by Beth Kassab | Sep 24, 2025 | City Commission, News, Taxes, Uncategorized

How Today's City Commission Meeting Will Hit Your Wallet

Winter Park is poised to raise fees for everything from a round of golf to after-school programs along with a portion of your power bill

Sept. 24, 2025

By Beth Kassab

Winter Park Commissioners are set to vote Wednesday afternoon on the city’s $230 million budget, which includes an electric rate increase — though lower bills for the time being — and higher prices for everything from cemetary plots, off-duty police, rounds of golf and after-school programs.

The new fee schedule, which is slated to be adopted today along with a second and final vote on the 2026 budget, will take effect Oct. 1.

Some examples:

- Fire department detail for special events (with at least 10 days notice): From $47 per hour (for a minimum of three hours) to $60 an hour.

- Off-duty police officer (with at least seven days advance notice): From $57 per hour to $58 (with a four hour minimum); holiday pay for off-duty officers will move from $82 to $83 per hour.

- Fees for adult sports teams fees will jump from $500 for flag football and softball to $550.

- Youth after-school programs will increase from $50 to $55 monthly for residents and from $90 to $100 for non-residents.

- A single resident space at Palm Cemetery will jump from $5,800 to $6,950.

- Greens fees at the Winter Park Nine for residents on Friday through Sunday will increase from $22 to $26. Electric cart rental will go from $12 to $14 and from $10 to $12 for seniors.

- Rental of the Winter Park Events Center on a Saturday will change from $5,50 to $5,775.

The city’s budget proposal discussed how slower growth forecast in the economy means “adding new services and projects will only be possible in the context of the growth rate of traditional revenue sources such as the millage rate, fees and customer rates.”

The document even went so far as to make clear that fees for services have already become a critical piece of the budget as City Commissions have decided against raising the millage rate (which determines how much residents and businesses pay in property taxes, which make up the largest portion of the city’s general fund). And how future increases are likely:

“As the second largest component of the general fund at 20%, and as one of the few revenue sources that the city has direct control over, charges for services is likely to increase over time as fees and prices for activities and services will have to continue to be raised to support operations. In many municipal circles this is being called the pay-to-play form of providing services to residents and businesses and will only be more crucial if property tax revenue growth rates begin to slow.”

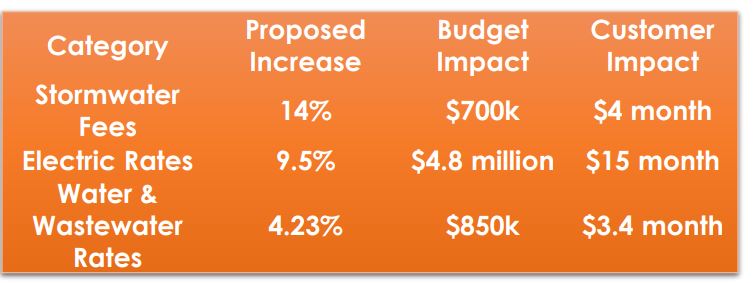

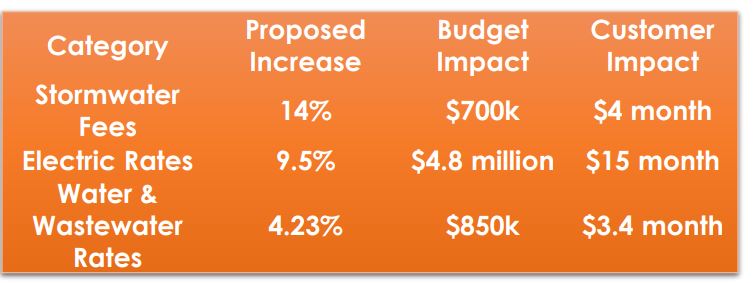

A portion of resident’s electric rates will also climb in October, though total bills will decrease.

That’s because the electric bill includes multiple fees, charges and taxes with some going up and one going down.

The non-fuel portion of electric rates based on how much each customer uses will increase by about 7%. That equates to a monthly jump from $91.46 to $98.26 for a home using 1,300 kwh, according to an estimate provided by the city.

But the charges customers pay for fuel (mostly natural gas in Winter Park) are going down from $49.20 to $29.61, resulting in a lower monthly bill.

Fuel charges, however, are variable and could rise again.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Aug 5, 2025 | City Commission, News, Taxes, Uncategorized

Winter Park to keep property tax rate the same for 18th year

The city’s $233.5 million budget accounts for 7% growth in property tax revenue based on higher values as well as increases in utility fees

Aug. 5, 2025

By Beth Kassab

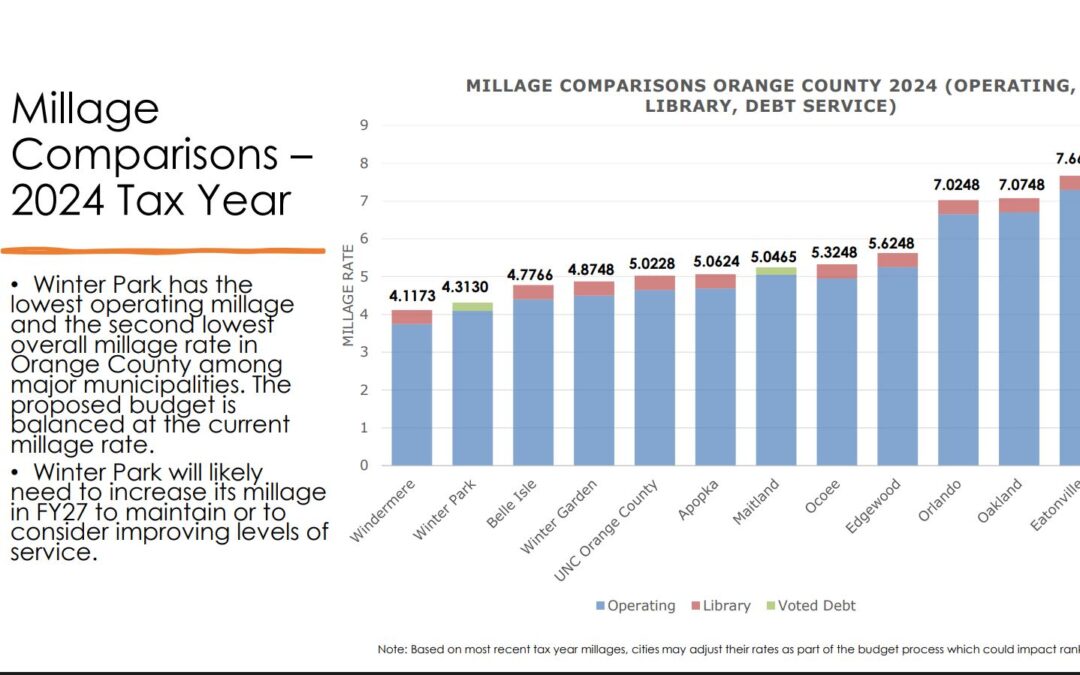

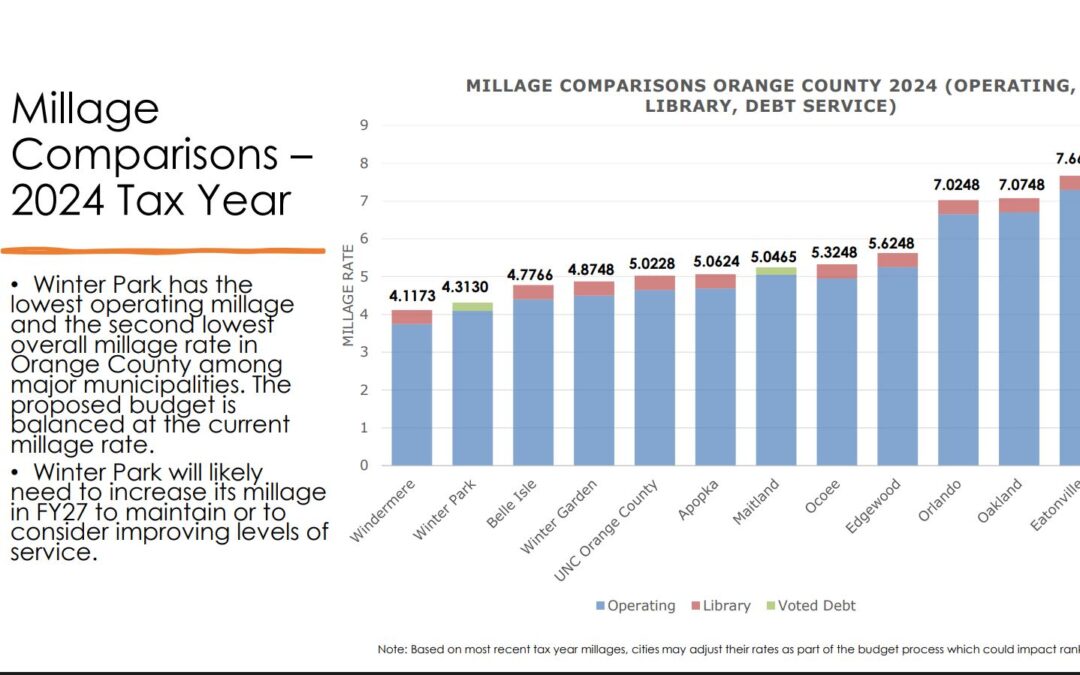

Winter Park City Commissioners will keep property tax rates the same for the 18th year in a row despite pressure from two commissioners to consider increases.

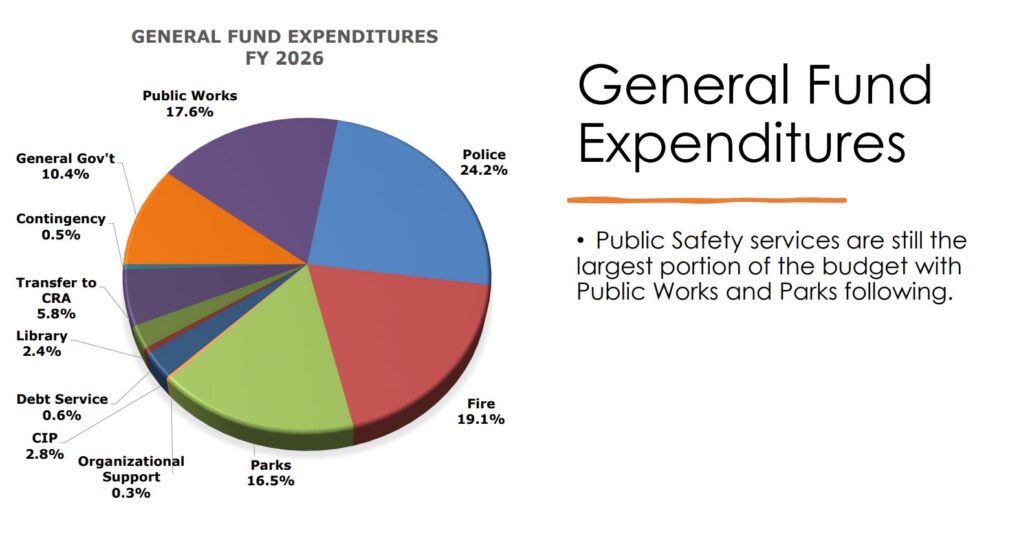

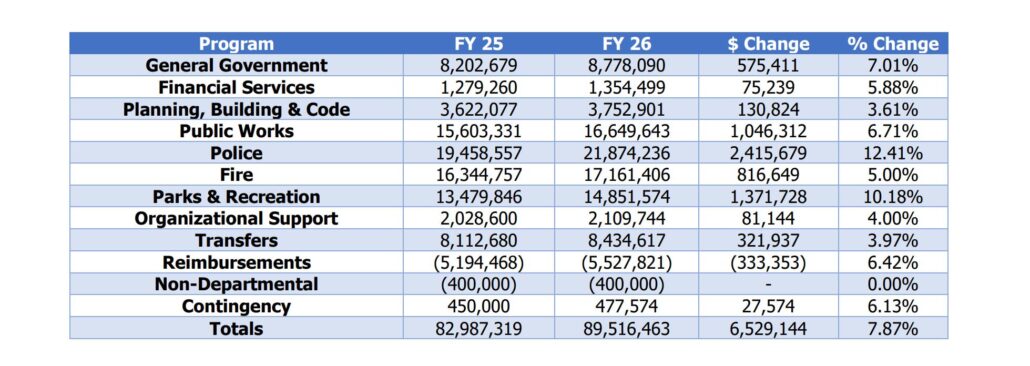

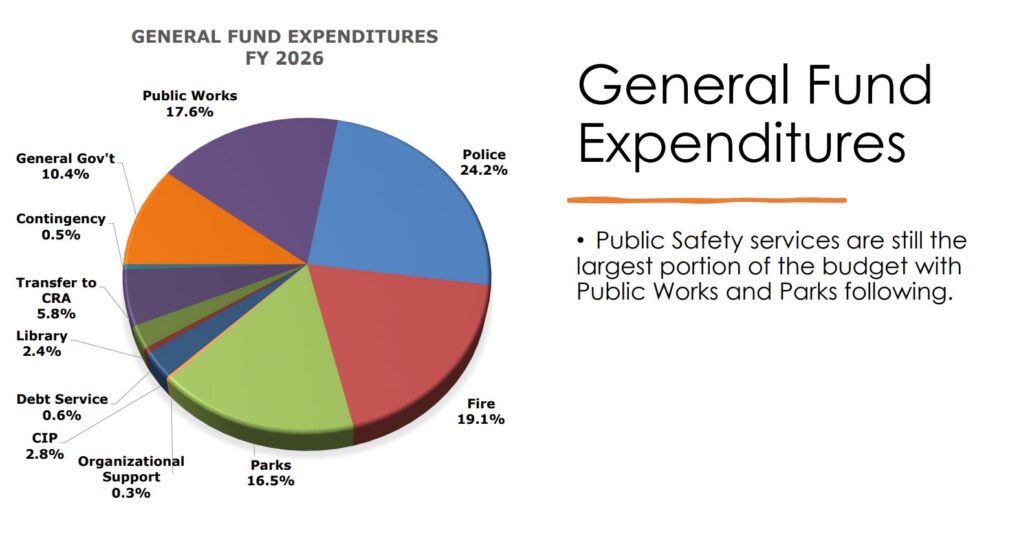

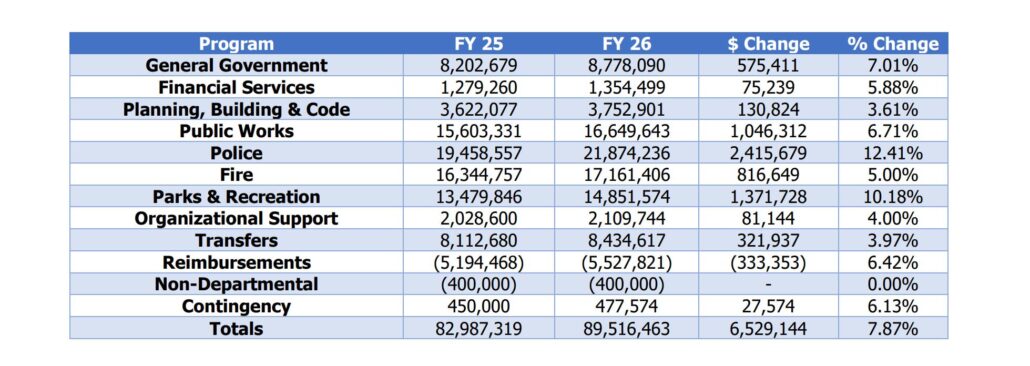

With a 3-2 vote to hold the line at the July 23 City Commission meeting, officials signaled that the increase in property values will drive a 7% increase in property tax revenues — from $36.2 million to $38.9 million — will be enough to cover expenses along with significant proposed increases in utility rates.

The city’s overall budget is proposed to increase by 8.9% or $19 million to $233.5 million.

City Manager Randy Knight cautioned that its likely he will ask commissioners to raise the property tax rate next year on top of the utility increases that are being proposed this year.

Mayor Sheila DeCiccio along with commissioners Warren Lindsey and Kris Cruzada voted to keep the millage rate the same. Commissioners Marty Sullivan and Craig Russell dissented.

Sullivan began talking about a potential increase months ago in a letter to residents, citing growing costs and changing economic conditions. He said he wanted to raise the millage rate by a quarter mil with the intent of revising it back down in September after receiving reassurance from the city’s share of revenue from the state sales tax and other sources wouldn’t plummet.

“That’s a big unknown,” he told the group, citing needs like a new fire training center and continuing to build the city’s reserve fund, which would prove crucial in the event of a major hurricane or other disaster.

Russell surprised some observers by going even further, proposing a half mil increase.

He was elected as a first-time candidate in 2024 and was championed by local business interests and even campaigned on cutting taxes and targeting waste.

But he said he’s learned a lot about what it takes to keep the city running with the high level of service that residents have come to expect.

“How long can we provide the level of service we do without addressing that taboo subject?” he asked.

He proposed earmarking any increase for specific needs like roads or sidewalks to provide residents with “transparency” about how the dollars will be spent.

Russell said he knows most elected officials shy away from raising taxes because it could cost them their jobs the next time voters got to the polls.

“Anybody sitting up here is afraid of not getting elected the next time,” he said. “I’m a liar …” he said referring to his own campaign materials last year that called for reducing taxes. “But when you dive into it and sit here and you take on fiscal responsibility for thousands of people you have the ability to learn what that really means.”

The seats belonging to Sullivan and Russell are up for election next year.

DeCiccio expressed some doubt about how much longer the city would be able to maintain property tax rates, even with higher appraised values. She attributed the city’s growing values to the level of service residents receive when it comes to quick police and fire response, parks, roads, electricity and other services the city provides.

“The level of service and higher property values go hand in hand,” she said. “It truly amazes me that we are able to maintain the same millage rate and still maintain that … I don’t know how long we will be able to do it, but we can definitely do it this year, make this the 18th year we don’t raise property taxes.”

Residents will, however, see other proposed changes that are likely to hit their wallets.

The average resident will pay an extra $23 for electricity, water and stormwater is the proposed changes are approved.

The next budget hearing will take place next week on Aug. 13 where residents can sign up to speak on the budget.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Mar 16, 2025 | City Commission, News, Taxes, Uncategorized

More commissioners signal interest in raising property taxes

At the board’s first budget work session of the year, city staff pitched a targeted increase to cover transportation or public safety costs

March 16, 2025

By Beth Kassab

With costs for police and fire, transportation and other city services continuing to rise amid stubborn inflation, commissioners discussed last week the idea of increasing how much residents pay in property taxes by a quarter mil.

The talks took place at the Commission’s first budget work session of the year where the elected officials heard an overview of anticipated revenue and costs for next year.

Warren Lindsey, who will be sworn in as a new commissioner in Todd Weaver’s seat later this month, attended alongside Weaver.

Commissioner Craig Russell voiced a willingness to consider a tax increase and pondered ways to get residents on board with the idea.

“It’s just a matter of telling the story,” Russell said. “We still have unfunded projects” and expressed concern about a decline in city services “where we won’t be a destination anymore, we’ll just be run-of-the-mill.”

Russell, who was backed by the Winter Park Chamber of Commerce and is up for re-election next year, said commissioners must talk about the needs with residents and “agree on whether we can market it so that the messaging is cohesive across the board with the public.”

Commissioner Marty Sullivan, who is also up for re-election next year and who proposed a property tax increase recently in a written message to residents, responded, “Craig, you stole my thunder.”

Sullivan said he didn’t mind if an increase is unpopular with voters. He said a .25 mil increase for many residents would be about $8 or so a month or “not much more than a cup of coffee at Barnie’s.”

“I’m OK with people hating me for it,” he said. “If 10 or 20 years from now they say they’re glad we did it.”

Commissioner Kris Cruzada, who was just re-elected last week and is often one of the more fiscally conservative voices on the board, said some older residents are “aging in place” and could be more concerned with increased costs.

He said he encountered a variety of viewpoints on the matter when he canvassed door-to-door ahead of the election.

“Some are more concerned,” he said. “I did get other residents who said, ‘I wouldn’t mind paying a little bit more,’ to make sure key performance indicators can be met,” such as police and fire response times.

“So it is a bit of a mixed bag with some of the residents,” Cruzada said.

City Manager Randy Knight said commissioners will be asked to set a tentative millage rate in July, the city’s typical practice. Then, in September when the budget must be approved, the board can lower the rate if there is negative feedback or if revenue estimates change.

Mayor Sheila DeCiccio recalled how the board attempted to push the rate higher in 2020 in response to the pandemic.

“And there was a public outcry and we brought it down,” she said.

Winter Park’s millage rate is 4.0923 and is the only local city that has not increased its tax rate “since the 2009 Great Recession,” according to last year’s budget document. The rate equals about $4.09 in taxes for every $1,000 of a property’s taxable value.

City Management and Budget Director Peter Moore told the group that potential new costs in the city’s more than $214 million budget could total as much as $5.6 million, but potential new revenues under the status quo could reach just $3.5 million.

The potential new costs include: $900,000 in general fund operating costs; $700,000 for public safety positions; $250,000 for equipment replacement, which he said could face increasing costs as a result of federal tariffs; $300,000 more in the general fund for building projects; $150,000 for IT software and $140,000 to update the parks master plan.

He said the property tax base for Winter Park is expected to remain strong, though growth could slow or at least level out.

He added that he expects harder-to-come-by federal and state grants and higher electric utility costs down the road.

“We’ve seen cities target specific things,” Moore told the group such as raising taxes specifically for transportation or police as some other local governments have done. “Allocating a quarter point to public safety would help.”

At the City Commission meeting earlier in the week the board voted to pause offering more money for local nonprofit grants until later in the year as they wait to get a better picture of the budget numbers and after DeCiccio raised that federal and state grants will likely dry up.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Jan 29, 2025 | City Commission, News, Taxes

Winter Park Police to start new program aimed at helping homeless

The program relies on a federal grant that was temporarily frozen by the Trump administration this week, but Winter Park said it had planned to move forward anyway

Jan. 29, 2025

By Beth Kassab

Winter Park will launch a new program on Monday supported by a federal grant aimed at helping its police department connect homeless people with resources to find housing and other services.

The three-year $250,000 grant through the U.S. Department of Justice’s Community Oriented Policing Services office is slated to fund a portion of two new sworn officer positions at the Winter Park Police Department dedicated to one-on-one interactions with people who are living on the street.

The status of the money was in jeopardy this week as the Trump administration issued a freeze on all federal grants, though Winter Park officials said they planned to move forward anway.

“We have every intention of moving forward with the HART [Homeless Advocacy Response Team] program on Monday, even with the grant freeze,” Winter Park Police Chief Tim Volkerson said Wednesday morning.

By Wednesday afternoon, the administration rescinded the federal memo that froze trillions of dollars, but not before there was widespread confusion and upheaval.

Chief Tim Volkerson

City Manager Randy Knight said he met with U.S. Rep. Maxwell Frost’s office to get a better understanding of the impacts of the freeze, but there remained a number of unanswered questions. The grant for the police department is the primary piece of federal funding in the city’s current operating budget, he said.

The Winter Park program illustrates how the federal freeze trickled down to local jobs and neighborhood programs aimed at helping people in crisis.

It also showcased how local governments like the city of Winter Park, which are tasked with everything from sweeping streets and approving new development to providing lights and water to thousands of homes, are also caught in the crossfire of an increasingly combative and unpredictable political environment on the state and federal levels.

\Winter Park Police not only felt the effect of President Donald Trump’s attempt to root out federal expenditures that he says don’t align with his political ideology, but also must contend with a new state law that bans camping on public property.

The Florida law — which is modeled on policy from the conservative Texas-based Ciero Institute and has also taken hold in Oklahoma, Texas, Kentucky and elsewhere — allows cities like Winter Park to be sued beginning this month if the city doesn’t enforce the ban on sleeping in public areas. It’s one of a number of state laws in recent years that has mandated new action or pre-empted existing policy by local governments, who often carry the biggest burden when it comes to carrying out policy forged in Tallahassee.

Volkerson said his goal is not to arrest people who are homeless, but to connect them with meals, a change of clothes, a shower, medical care and, when possible, permanent housing.

“While the law has changed, our function hasn’t changed,” he said. “Our parks are closed at night and that’s still the case. We want people to know we have these services available and we are more than happy to take you … we ask what they need.”

The HART program, which his officers piloted for a few months last year, is intentional about establishing a rapport with people who are in need. The same two officers are assigned to the duty each day and they drive pickup trucks rather than patrol vehicles.

The pick-up trucks are marked, but have regular back seats compared to patrol vehicles, which are outfitted to transport people who are under arrest.

That makes it more likely, Volkerson said, for people in need to accept rides to drop-in centers, shelters or other places where they can find resources. Usually, he said, that doesn’t happen the first time officers talk with someone. It often takes multiple interactions to build up trust so that a person is willing to consider some of the nonprofits that provide assistance.

“Our goal isn’t to take them and dump them. Our goal is to get them the help that they need,” he said. “Ultimately, we want to connect them with something that is sustainable … there are some people who have no desire for permanent help. They are not interested in going to a shelter or connecting with family and friends.”

His officers have not arrested anyone for sleeping in a public space. Most arrests of people who are homeless, he said, are a result of an officer finding the person has an outstanding warrant on other charges.

“We do not see a lot of sleeping in our parks or on our sidewalks,” Volkerson said. “It’s not that common for us to encounter that.”

Most of the interactions take place on private commercial property such as at gas stations or shopping plazas.

He said his officers focus not just on building relationships with people who are homeless, but with agencies in Central Florida that provide support so that the officers can offer the best options to people who want help with qualifying for social security, Medicaid, a new ID or even just a shower and a hot meal.

The federal grant is expected to cover $250,000 over three years. The city of Winter Park is contributing about $280,000 to cover the cost of the trucks, equipment and the difference in wages and benefits that the grant would not cover.

Frost said the freeze of the grant money was akin to an attempted “theft” from local taxpayers.

“This is political posturing the president is doing on spending to free up money so he can pass it along in the form of tax cuts to billionaires and corporations,” he said. “There’s also just the gross incompetence of how it’s being done and the lack of clarity and confusion it’s causing.”

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Jan 8, 2025 | City Commission, News, Taxes, Uncategorized

News outlets in Central Florida will collaborate to examine impacts of homeless camping ban

The Voice joins 10 outlets in providing reporting on an important topic for local residents, taxpayers and the homeless

Dec. 8, 2025

Staff Report

The Winter Park Voice is joining 10 local news outlets in a regional collaboration to report on the local impact of Florida’s new Unauthorized Public

Camping and Public Sleeping bill (House Bill 1365), set to be enforced Jan. 1. For six months these news outlets will share and cross-publish their reporting to work toward creating a more informed and engaged Central Florida community. This collaboration is an ongoing effort, which additional news organizations may join over time.

The Voice is contributing reporting to examine how the law will impact residents and taxpayers in Winter Park and beyond. Through its coverage, the Voice aims to provide readers with timely and trustworthy reporting on this critical issue.

“This project will, in part, help examine how laws passed in Tallahassee ripple out to city halls and local taxpayers where the true impacts, costs and consequences are often most acutely felt,” said Voice Editor Beth Kassab. “We are excited to be a part of this first-of-its-kind local collaboration and provide information that we hope will help engage our community on the important issue of homelessness and the steps needed for real solutions.”

This collaboration was formed at the Central Florida Journalism Ecosystem Summit, created last summer by Central Florida Public Media, Central Florida Foundation and Oviedo Community News. The Summit served as the first strategic alliance of local news organizations looking to change the course of civic engagement in Central Florida.

Following the Summit, a nine-member task force facilitated by Mark Brewer, president and CEO of Central Florida Foundation, met to fine-tune the collaborative’s goals and select a pilot project – choosing House Bill 1365 as the first major issue to address together.

This collaboration highlights the power of regional news outlets unifying under the same goal.

“As the only local nonprofit news organization serving all of Central Florida, we believe we have a responsibility to unite the community’s news outlets and prioritize public service over competition,” said Judith Smelser, president and general manager of Central Florida Public Media. “Gone are the days when one single media outlet could meet the region’s needs alone. By working together, we can strengthen and preserve local journalism.”

“One of the Central Florida Foundation’s core values is fostering a well-informed and civically engaged community,” said Mark Brewer, president and CEO of the Central Florida Foundation, which is providing operational but not editorial guidance to the budding collaborative. “The Journalism Ecosystem Summit and, subsequently, this first collaboration among local news organizations are excellent examples of Central Florida as a leader in community innovation,

with organizations across sectors that want to work together to achieve shared goals.”

“Looking to best practices around the nation, this group of committed news organizations has been working hard to create a local model that will reach more Central Floridians and dive deeper into issues that matter to our audiences,” Oviedo Community News Editor-in-chief Megan Stokes said. “Accessibility and creating news that responds to local needs have been pillars of Oviedo Community News from the start. We are excited to work with this collaborative to help spread that public service throughout the region.”

You can find more information on all participating organizations below:

- To learn more about Central Florida Public Media, visit https://www.cfpublic.org/about

- To learn more about LkldNow, visit https://www.lkldnow.com/about/

- To learn more about Orlando Sentinel, visit https://www.orlandosentinel.com/about/

- To learn more about Osceola News-Gazette, visit https://www.aroundosceola.com/advertise

- To learn more about Oviedo Community News, visit https://oviedocommunitynews.org/our-story/#

- To learn more about The Community Paper, visit https://www.yourcommunitypaper.com/contact-us/

- To learn more about VoxPopuli, https://www.wintergardenvox.com/about

- To learn more about Winter Park Voice, visit https://winterparkvoice.com/

- To learn more about WKMG-TV/ClickOrlando.com, visit https://www.clickorlando.com/station/

- To learn more about WUCF, visit https://www.wucf.org/about/

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

by Beth Kassab | Oct 3, 2024 | City Commission, News, Taxes, Uncategorized

Winter Park Playhouse, Rollins come out as winners in TDT recommendations

They are among 11 arts and culture projects that the Tourist Development Tax board is asking the County Commission to fund

Oct. 3, 2024

By Beth Kassab

The Winter Park Playhouse and the Rollins Art Museum are on track to receive their full request for dollars from a portion of Tourist Development Tax money set aside for arts and cultural projects over the next five years.

The playhouse project, through a partnership with the city of Winter Park to purchase and renovate its current building after nearly losing its lease, will receive $8 million between now and 2028 if the recommendations from the Tourist Development Tax Advisory Council are approved by the Orange County Commission later this month.

The Rollins Art Museum, which made a bid to take over the old Winter Park Library but was pushed aside for the Blue Bamboo Center for the Arts, will receive $10 million between 2026 and 2028, according to the recommendations.

The college announced this week that museum leader Ena Heller is leaving to take a position as the next director of the Boca Raton Museum of Art, but President Grant Cornwell told the Voice in a statement that the vision for a new museum will continue with a broad base of support.

“It has been an honor to work alongside Ena, whose visionary leadership has transformed the Rollins Museum of Art into an integral part of the College’s mission,” Cornwell said. “I am deeply grateful for her contributions and creativity and for ensuring the museum’s successful standing as we build upon the foundation she is leaving. The museum has strong support and a vital group of members, donors, partners, and patrons supporting it, and we are excited about this next stage as we come to closure on our future museum.”

The County Commission will take up the funding requests for final approval on Oct. 29.

Earlier this year, local arts groups were invited to apply for grants from $75 million of tourist tax money set aside over the next five years for local arts and cultural projects. The tax on hotel rooms brought in a record $359 million last year in Orange County, a significant recovery from the pandemic years, which saw collections drop to about half that amount.

Winter Park Playhouse

The bulk of the hotel tax goes toward paying off the construction costs and operating the Orange County Convention Center, other large venues and Visit Orlando, the publicly-supported organization that markets Orlando as a destination.

The convention center’s operating expenses exceed its revenue so far this year by $12.6 million, according to the comptroller’s report at the Sept. 27 meeting. The subsidy paid by the county out of tourist tax dollars to keep the convention center operating in the black is tracking higher this year than the previous two years, the report showed.

In all, 14 groups originally applied for the arts money with requests totalling $126 million.

Three groups were deemed ineligible for the funds, leaving 11 groups with requests totalling $94.2 million — nearly $20 million more than the allotted $75 million budget for the projects.

A committee led by former Orange County Comptroller Martha Haynie met to rank the projects and recommend how much each would receive.

The Tourist Tax Council, which includes Orange Mayor Jerry Demings, Orlando Mayor Buddy Dyer, Eatonville Mayor Angie Gardner, four hotel owners or industry representatives who must remit the tax and two others, accepted those recommendations at its meeting last week.

Haynie urged the board to reconsider the criteria for future local arts projects to put less emphasis on driving overnight hotel stays — a move that she said could help demonstrate how the tax is used to benefit local residents vs. the tourism industry.

“I think when the Board of County Commissioners can demonstrate the interest and the support of local cultural organizations it supports the position county has always taken,” to reserve the bulk of the tax for industry projects amid pressure to expand how the tax is used, Haynie said. She noted that expanding uses of the tax “in the long run probably would not serve the county as well as it has been served today.”

Intensified calls to use some of the hotel tax revenue on local projects such as roads or train lines are playing out in three county commission races on next month’s ballot. That is especially the case in District 5, which represents Winter Park, where former Mayor Steve Leary is receiving financial contributions from the tourism industry against Kelly Semrad, a UCF professor who studies tourism economies, and is calling for the tax to more substantially benefit people who live in Orange County.

Demings focused his comments on the “financial readiness” of some of the organizations who requested money.

“We have had some challenges like the Pulse Museum and others when they don’t execute the fundraising to cover the gap to do the project and then the project gets extended and the price escalates and then they come back and request additional money,” Demings said, though he said he was pleased to see geographic diversity in the list which touched on Winter Park, Winter Garden and Apopka. “The list looks pretty good, but I still remain somewhat concerned about the ability of these organizations to cover the gap … so we’ll see where this ends up.”

Haynie’s committee recommended all but three organizations receive the amount of funding they requested. The recommendations to be considered by the County Commission later this month are:

- City of Apopka: $13.1 million to construct and improve softball fields, the amphitheater and other facilities. Estimated total cost of the project is $13.3 million.

- 4R Foundation: $12 million for a community events center plus and outdoor stage and lawn at 4Roots Campus, which also includes a farm and classroom space in Orlando’s Packing District neighborhood. Estimated total cost of the project is $65 million.

- Orlando Science Center: $13.9 million enlarge and remodel the outdoor terrace and event venue. Estimated total cost of the project is $14.1 million.

- Rollins College: $10 million to construct a new art museum for new art museum. Estimated total project cost is $30.6 million.

- Orlando Philharmonic Plaza Foundation: $2.1 million to improve the auditorium, including a patron’s room. Estimated total project cost is $3.1 million.

- Winter Garden Art Association: $4 million for a new museum next to the current space. Estimated total cost of the project is $7 million.

- Orlando Family Stage: $5.8 million to remodel and operate the auditorium. Estimated total project cost is $7.6 million.

- City of Winter Park : $8 million to acquire, enlarge and remodel the Winter Park Playhouse. Estimated cost of the total project is $10 million.

- Friends of the Mennello: $2 million (request was $13 million) to enlarge and improve the folk art museum. Estimated total cost is $30 million.

- Orlando Museum of Art: $2 million (request was $7.2 million) to repair the roof and HVAC system. Total cost of the project is estimated at $7.5 million.

- PAST/Wells’ Built Museum: $2 million (request was $5 million) to acquire the property and construct and improve the museum and auditorium. Estimated total cost is $10 million.

WinterParkVoiceEditor@gmail.com

To comment or read comments from others, click here →

Recent Comments