if you really know what you’re doing and if you’re aware of your surroundings, you really can’t go wrong,” said Marco Malave, a sophomore at Winter Park High who uses his e-scooter to get to school and extracurricular activities. Although Malave has had accidents with his scooter before, he doesn’t believe licensing or a ban are needed as long as simple rules are created to “keep everyone safe.”

School Board member Alicia Farrant, who represents District 3, which runs from downtown Orlando south to near Walt Disney World, questioned the idea of a ban at the November meeting and suggested more safety education would suffice.

“As the school district, our place here is really to educate parents, educate the community on what is happening…but I don’t know that it is our duty as a school district to eliminate something completely, and I would be more in favor with each school having more of a say in…their area,” Farrant said.

District 2 member Maria Salamanca, who represents Lake Nona, advocated for rules governing scooters and bikes to be added to the OCPS Code of Student Conduct, which currently doesn’t mention the motorized devices.

“I have seen a really large uptick of very dangerous accidents with scooters on the way to school and very near to campus,” Salamanca said. “I think one of the things I’m seeing a lot, specifically in high school as well, is very young drivers who are distracted and then very fast scooters who are on their phone, and they crash in or around campus.”

Board Chair Teresa Jacobs expressed the need for a thorough course of action if rules are not followed.

“I would look along the lines of what is already not allowed, increase the limitations hopefully at a statewide level, and then use the authority of our Code of Student Conduct to put in place consequences for those students who are violating those,” she said.

When the Florida Legislature convenes in January, at least one member is already pushing a bill to require operators of high-speed versions of the devices hold a license and pushes for other safety measures like collecting and maintaining data on electric scooter and bike accidents.

Under HB 243 filed by Rep. Yvette Benarroch, R-Naples, operators of Class 3 e-bikes, which can go up to 28 miles per hour, would be required to have a learner’s permit or driver’s license.

“I filed this bill because government’s first duty is to protect the people,” Benarroch said, according to the Florida House’s informational page about the bill. “Freedom comes with responsibility, and when public safety is at risk, we have a duty to act. Guided by the Constitution and common sense, this bill protects lives, preserves liberty, and does what’s right for all Floridians.”

Potential new rules for school campuses are expected to be discussed at a meeting for Orange County principals in January. And Russell is planning a community meeting for parents and students in Winter Park.

WinterParkVoiceEditor@gmail.com

Tilly Raij is a sophomore at Winter Park High School. Her work has been published in The Community Paper, J Life Magazine and The Wildcat Chronicle.

To comment or read comments from others, click here →

by Beth Kassab | Dec 16, 2025 | News, Police and Public Safety

Family of Man Shot by Police at Wedding Receives $400,000 Settlement

It is unknown who is paying the settlement related to the death of Daniel Knight, but the city of Winter Park says it is not paying the money

Dec. 16, 2025

By Gabrielle Russon

The estate for Daniel Knight — the man shot and killed by Winter Park Police at his niece’s wedding in 2022 — is receiving a $400,000 settlement from a federal wrongful death lawsuit filed against the city of Winter Park, according to Polk County probate court records.

What’s not clear in the court records: Who is actually paying the money?

Knight’s estate “reached a confidential settlement agreement with named and unnamed defendants for a total of $400,000,” according to Sept. 24 court filing that gave an estate status report to the courts. The city of Winter Park and the two officers involved in the shooting were the named defendants in the federal lawsuit.

Winter Park officials already confirmed that neither the city or its police officers are the source of the settlement money.

Word of an agreement came earlier this year not long after a partial victory for the family when a federal judge ruled her claim could proceed against one of the officers, who fired his weapon seven times. The judge called the shooting “so far beyond the hazy border between excessive and acceptable force that the official had to know he was violating the Constitution even without case law on point.”

Daniel Knight

The settlement money will go to Knight’s adult child and his two minor children although $184,323 — almost half — will go to lawyers for fees and legal expenses, according to an Aug. 28 court filing petitioning to approve the structured settlement agreement.

The Courts approved that settlement agreement Sept. 29, a Nov. 21 filing said.

Paul Aloise Jr., the lawyer representing Knight’s fiancé, declined to comment nor acknowledge that a settlement had even been reached.

The mention of a $400,000 settlement appeared in the probate court records filed in Polk County Circuit Court. The records have been viewable online for weeks – which is how Winter Park Voice learned of the amount. A spokeswoman for the Polk County Clerk of the Circuit Court & Comptroller said Friday the records were confidential and should not have been released. A short time later the court filings were no longer accessible on the website.

Previous virtual hearings in the probate case have been closed to the public this year.

No amount of money is worth the pain of losing her brother, said Katrina Knight, the mother of the bride, and who is not part of the settlement agreement.

Any settlement “doesn’t really mean anything to our family because the whole reason we even pursued this is to clarify what actually happened,” said Katrina Knight, who said the police put out misleading information about her brother’s death to justify his killing.

A Winter Park Events Center manager called 911 to complain about Knight, 39, acting “violent” and “trying to beat people up” at the wedding.

“There’s no video of him beating anybody up, pushing people, choking people,” Katrina Knight said. “There’s video of him dancing, having fun.”

“He just had too much to drink.”

No police officers have been held criminally responsible for Knight’s death. The federal lawsuit against the city of Winter Park was settled and dismissed in May without the city having to admit wrongdoing or pay anything to Knight’s family.

Police arrived at the wedding, and the situation escalated in seconds. In less than two minutes, Knight was dead.

U.S. District Judge Roy B. Dalton Jr. noted that Knight’s family had “sufficiently pled that the use of deadly force was not objectively reasonable under these circumstances” in a ruling this year.

“Here, Knight’s family begged the officers to slow down and pleaded that he was not hurting anyone, but [Sgt. Kenton] Talton shot him less than two minutes after arriving on the scene,” Dalton wrote in his Jan. 28 order. “Yet the initial crime for which (Knight) was approached was relatively insignificant—at best, drunk and disorderly. He posed little serious danger to two armed police because he was unarmed and drunk. He was not a flight risk given that he was surrounded by family.”

Police told Knight and his sister to “back up” and “move out of the way” 13 seconds after arriving. When Police Officer Craig Campbell tried to separate Daniel and Katrina Knight, Daniel yelled not to touch his sister and pulled her closer, previously released police body-worn camera footage showed.

A struggle ensued. Knight hit Campbell, who fell down. Talton shot at Knight, firing seven times. Five bullets struck Knight.

Knight left behind his three children and his fiancé Mellisa Cruz, who filed the wrongful death lawsuit against the city of Winter Park and police.

The American Civil Liberties Union and some law enforcement experts were critical of Winter Park Police for not using de-escalation tactics to calm the situation down, which they argue, could have prevented the physical altercation with police and Knight’s death.

“By slowing things down and using some distance, that gives the officers more time to come up with a plan,” Don McCrea, a 35-year law enforcement veteran who runs Premier Police Training, previously told Winter Park Voice. “Yelling or barking orders – that’s typically not considered a de-escalation tactic. Giving people an opportunity to explain what’s going on and take in the big picture, that’s what de-escalation is more about.”

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

Recent Comments